We've talked a lot about the inflation picture - we'll get the big August inflation data this week.

For some perspective, let's revisit the difference between level of prices and the rate-of-change in prices;

The level of prices is here to stay.

The rate-of-change has to slow, and has been.

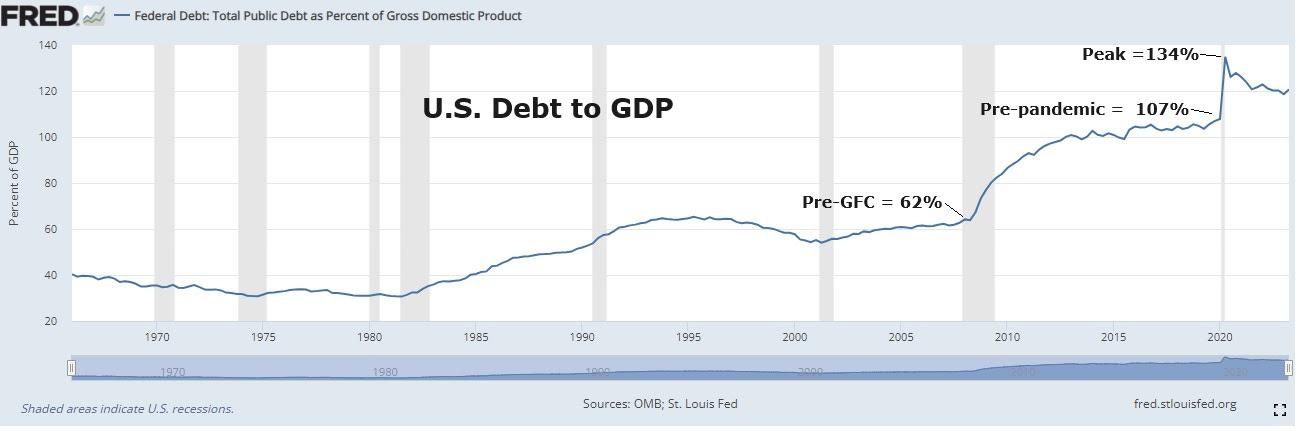

Remember, the massive monetary and fiscal response to the pandemic (plus the subsequent agenda spending binge) ramped the money supply by 40% in just two years - that was ten years worth of money supply growth (on an absolute basis), dumped onto the economy over just two years.

That tsunami of money rapidly reset the level of prices, of almost everything. It was by design. It was an explicit decision, out of necessity and opportunity, to inflate asset prices and inflate away the value of debt.

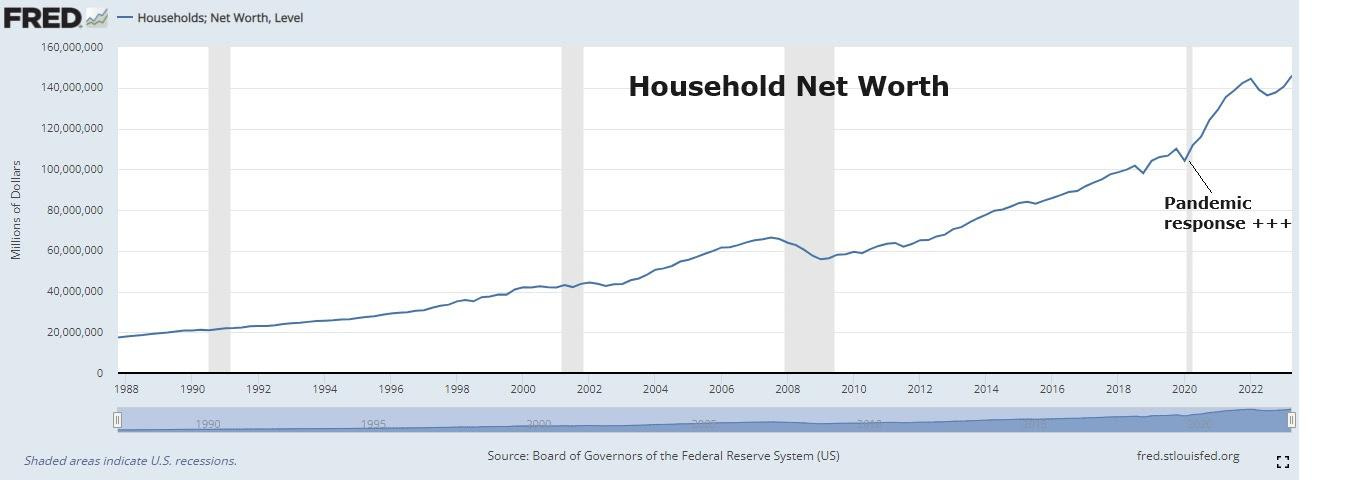

On the former (i.e. inflating asset prices), that translates into the Q2 report released on Friday on household net worth - it's at new record highs . . .

On the latter (inflate away the value of debt), the nominal size of the economy has grown at an average annual rate of 10% coming out of the pandemic-induced contraction, largely resulting from the nominal price of things.

With that, as you can see in the far right of this chart, the debt burden has been shrinking from the pandemic policy-response driven peak. What matters is debt relative to the size of the economy, and as you can see in the chart above, that's been improving (thanks to hot nominal growth).

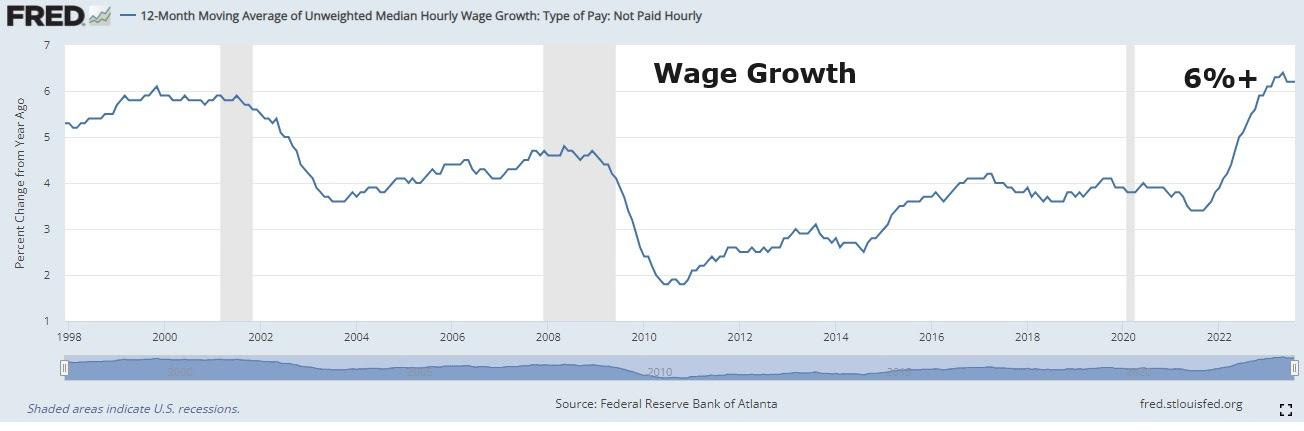

With the rate-of-change in prices now under control, as we have often discussed we need a reset in wages (higher wages) to offset the reset in prices - to restore the standard of living.

It's a slow, painful, lagging process, but it looks like it's happening. Plus we're getting productivity gains, which mutes some inflationary effects of wage hikes. Below is median hourly wage growth . . .

The New York Fed's Labor Market Survey says the average full-time wage received in the past four months increased from $60,764 in July of 2022 to $69,475 in July of this year. That's 14% - a big number. It was just 3% growth the prior year.