Stocks in the US finished deeply in the red on Wednesday, halting a nine-day winning streak.

The S&P 500 and the Nasdaq 100 sank 1.5% each, while the Dow Jones tumbled 475 points.

Meanwhile, fresh economic data topped forecasts, with existing home sales unexpectedly rising while the CB consumer confidence rose by the most since early 2021.

Consumer staples were the biggest laggard, while energy gained the most.

Alphabet rose 1.2% after announcing plans to reorganise a significant part of its 30,000-person ad sales unit

Macro Perspective

Stocks were continuing to drift higher into the end of the year, when this happened . . .

It was a broad reversal across the stock market;

The VIX popped, albeit off of low levels.

Oil reversed.

Yields finished the day lower.

Was it a war flashpoint in the middle east? Was it concern over U.S. domestic election interference/ weaponization of the justice system? Was it China/Taiwan news? Unlikely.

Rather, the timing of sell-off in stocks aligned with another underwhelming bond auction by the Treasury. But the sharp reversal in stocks had more to do with that minor catalyst meeting less liquid holiday markets.

To be sure, the key driver for markets continues to be inflation and interest rates.

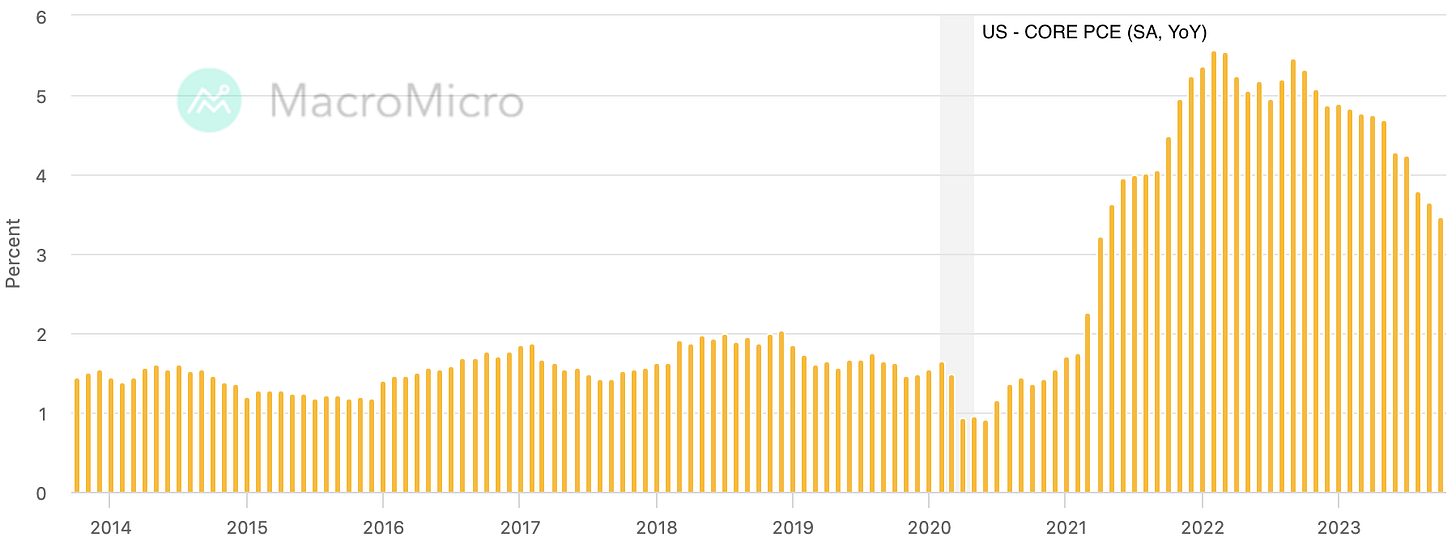

With that, as we've discussed the market is pricing in six rate cuts next year. The Fed has projected just three. But as we've also discussed, with this trend in inflation (chart below), the lower the rate of inflation, the more restrictive Fed policy becomes (i.e. the real rate rises).

And as the Fed Chair told us last week, in his post-meeting press conference, they estimate for the 12-months ending in November, that "core PCE prices rose 3.1%."

So, when we see the inflation data this Friday, we should expect the yellow line in the chart above to fall another 40 basis points - which means Fed policy will have gotten 40 basis points tighter.

Additionally, to get to 3.1% in the year-over-year number, the November monthly change in prices should go (slightly) negative (i.e. indicating deflation in November). We've seen just that over the past two days from the euro zone and the UK - price deflation in the November data.

This should all support the view that the interest rate market has it right in projecting more aggressive cuts from the Fed next year.