We get the June inflation number today.

As we discussed yesterday, rising gas prices in June will be a big contributor to upward pressure on CPI. The consensus view is for a hot headline number - a new 40-year high.

But as we also discussed yesterday, given some weakness in other inflation inputs, as well as weakness in broad economic data, don't be surprised if the Fed and the media try to turn focus to the "core" inflation rate (in effort to manage confidence).

The core number excludes the effects of food and energy - it has been ticking down the past two months, and is expected to continue that trend in today's report.

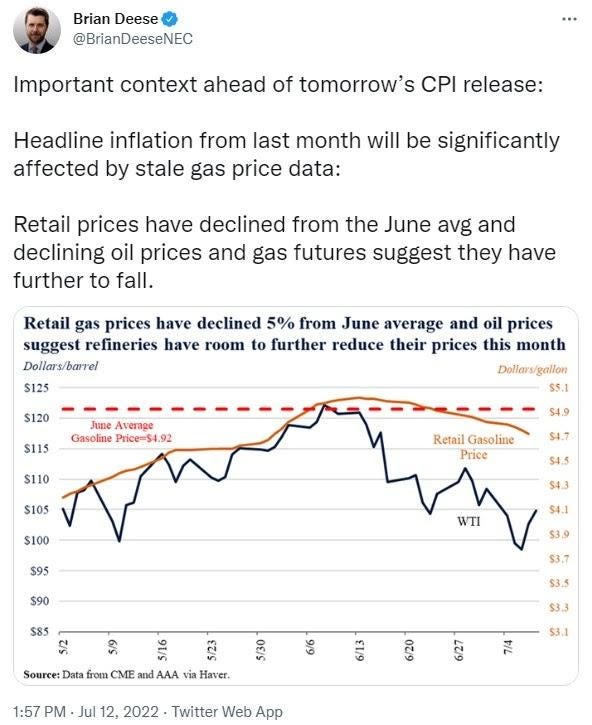

On cue, we had an article from Reuters yesterday afternoon that drew attention to the core number. Whilst the head economics guy at the White House tweeted this…

So, the White House is trying to get in front of the number. The White House also included a sentiment manipulation campaign, that economic data in Q1 and Q2 was not consistent with "recession."

However, as we know, official Q1 GDP was negative and Q2 is tracking a contraction of 1.2% - that would be two consecutive quarters of negative GDP, which is technically defined as recession. The White House is clearly trying to assuage a recent small business optimism index report, which plunged to nine-year lows, and consumer sentiment which is on record lows.

All of that said, if we look at nominal growth, the economy is indeed growing at a better than average clip of over 6%. It's inflation that is crushing "real" growth. It's an inflation-driven recession.

If we look back to the inflation spikes of the early early 80s, nominal GDP grew by an annual rate of 9% during those periods. Stocks did this...

Notice the impact inflation had on the real (after adjusted for inflation) rate of return in stocks (the third column).

Through a four-year period, where inflation averaged nearly 10% per year, you can see, in the far two columns, what it looked like for those that remained invested in stocks, relative to those that went to cash.

The takeaway: Being long stocks not only gave you a hedge, but increased your buying power by 30% over the period. Going to cash, destroyed your buying power by 33% over the period.

Alpha Idea:

NDX or QQQ Long 12,269.50, towards 14,343.10.

Stops below recent local low at 11,030.00.