Intact

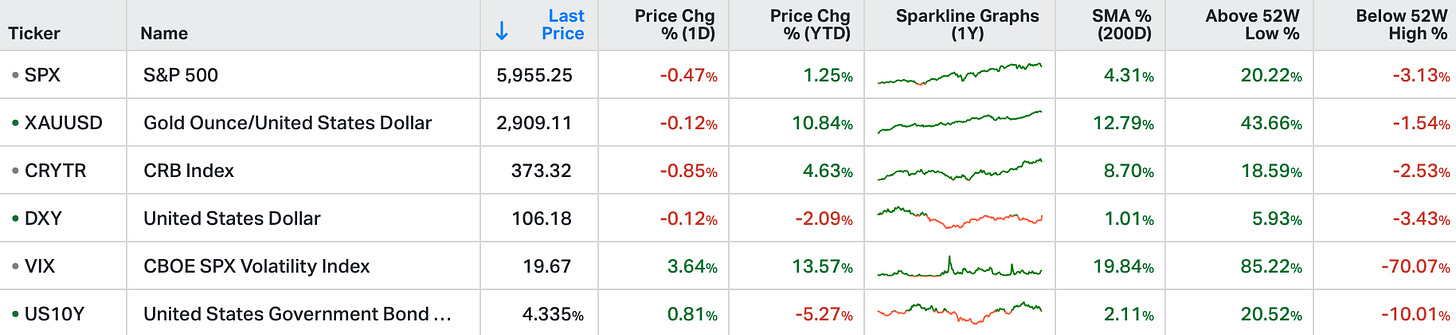

The S&P 500 extending its losses by 0.5%, marking a fourth consecutive decline.

The Nasdaq 100 dropped 1.2%, turning negative for the year, while the Dow Jones outperformed, rising 159 points.

Investor uncertainty deepened after President Donald Trump revived tariff threats on Mexico and Canada, while also signalling potential new restrictions on China's semiconductor industry.

The 10-year Treasury yield slid to a multi-month low as traders increased bets on Federal Reserve rate cuts.

Earnings reports from Home Depot (+2.9%) and Lowe's (+2.2%) remained in focus, offering key insights into consumer spending trends.

Nvidia earnings are due today after the market close.

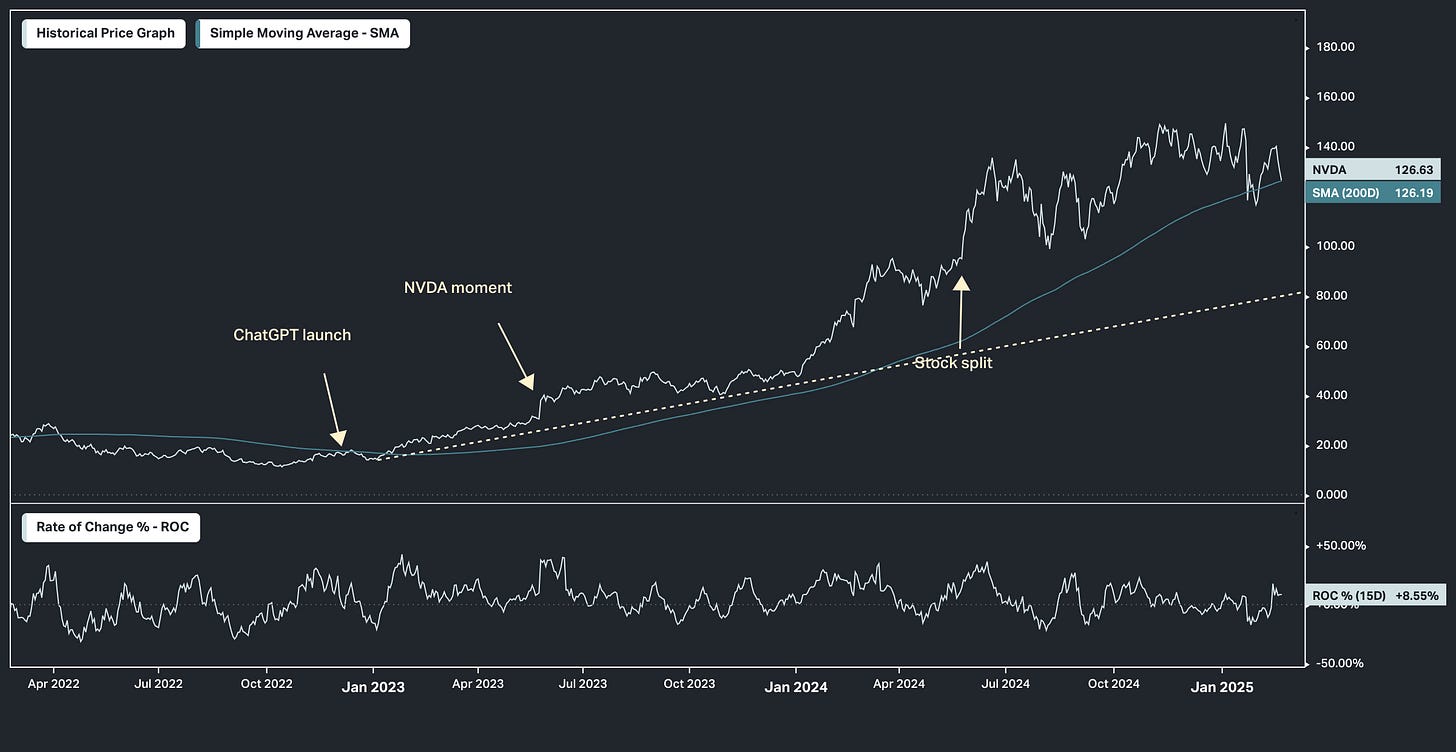

As we discussed in my note yesterday, Nvidia's quarterly growth capacity seems to have hit a wall (constrained by manufacturing capacity). The market seems to have recognised it, based on the behaviour of the stock after last November's earnings release.

Given some of the risk-off behaviour in markets yesterday, the set of outcomes looks skewed toward negative for Nvidia shares from today’s earnings. And that would set up as a catalyst for some broader stock market weakness (a correction).

With that, let's look at a few charts …

Above is the chart on Nasdaq futures. You can see the influence of the "ChatGPT moment" (as coined by Jensen Huang). A move down to this trendline would represent an 11% correction.

Next, is Nvidia. A move back to a similar trendline in Nvidia would be in the low $80s. A retracement to the day of the stock-split-announcement (May 22, 2024) would be about $95.

This next chart would argue: If we are in the midst of a correction in the American AI-theme, the movement of capital into Chinese AI—where substantial value opportunities exist—confirms the investor confidence in the AI theme. It's an opportunistic shift towards value, not a retreat from the theme.

And as I said in my note yesterday, the AI revolution is real and well intact. And a correction in the AI-theme would be a welcome buying opportunity.

Nvidia Data: Given its 7% weight of SPY, 8% weight of QQQ and 19% weight in the VanEck Semiconductor ETF (SMH), NVDA’s earnings can create outsized volatility in the broad market ETFs and semiconductor sector. A big beat or miss could pull the whole ETF up or down sharply.

Historical NVDA Movement: