If this is the 70's...

The chart below caught my eye.

$35 TRILLION in global market value erased since the beginning of the year. That's 14% of all global wealth. Includes the $1T losses in crypto. For reference - 2008 was a 19% decline.* *Doesn't include non-financial assets such as housing.

Using the chart above as inspiration, I wanted to put some basic 1970’s observations onto the market place and see where the chips fall…

The left hand chart is the nominal return of the US 60:40. In the 1970’s, it fell in nominal terms as inflation went from 3% to 12%, even with deeply negative real rates. It rebounded when real rates rose because the driver of that rise was falling inflation. But when inflation took off again and real rates went negative a second time, the US 60:40 rose sharply in nominal term (this throughout the Volker hikes)…illustrating the dangers of outright shorts today.

So on the face of it, not so bad then? Actually no. Very bad.

Firstly, even in nominal terms, for that entire decade cash (t-bills) outperformed the 60:40. Short duration floating cashflows reign supreme even nominally, in inflation.

But it gets worse, on the right hand chart we can see that cash drew down in real terms by 18% through to 1982. The US 60:40 experianced an absolutely crushing 37% real decline.

People lost nearly half their real wealth, US assets were dead money in real terms for nearly 15 years.

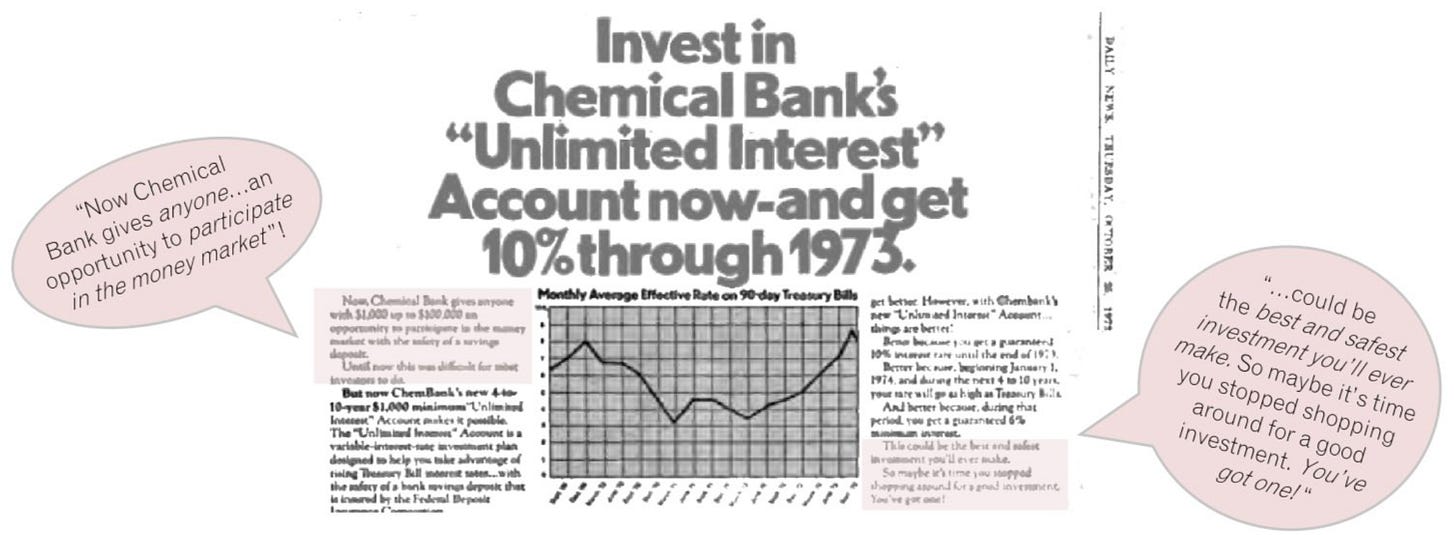

And that is why people scrambled for ways to protect their assets and move money out of stocks and bonds. Even though short-term cash equivalents experianced a real drawdown of 18% from 1972 through to 1981, bills did better than stocks and bonds.

"Necessity is the mother of invention" - the advent of retail-accessible money market mutual funds in the 1970’s.

Without wanting to come across as alarmist, another point needs to be made about how dangerous this actually is in a hyperfinancialised world…

In 1972, household wealth (ex-property) was 2.5X US GDP. The decades real wealth destruction of -30% (across financial assets) equated to 75% of 1972 starting GDP. Today, household wealth is 6.2X US GDP. Its about 5X ex-housing - twice as big as then (I’ll put households aside for now, but at these prices it’s hardly immune to inflation and rate risk). If we see the same -30% real decline in financial wealth off todays inflated levels, that would equate to 150% of starting GDP. In other words, the wealth hit would be twice as significant, economically.

Society’s already hanging by a thread - imagine how pissed people would be then!