Having talked about the new added risk to the inflation picture - the supply disruption in the Suez Canal.

I was asked: What's your solution for this inflation drama you keep going on about (my paraphrase)?

Answer: You want to be long "inflation assets."

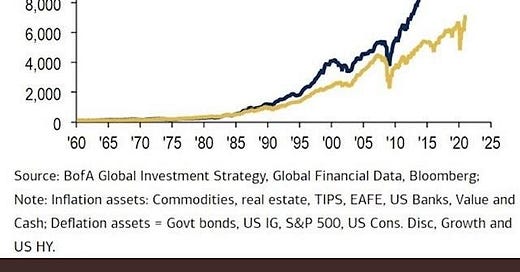

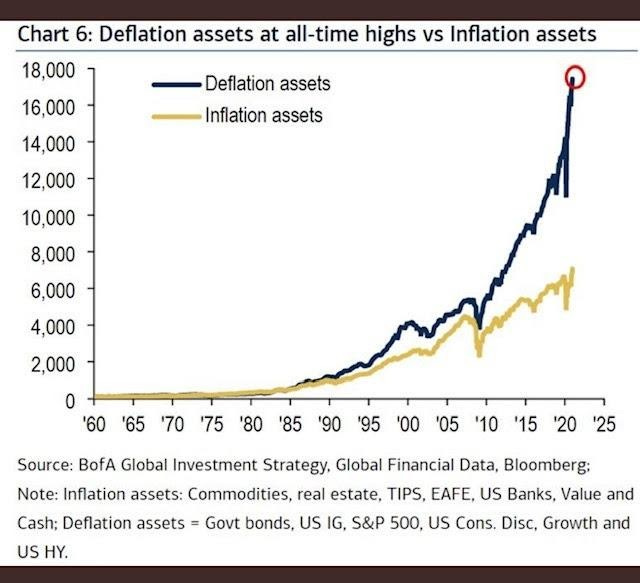

So on that note, let's take a look at an interesting chart from Bank of America, and the way they define these asset groupings for these two different price regimes (inflation and deflation)...

In their grouping of inflation assets, they include commodities, real estate, Treasury Inflation Protected securities, EAFA (developed market international stocks), US Banks, Value stocks and cash. I would disagree with cash, but you can see the huge divergence in the performance of these two groupings over the past 35+ years. And as you can see this divergence is at a record extreme.

Are we seeing the turning point, driven by the unimaginable catalyst of profligate monetary and fiscal action, combined with a global supply crunch and pent-up demand from a global pandemic?

If it is, it would have good company, historically, in terms of major events. If we look back at the periods where inflation assets outperformed deflation assets by 15 percentage points or more, we find three:

1941 - End of the Depression and big government spending through The New Deal. Inflation ramped up to double digits in 1942.

1973 - Oil crisis. Inflation ramped to double digits in 1974.

2000 - Bursting of the dot com bubble. The Fed prevented a spike in inflation, through rate hikes, but crushed the stock market and created recession.

Again, these are historic periods where inflation assets outperformed. It looks like we are in the early stages of another one: buy inflation assets.