The big April inflation report comes in today. Let's talk about what to expect …

First, it was the inflation report from last month that finally got the market stirring - the 8.5% headline change in prices, from the year prior, was the hottest since 1981.

But it was the monthly change that was even more stunning, at 1.2%. That number, compounded monthly, would give us around 16% annual inflation - and that would actually sound more like the reality of prices consumers are seeing in every day life.

Still, following that report last month, the media, the administration and the Fed immediately responded by promoting the idea that (somehow) inflation had peaked. We will see today.

The market is expecting a 0.2% change from April to March - that would be a dramatic softening from the March report, and the year-over-year expectation is for 8.1%.

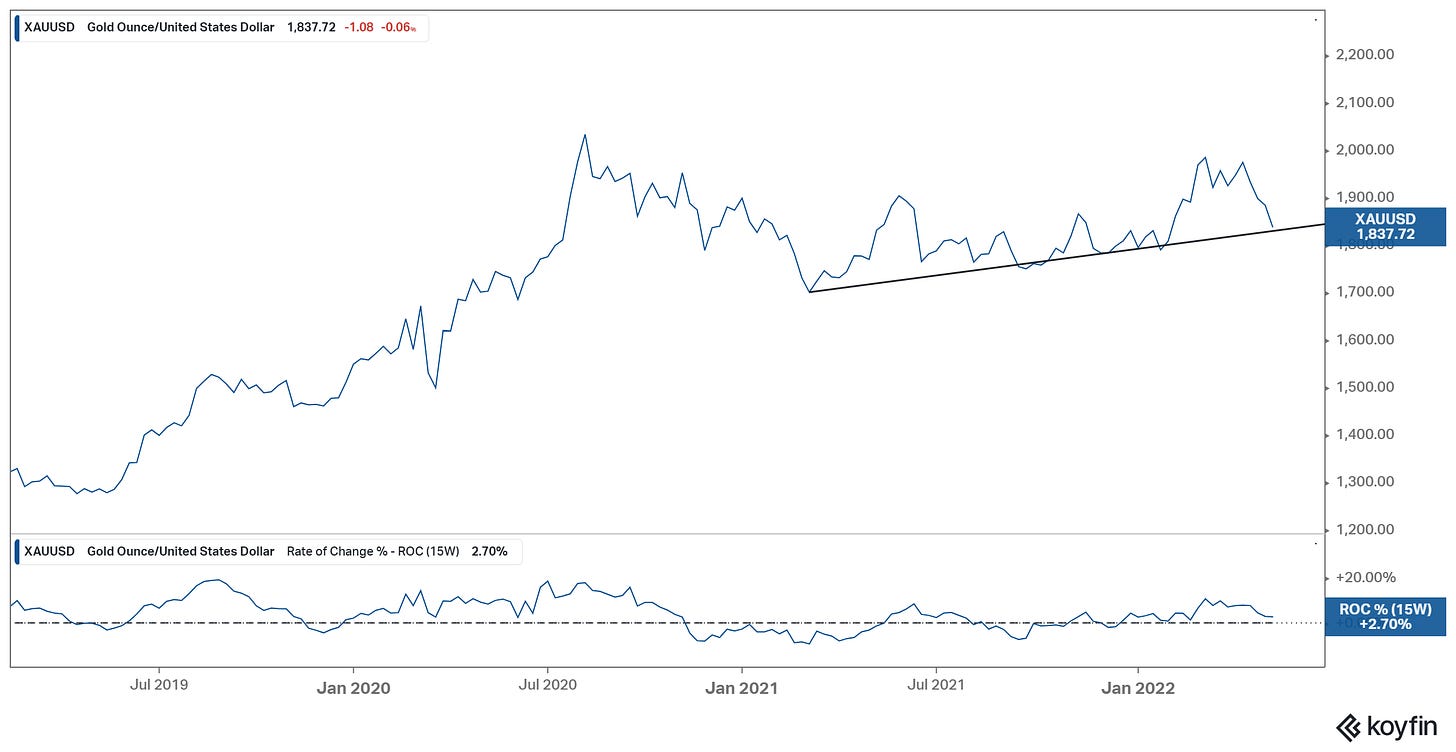

If we focus on the monthly number, this sets up for a negative surprise (i.e. a hotter than expected number). This comes as the historic inflation hedge, gold, sits on this big trendline/ support.

Meanwhile, what has been considered the "modern day gold," and new inflation hedge, Bitcoin, has already technically broken down - in sympathy with the bursting of the tech bubble.

If we get a hot inflation number today, and moreover, if inflation has yet to peak, I suspect we will get to see if gold recovers its role as the favored inflation hedge.