Yesterday we talked about the prospects of more direct government and Fed intervention, having already seen unprecedented intervention through monetary and fiscal policy. Will the Biden administration take it further, and attempt to manipulate commodities prices (lower)?

A step in the direction has been taken - alleging price gouging from the domestic (US) oil and gas industry and calling for an investigation into producers.

The question should be, is this the China playbook?

The Chinese government intervened in the domestic iron ore market this past summer. Iron prices had more than doubled from pre-covid levels. The government stepped in, in May - with investigations and inspections into producers and speculators. Prices are down ~60% since May.

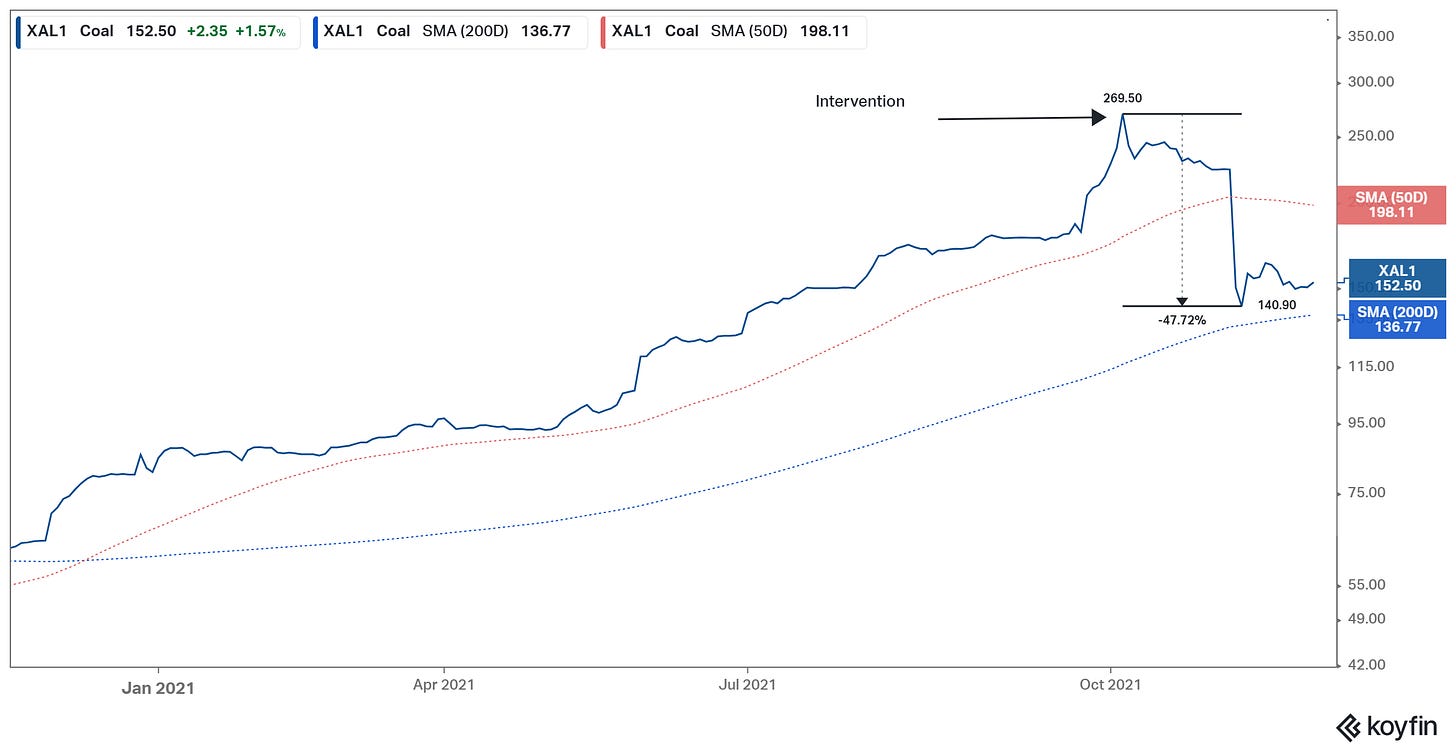

The Chinese government intervened in the domestic coal market in October. Coal prices had tripled over the prior twelve-months, prices are now 40% lower, in just one month.

In September, China made a move to stabilise oil prices by releasing oil from its strategic reserves, for the first time ever - prices went up, not down.

What's the difference? China is the biggest producer of coal in the world and is one of the biggest producers of iron ore in the world. It has less control over oil supply, and now, given that the U.S. has regulated away and is defunding new domestic oil exploration, the U.S. has less control over supply too.

So, the news yesterday that Biden and Xi (China) discussed releasing strategic oil reserves should do little to change the trajectory of higher oil prices. It doesn't address the structural supply/demand imbalance.