We get the much-anticipated October inflation report today.

As we've discussed over the past week, if inflation continues to go the Fed's way (i.e. continues to trend lower), the Fed will have to cut rates aggressively next year, otherwise real interest rates (the difference between the Fed Funds rate and inflation) will continue to rise, which will tighten financial conditions even further.

They haven't acknowledged it. But it's obvious. In fact, UBS said that they expect the Fed to cut by 275 basis points next year!

So, what does the inflation number look like?

The consensus view is for a 3.3% year-over-year change.

A powerful driver of falling inflation (the fall from over 9% to 3%) has been DEFLATION in energy prices. That said, that deflationary contribution from energy prices should be waning, given supply/demand fundamentals. If we look at the price records from the EIA (Energy Information Administration), the year-over-year change across broad energy should be negative for the month of October.

That should contribute to a slide in October headline inflation from 3.7% (the prior reading). It should be welcomed by markets and cheered by the media - more fuel for stocks, and more downward pressure on bond yields.

This come’s as we already have a bullish trend break across the S&P 500, Nasdaq and DJIA . . . whilst 10-year yields are trading in the mid-4% area, after failing to break above 5%.

With that, the Fed has a line-up of speakers this week. We should expect them to curb any enthusiasm - they've acknowledged that higher longer-term bond yields, lower equity prices, and a strong dollar have "tightened financial conditions significantly."

They've also made it clear that they want these conditions to persist.

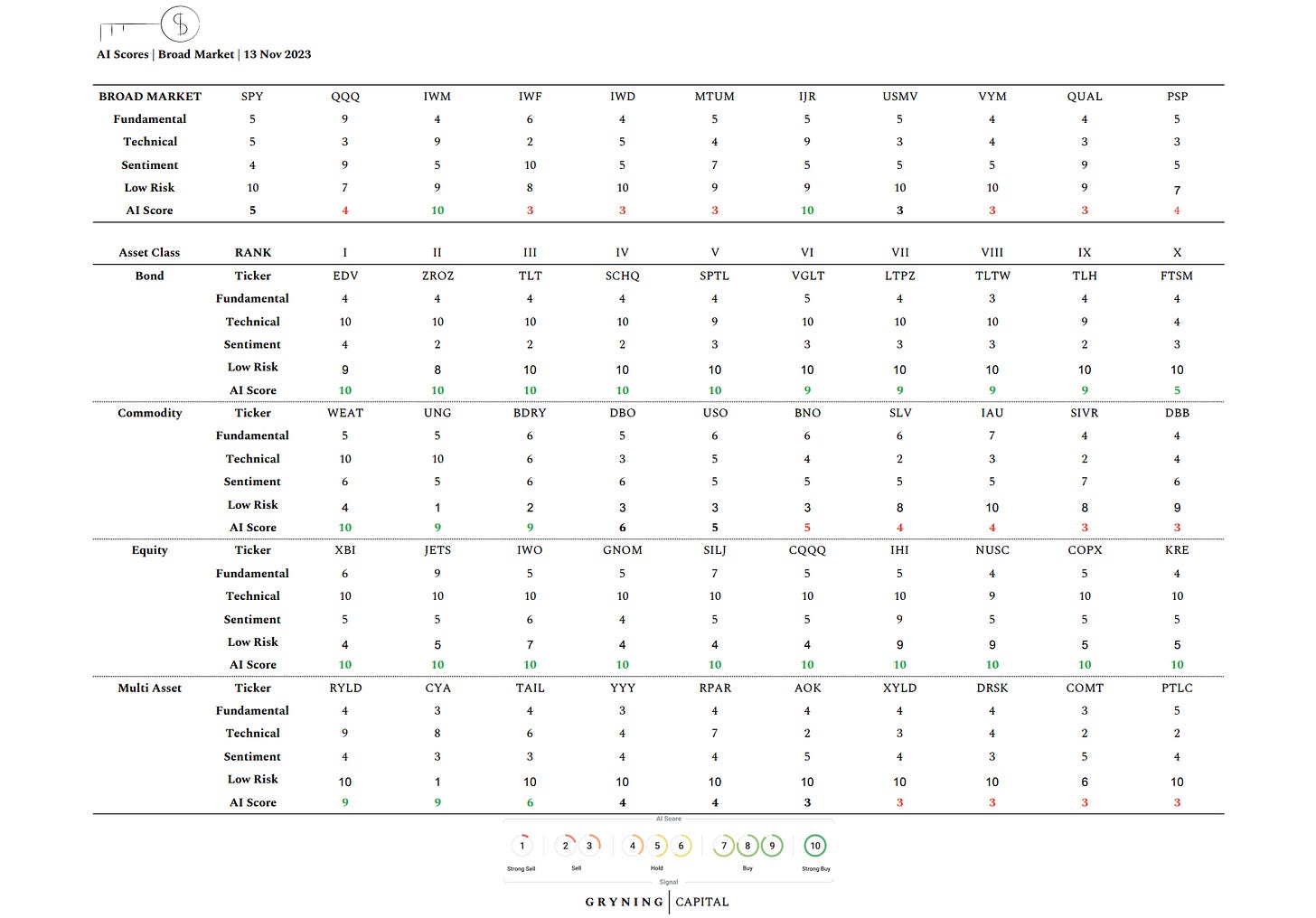

ps: If you’re looking for places to go express a bullish view, IWM 0.00%↑ & IJR 0.00%↑ show an AI Score of 10 (Strong Buy) according to our AI.