There was news of a bipartisan deal on an infrastructure package late Thursday. Though Friday, the bipartisan agreement became less clear. What is clear, and has been since the Georgia Senate run-off, is that the Biden administration will get whatever spending package they want across the finish line.

Whether or not they seek any support from the minority party in Congress will only serve to create perception that they tried.

The important takeaway for markets is that the wheels on the infrastructure bill are moving and it would be smart for the administration to get it done before Q2 data starts rolling in - in just a couple of weeks. When that data hits, and displays some eye-popping economic activity, and related inflationary pressures, the case for another $1 trillion plus spending package will be impossible to justify (assuming it were possible).

On that note, expect the urgency to step up on getting a bill through Congress, and signed.

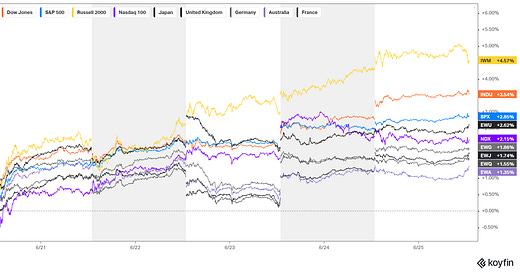

With the inflation data already telling a clear story, and with the catalysts of a massive infrastructure spend and Q2 data directly ahead of us, stocks closed the week on new record highs.

Meanwhile the historically favored inflation trade, gold, has given everyone a second chance to get involved. After a run-up to $1900 earlier this month, the price of gold is now 7% lower. That leaves it down 6% year-to-date, and flat over the past twelve months. It's a buy.

Within this inflation price regime, value stocks are outperformers.