Building on the inflation theme we've been discussing, we have more price data - import and export prices.

Both came in hotter than expected with export prices up 2.5% - biggest monthly change on record.

The monthly jump in import prices was the biggest jump since 2012.

What's the driver of the hot prices?

For imports, it's oil. Fuel import prices were up 7.4% from December to January. So, we're in the early stages of seeing the impact of Biden energy policies on fuel prices - the "clean energy" plan puts OPEC back in charge of oil prices.

On the export front, the hotter prices are driven by agricultural exports. China's buying spree of global commodities - they bought record volumes of crude oil, copper, iron ore and coal in 2020 whilst also imported a record amount of corn, wheat and soybeans.

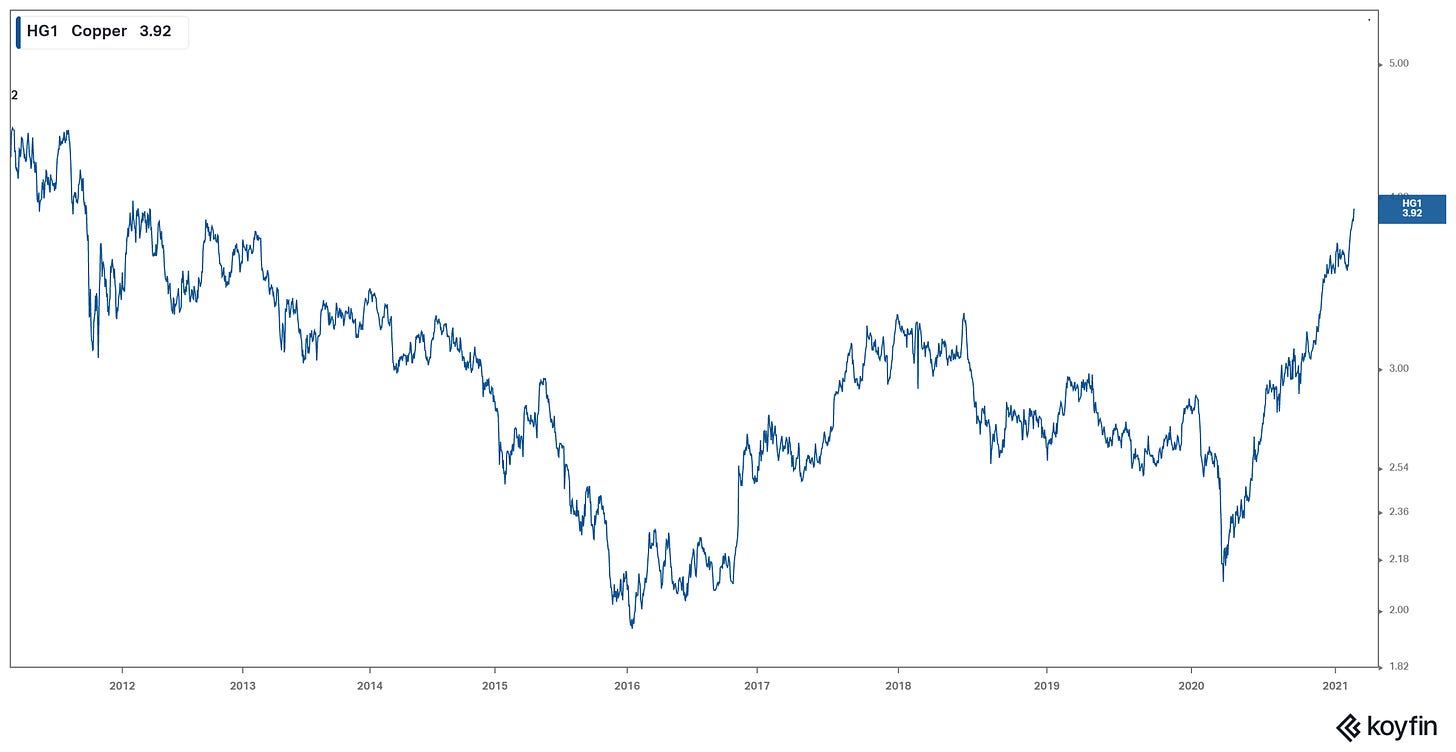

What happened to commodity prices the last time China went on a commodities binge in a global recession (a decade ago)? Prices spiked and it's currently far from over.

Let's revisit the chart of copper prices, which traded to nine-year highs yesterday...