Is the Fed ready to Act?

US stocks remained volatile in afternoon trading as investors weighed Nvidia’s earnings, trade policy uncertainty, and economic data.

The S&P 500 slipped 1%, while the Nasdaq 100 lost 2% as Nvidia shares tumbled 6.1% despite exceeding earnings expectations.

Salesforce fell 2.9% after issuing disappointing revenue guidance, adding to the cautious sentiment.

Market jitters deepened after President Trump confirmed that 25% tariffs on European autos, as well as levies on Mexico and Canada, will take effect on March 4.

Meanwhile, economic data showed GDP grew at an annualised 2.3% in the fourth quarter, while jobless claims unexpectedly rose to 242,000, signaling potential labour market softening.

Going into Nvidia earnings, we talked about the setup for a negative reaction for stocks.

It looks like we're getting it—and maybe a correction in what has been a very hot run for the stocks of the companies leading the AI revolution.

With that, we ended the day (yesterday) with the (tech heavy) S&P 500 sitting on a very significant trendline. This trendline originates from October 2023, when the Fed signaled the end of the tightening cycle. They did so because the bond market forced their hand. The 10-year yield was sitting at 5%, which was the danger zone for financial stability, and stocks were in an 11% correction.

The Fed flinched. Yields fell. Stocks rallied.

Now the trendline is being tested, vulnerable to a break (down).

It's happening as yields have just fallen like a stone—down 44 basis points in 11 days. That's happened just two other times in the past year, one of which was driven by the carry-trade unwind event in early August of last year.

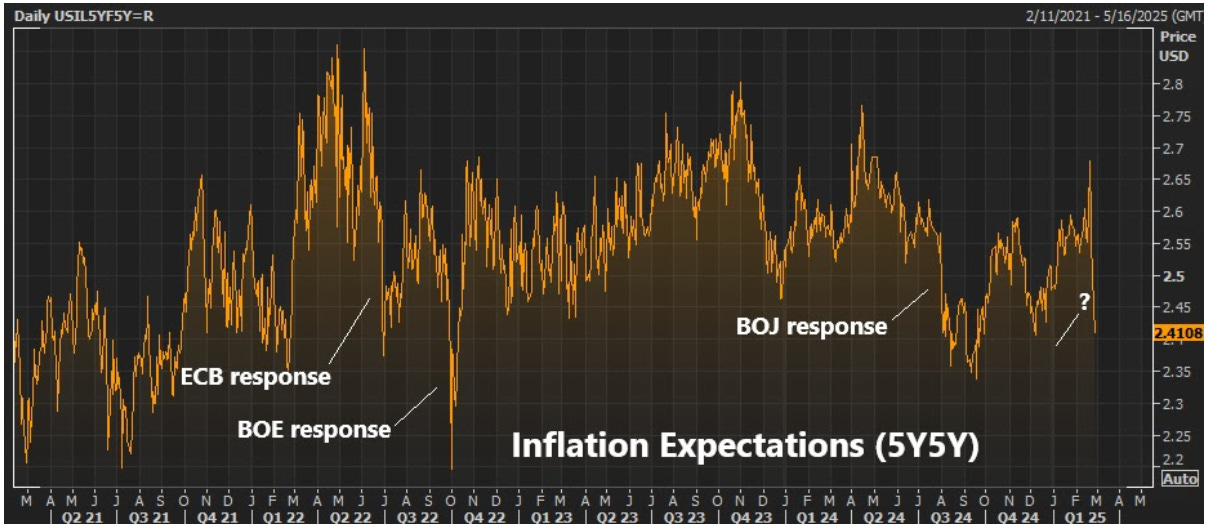

What's going on this time? If we look at this bond market gauge of inflation expectations (next chart), we can see it's falling sharply (far right of the chart).

Of course, this can happen in this metric when benchmark bond yields take a sharp fall (for a variety of reasons). On the "variety of reasons" note, if we step back through the chart, we can see the sharp moves lower share the feature of significant events, and subsequent central bank action.

Moving left to right, we had the June 2022 stress in the European sovereign debt market. The ECB had to restart QE (QE by a new name, the "Transmission Protection Instrument") to stabilise bond markets of the weak euro zone countries.

In September of 2022, it was bond market stress in the UK. The Bank of England had to intervene to avert a financial crisis (which would have been global).

In August of last year, the Bank of Japan took another step toward exiting emergency-level policies, announcing plans to exit its role as the global liquidity provider. It induced a liquidity shock for global markets (including an unwind of the carry trade), and the Bank of Japan was forced to quickly walk it back (verbal intervention, if not actual intervention/asset purchases).

What's going on this time? Maybe its the shock to the labour market that's coming, given the DOGE agenda. And it will come with a Fed that's still holding real rates (Fed funds rate minus PCE) at an historically tight level.

The Fed should be communicating to markets that it stands ready to act (ready to ease).