We've talked in recent days about the end of globally coordinated easy money policies.

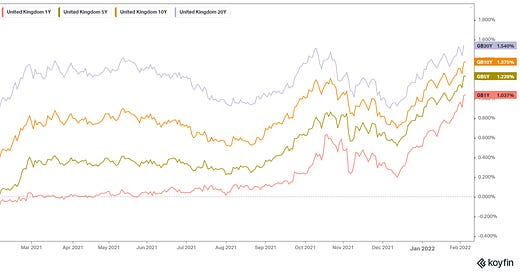

The Fed triggered it all in December, when they laid out a timeline for the end of QE. The next day, the Bank of England surprised the world, with a rate hike.

Yesterday they raised again, another quarter point, with four of the nine voting committee members wanting a 50-basis point hike.

Then the European Central Bank followed. They did nothing on the day, but in a flip-flop from just months ago, Lagarde signaled a rate hike could come this year.

So, over the past couple of months, we've talked about what to expect when the reality of inflation-fighting central banks sets in. A rising interest rate environment is good for value stocks, but bad news for the high growth, high multiple tech stocks (i.e. it's "re-rating" time).

We've seen it early this month in the aggressive selling of small cap, no eps tech stocks. Yesterday we saw it on one of the most widely held stocks in the world, Facebook.

Facebook was trading north of 25 times earnings before Jay Powell's pivot on the inflation outlook late last summer - it's closer to 17 times earnings.

Within the context of a broader market (the S&P 500) that was trading close to 30 times trailing-twelve-month earnings last summer - it's 26 times (19 times forward twelve-month estimated earnings).

The long term average P/E on the S&P 500 is 16.