Its A Wrap

Wall Street closed higher on Monday, buoyed by robust gains in Big Tech and semiconductor stocks despite weak economic data.

The S&P 500 and Nasdaq 100 gained 0.7% and 0.9%, respectively, while the Dow Jones pared earlier losses to finish 66 points higher.

Meanwhile, US consumer confidence in December tumbled in its largest month-over-month decline since November 2020 amid Americans' growing uncertainty over the economic outlook in the year ahead.

The survey data reflected household apprehensions about potential tariff-induced cost increases under President-elect Trump's economic policies.

These fears weighed heavily on consumer defensive stocks, with Walmart slipping 2%.

As we near year-end, let's take a look at the bond market.

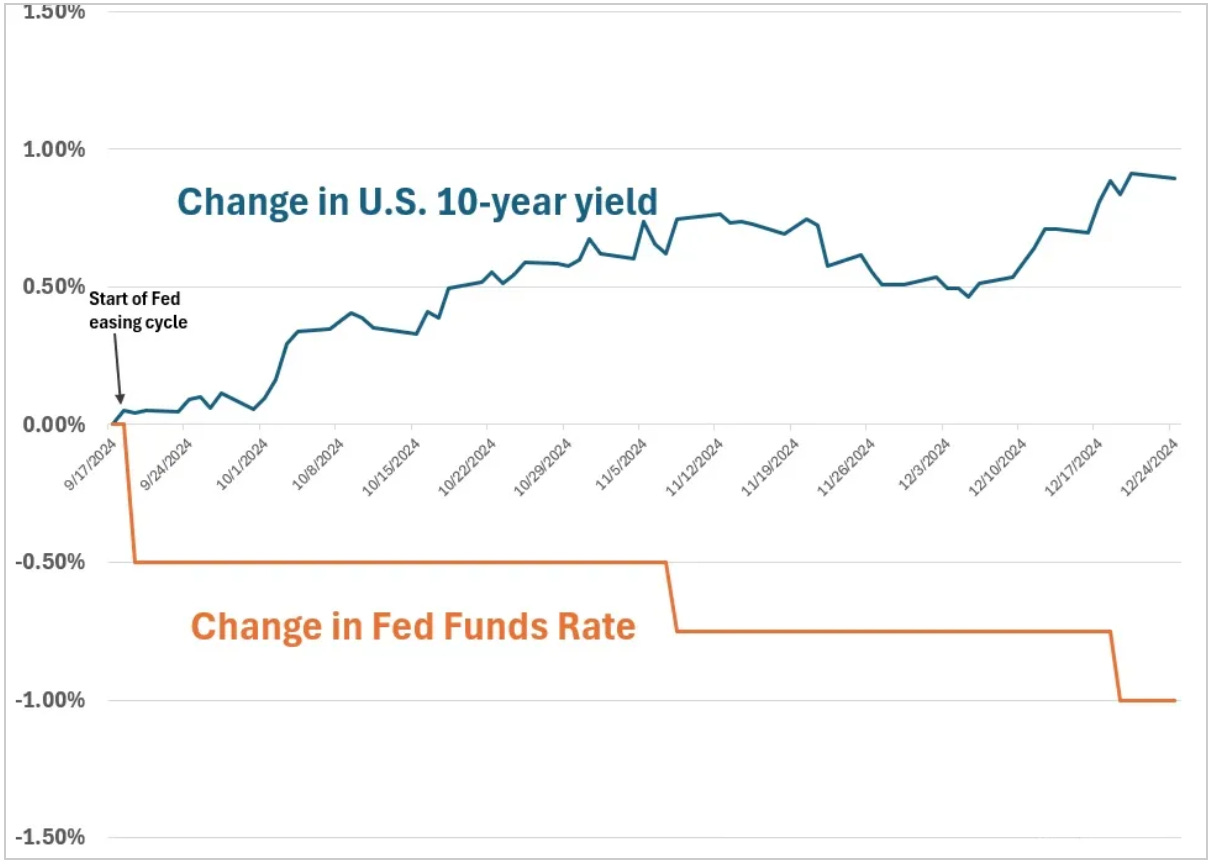

As you can see in the chart below, since the Fed kicked off the easing cycle back in September, the 10-year Treasury yield has moved almost 100 basis points higher as the Fed has taken the Fed Funds rate 100 basis points lower.

And as you can see in this next chart, with this rise in the 10-year, the downtrend in yields has broken.

And this trendline is significant. It represents the regime change in monetary policy, signaled by Jerome Powell back in October of last year — when he signaled the end of the tightening cycle.

The 10-year yield proceeded to fall as much as 140 basis points on the anticipation of an aggressive Fed easing cycle. But when the easing cycle actually began, yields went straight up – now back at 4.58%, having broken above the trendline.

Is it reflecting a Trump-agenda-fueled outlook for higher growth and higher inflation? Or is it reflecting potential trouble in the bond market?

On the latter, let's revisit an excerpt from my note last month “Duck, Duck, Goose” (here), where we discussed (now Treasury Secretary nominee) Scott Bessent's concerns about Janet Yellen's handling of the deficit.

Bessent argued that Yellen financed it in a way that traded short-term gain (in attempt at political gain) for medium and long-term economic pain — leaving the pain for the next administration.

As you can see in the right side of the chart below, the government has been funding the largest deficit spending in peacetime history, by issuing an unusually large proportion of short-term debt (Treasury bills, the blue bars).

By funding more of the deficit with shorter dated Treasury bills over the past year, Yellen paid more to borrow, as short term rates were higher than long term rates (an inverted yield curve).

But by focusing on Treasury bills, and limiting the increase in longer-term bond issuance, Yellen was able to influence longer-term interest rates lower or prevent them from rising further.

Bessent has made the case that this looks like Yellen purposely manipulated financial conditions through this strategy to "goose the economy."

Now, for the new administration, these short term Treasury Bills will have to be refinanced, creating risks for rate volatility and, as Bessent put it, "the potential for a financial accident."

We have a lot of tailwinds for 2025, but we should expect the path to be bumpy.

This will be my last Macro Perspectives note for the year. Thank you for being a loyal reader of my daily notes. I want to extend my best wishes for a Merry Christmas and a Happy and Healthy New Year!

ps: Consider leveraging our knowledge and research into your investment process; Cutting-edge research, ready-to-use strategies and scalable solutions…