We started the week (Monday) talking about the mixed signals in markets.

Yields going down, despite the Fed taking the first step in a policy reversal last week.

Yields went down yesterday, despite the house passing a $1.2 trillion spending package over the weekend.

The Vix going up, and gold going up (finally) despite stocks closing the past week on record highs - continues this week - all signals of risk hedging.

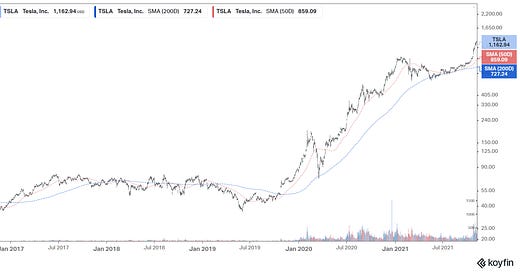

We ended last weeking asking if perhaps the official change in direction from the Fed, and an ending of the pandemic could be setting the stage of an unwinding of some very bubbly growth "disruptor/stocks of the future." And this chart came to mind (also posted in Monday’s note)...

Fast forward a few days, and we have another "turning point indicator" in that view: Congress may have fired its final fiscal bullets, passing the infrastructure spend over the weekend.

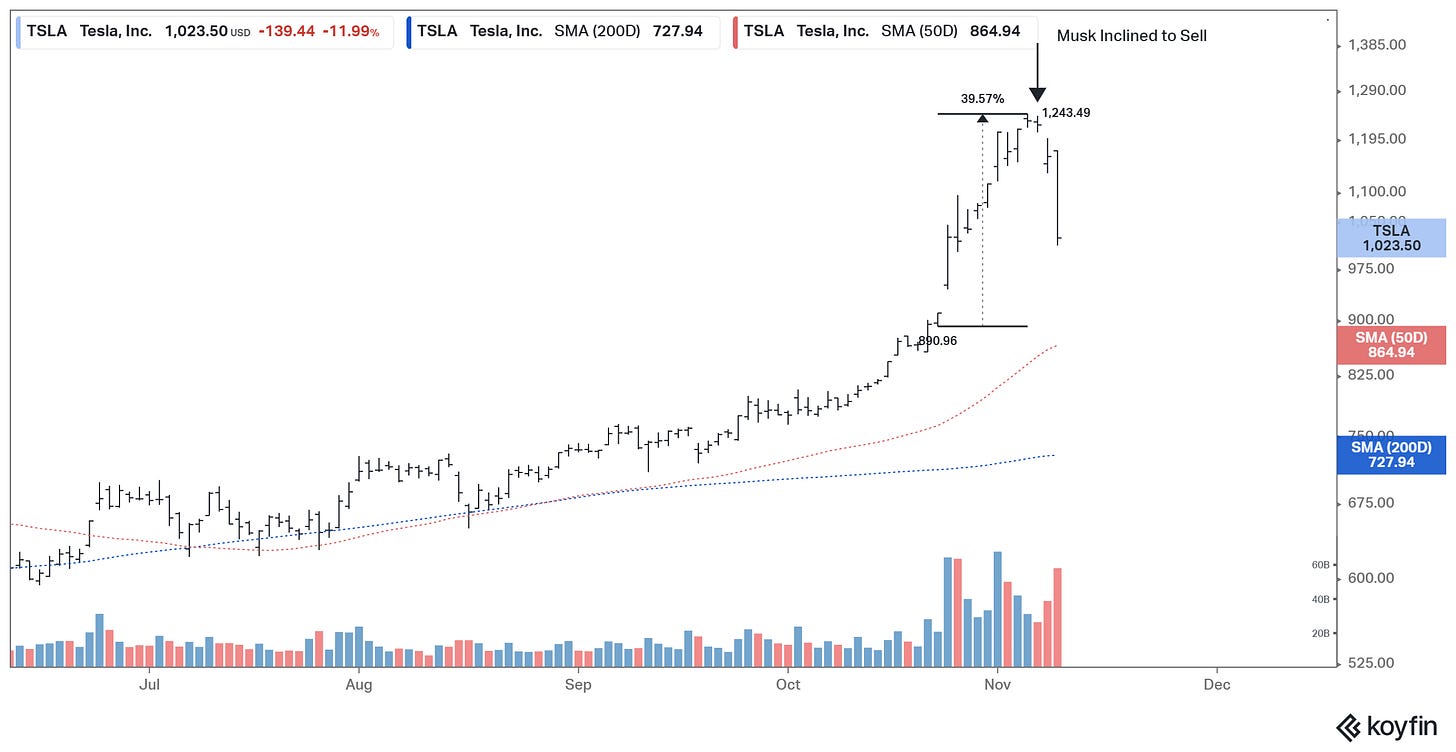

Add to that, over the weekend, after becoming the richest man in the world, thanks to the chart above, Elon Musk suggested he might be inclined to sell 10% of his stock. Now we have this chart...

The great macro trader, Paul Tudor Jones, has described the euphoric stage of bull markets like this: "there's typically no logic to it, and irrationality reigns supreme."

Tesla, while ebitda has increased 3x from the pre-pandemic quarter, the value of the company has increased almost 15x...and, as you can see in the chart above, Tesla, one of the biggest companies in the world, increased in value by 39% in just nine days. Irrationality reigning supreme?