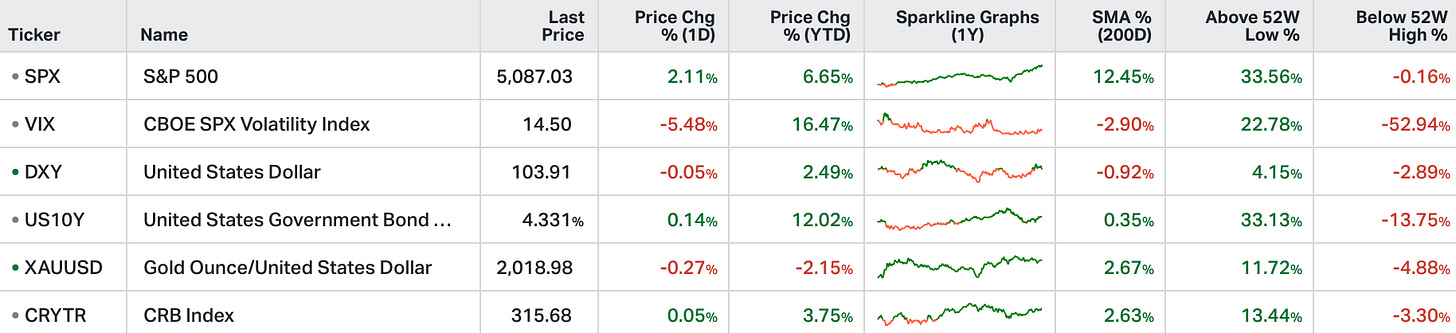

Wall Street’s major stock indices continued their rally in the afternoon session, buoyed by AI fueled optimism following chip giant Nvidia's upbeat earnings.

The S&P 500 surged over 2.2%, reaching a new record high, while the Nasdaq was on pace for its largest one-day gain since February 2023, climbing 3%.

Nvidia surged over 15% to $777.34, pushing its market capitalization beyond $1.9 trillion after exceeding quarterly expectations.

This performance reflected growing confidence in AI and demand for its specialized chips.

Nvidia's stock saw a historic one-day gain, adding $250 billion to its market value.

Stocks reversed the losses of recent days to finish on new record highs.

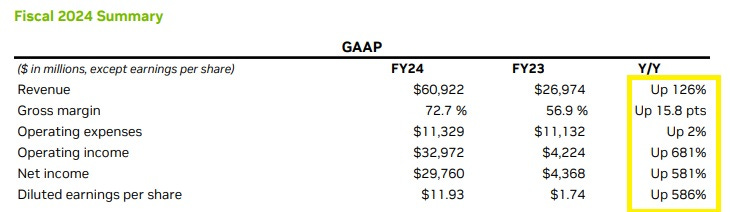

It was fueled by the earnings and insights from the most important company in the world, Nvidia. Keep in mind, not only does the opportunity ahead of Nvidia make it the most important company in the world, but the numbers they are putting up right now, put them in a class of their own (maybe in history).

Take a look at the hyper-growth (both relative and absolute) in this 2024 financial summary from Nvidia …

For perspective on the durability/credibility of this growth, keep in mind the biggest, most powerful technology companies in the world (Meta, Google, Amazon, Microsoft) are not only making record-level investments in building AI infrastructure, but they are completely transforming their companies to focus on generative AI.

So, as we’ve discussed here in my daily notes, with the events of the past year, it’s clear that we are in the early stages of a new industrial revolution.

And that statement should be the answer to the question: Is it too late?

It’s not too late. For those that have been calling the boom in AI stocks unsustainable, they are underestimating, if not misunderstanding, the significance of this technology revolution. It’s productivity enhancing, and a formula for a boom-time era in economic growth.

As we’ve discussed throughout the past year, the generative AI impact will mean bigger companies, in a bigger economy - a bigger pie. It’s already happening. Just in the past month, we have our first $3 trillion company, in Microsoft. Nvidia is nearing a $2 trillion valuation, and yet the price you pay for the stock today, relative to its earnings, is cheaper than it was back in May of last year, when they shocked the world declaring “a rebirth of the computer industry” was underway.

With that, as I said in my 03 Feb 2024 note (here)* the best time to get invested in this technology revolution was November 30, 2022 (when ChatGPT launched), the next best time is today. Remember, the CEO/Founder Jensen Huang has said “every company, every industry, every country” will go through this computing transition. He sees “significant total addressable market expansion” - that’s the pie growing.

Already he sees the cost to “retool” the world’s data centers to accelerated computing climbing from $1 trillion to $2 trillion within the next five years. Given that Nvidia is supplying about 90% of it (at the moment), and they’ve done under $50 billion in data center revenue over the past year, this global data center transformation has a long way to go.

So, what comes next? Huang has said the future of this accelerated computing will power the “next big reinvention,” where “the digital world meets the physical world.” He says Nvidia’s Omniverse technology will power it, and it will reshape $100 trillion worth of global industry.

On that note, earlier this month, Apple debuted the Apple Vision Pro. Here’s how they describe the product: “Apple Vision Pro seamlessly blends digital content with your physical space.”

The CEO of Siemens, when he presented earlier this year at the Computer and Electronics Show (CES) in Las Vegas, called 2024 a “turning point” where real and digital worlds will converge. He introduced the “Industrial Metaverse” where generative AI is making reality better and building it faster and more efficiently, by using the virtual world. And the virtual world is all about the “digital twin.“

The digital twin is driven by generative AI and can create highly realistic and dynamic digital representations of a physical asset or system (products). Builders/developers/engineers and all stakeholders can see the products perform (as a digital twin), have fully immersive interaction with the product, before and while building it.

They can imagine it, design it, visualize it, simulate conditions for it (test it), monitor it - and all of this data becomes actionable insights via generative AI. So, they can improve it, before building it. This is the next wave of generative AI. And it’s coming as trillions of dollars of infrastructure-related government spending is being deployed. This convergence of technological advancement and government funding sets up for a manufacturing boom - it’s going to be at record speed.

Again, it’s still early in this technology revolution. There are tremendous investment opportunities, in an era that has already brought us the multi-trillion dollar companies. More are coming.

* Membership is still open to the AI Innovation Portfolio - details outlined here. Alternatively, to incorporate AI Analysis into your Investing Framework, click on the link below:

Great insights. Thank you