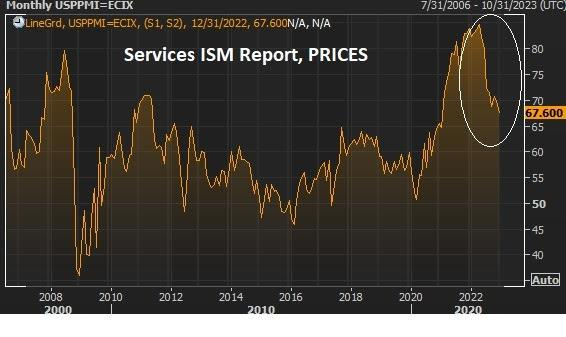

As a reminder, on Friday the ISM services report showed a decline in December services prices.

The chart below (pulled from yesterday’s note), shows the decline in the prices paid in this area of the economy has been dramatic, nearly returning to December 2020 levels- the fall has been even faster than the rise (of last year).

Also remember, it has been inflation in this area of the economy (services) that the Fed has highlighted, as justification for its guidance on the rate path (higher).

Now, with the above chart in mind, it's logical to think that softening services inflation will make its way into the government's inflation report soon, perhaps in the December report that will be released this Thursday.

This, as inflation data has already been trending toward a monthly negative price change (i.e. deflation). Still, the Fed continues to put officials in front of cameras to talk about how committed they are to raising rates above 5% (another 100 bps).

This sets up for a very interesting CPI report on Thursday.

Expect a massive move in stocks.

The last four of these reports have resulted in a daily trading range in stocks (S&P futures) with a magnitude that has historically only been associated with very significant events;

a 5.8% range on September 13th,

a 5.4% range on October 13th,

a 5.9% range on November 10th,

a 4% range on December 13th.

A Message from the Sponsor

The Gryning Portfolio research, tools and solutions are built on the idea that markets, securities and signals are actionable through analysis.

For less than a coffee a day, you can implement any/all of the four portfolio’s I provide daily updates on, whilst also accessing the various research and objective data points to manage your own trading/portfolio in an unbiased and unemotional manner.