Biden signed into law the infrastructure bill yesterday.

The question is: Will this be the final fiscal bullet fired?

If it is, with monetary policy now pointing in the direction of a tightening cycle (maybe to start by next June), we have to keep an eye on the "bubble" markets - the most vulnerable.

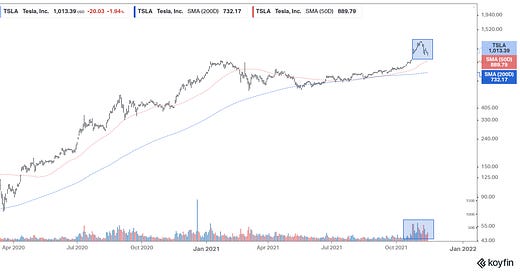

Perhaps the biggest bubble/manifestation of excess money and a mania surrounding the expectations of a global energy transformation is Tesla - a company that has exploded in value, from $78 billion to $1.2 trillion in just twenty-months. Over a trillion dollars of global capital has plowed into this stock.

What happens if the massive "clean energy" bill, that has been in negotiations in Congress and already whittled down significantly in size, does not make it to the finish line? Does the money move out of Tesla?

We're already seeing some selling from Elon Musk, and some price action that would fit the description of a blow-off top (a steep and rapid increase in a stock's price and volume, followed by a steep and rapid drop in price, on high volume).