News in 5

US stocks were mostly higher on Thursday, with the S&P 500 gaining nearly 0.2% and the Nasdaq rising 0.4% while the Dow Jones was little changed.

Traders digest the latest CPI report which showed the headline inflation rose more than expected to 3.4% while the core rate fell less than anticipated to 3.9%, prompting investors to lower bets for a rate cut by the Fed in March to around 65% from 70%.

Tech and communication services were the top performing sectors.

NVIDIA hit another all-time high of $549.37 and Amazon increased to a 20-month high of $155.64.

Coinbase shares rose more than 3.5% following the SEC's approval for Bitcoin-related exchange-traded funds.

Macro Perspectives

As we've discussed for the better part of the past year, the rate-of-change in prices has been steadily moving in the right direction - lower. And not only are we near (or at) the point where the Fed needs to start reversing its restrictive policy, but the Fed has, importantly, acknowledged it (finally).

So, for context, the market has priced in the first cut by the Fed in March. The Fed has projected, in its December Summary of Economic Projections, that the first cut will likely come in June.

So, that makes yesterday’s inflation data a key input in the Fed's decision making process.

What did we get?

The core CPI (excluding food and energy prices) ticked down for the ninth consecutive month, now under 4%.

The headline CPI ticked up from a prior 3.1% to 3.4%.

Is this an indication that the disinflation (falling inflation) trend is coming to an end? Not at all. In fact, we're about to see an acceleration in the fall of inflation. Let's take a look at the CPI index, without the shenanigans of seasonal adjustments.

The government's Bureau of Labor Statistics likes to show us a monthly change in prices that has been adjusted by their special "seasonal" formula. In that case, they showed prices rising 0.3% last month.

They also like to show us the 12-month change in prices without seasonal adjustments - reported at 3.4% (December 2023 compared to December 2022 prices). As the BLS says, this unadjusted data is what shows the prices consumers "actually pay." That seems useful.

On that "what prices consumers actually pay" theme, what the BLS doesn't talk about in their report is the monthly change in the price index without seasonal adjustments. It turns out, that number was negative (i.e. deflation in the month of December), and as you can see in the table above, it's a trend (three consecutive months of deflation).

This latest data is displayed in the table above and we can see how quickly the 12-month change in prices slides in the coming months, if we apply the average monthly price change over the past twelve months (0.23%) to the current index value. By the Fed's March meeting, this CPI index would be at 2.33%.

This index will be coming down fast, beginning next month.

On a related note, remember from last month, had the government not revised DOWN the prior four consecutive months of the most recent core PCE index data, the monthly price change would have been negative (i.e. deflation).

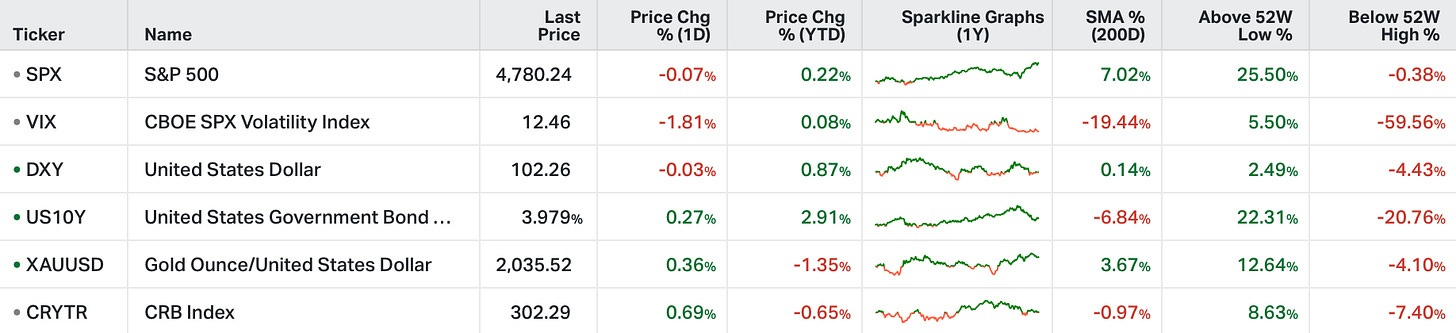

Considering all of this, the interest rate markets remained undeterred in their anticipation of a March rate cut, following this inflation report. Furthermore, none of the Fed officials that spoke publicly yesterday dismissed the possibility that the Fed could move in March.