As we know, the broad expectations on the inflation outlook are shifting. A hot CPI on Wednesday, a hot PPI yesterday…

Input prices, output prices, final prices. Everything is on the move - it's becoming indefensible for the Fed.

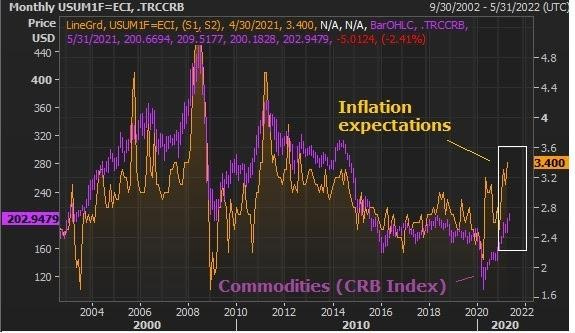

This is all translating into inflation expectations, which as you can see in the chart below, is leading commodity prices (i.e. inflation expectations are projecting a sharper move higher in commodity prices).

With the Fed caring about managing inflation expectations, they are losing the battle - and with the view creeping into markets that the Fed will have to move earlier on rates, rather than later, stocks have had a four-day sell off.

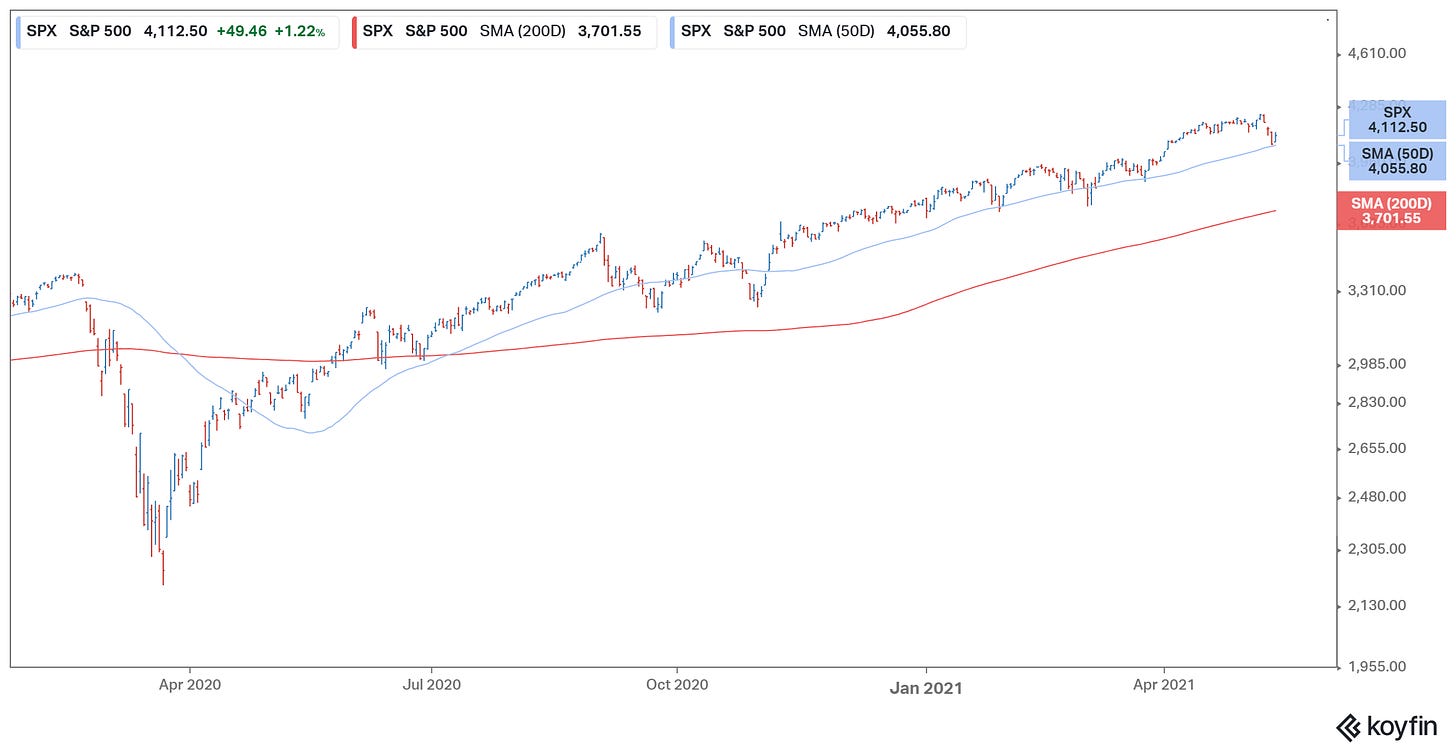

But if you miss this four-day, 4% dip in stocks (to buy), you may miss your chance.

As you can see in the chart below, S&P futures bounced early yesterday morning, right into the 50Day moving average, that has represented support on numerous occasions from the bottom marked by Fed intervention last year. That was good for a sharp 2% bounce.

Bottom line: Inflation is not a risk to stocks. Inflation inflates the nominal value of stocks. The risk to stocks is how quickly the Fed will kill the economic recovery to get inflation under control.

If we believe anything the Fed says, we should probably believe them when they tell us that they will let the economy run hot, "sustainably" above their target rate of 2%). Sustainably is the key word. It means they won't be killing the recovery soon.

It's looking more and more likely that they will be caught wrong-footed, chasing inflation from well behind, creating a scenario for a hot run in inflation (maybe/likely double-digits). That's a recipe for continued inflation of asset prices (stocks included).