It's a Matter of When?

Stocks in the US closed lower on Wednesday, as investors weighed the latest batch of earnings and hawkish tones from Federal Reserve officials.

The S&P 500 dropped 0.5% and the Nasdaq fell sharply by 1.1%, both marking the fourth straight session of losses, hitting February levels low.

Fed Chairman Powell noted that the central bank is in no rush to cut interest rates in response to recent signs of high inflation, a sharp change of rhetoric from previous remarks that hot inflation readings in January and February didn’t alter the disinflation trend.

Semiconductor stocks led the losses, as ASML sank 7% on poor results, while ARM and Nvidia dropped 12% and 3.8%, respectively.

Also, Abbott dropped 3% as a lower Q2 guidance offset strong sales.

The correction in stocks continues;

S&P futures are now down 5.3% from the April 1 record high.

Nasdaq futures are down 5.8%.

Dow is down 6.2%.

Russell is down 9.5% (20% lower than the record highs of November 2021).

Interestingly, it's not the broad indiscriminate selling of stocks you might find in an economic shock, or the unwinding of a grossly overvalued market. Over 40% of the S&P 500 stocks were up on the day (4 out of 10 sectors).

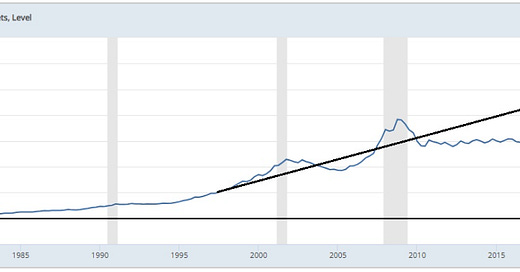

This continues to look like a technical correction in a bull market. Not only do we have the catalyst of a new industrial revolution underway, but the economy continues to be flush with cash - we've looked at this chart of money supply …

The money supply remains trillions of dollars above trend. And Biden's proposed 2025 budget would require printing another $1.8 trillion. If we extrapolate out the trend (crudely) in money market funds, the balance there is around $1 trillion above trend.

So, the correction is a buy in stocks. It's a matter of when.

As we discussed yesterday, given the adjustment in rate expectations, and the headline risk with Israel/Iran, it's fair to expect a deeper correction, still. With that, based on historical performance of the S&P 500 we should expect intra-year corrections, on average, of better than 10%.