The economy continues to run hot, well above trend growth - Q3 GDP came at an annual rate of 4.9%.

Meanwhile the tech stocks continue to put up big numbers, yet are all being sold.

Google did record revenues on double-digit growth, with 46% EPS growth (yoy).

Microsoft grew revenue by 13% and EPS by 27%.

Meta/Facebook did 27% revenue growth on record revenue, more than doubled operating income, and did 2.6 times the EPS of a year ago.

Amazon reported after the close - they had 14% revenue growth and 3x'd the EPS of a year ago.

Listening to these earnings calls, you would have a hard time trying to find something to be disappointed about with what's going on in these companies. They are all reorienting their businesses around AI. The Google CEO calls AI a "foundational platform shift." Zuckerberg (Meta CEO) says they are de-prioritising non-AI projects and shifting to AI.

It's a new growth and margin-expanding catalyst for these companies, which already have sustained high margins and double-digit growth. So, what's coming? Expanding margins and higher growth.

Plus, this AI technology revolution only widens the (already very wide) competitive moats of big tech.

With that, what's prompting the selling in these stocks?

Is it forced selling related to the war drums (i.e. foreign investment exiting in fear of future sanctions)? Maybe.

Mabye, its something bigger: The oligopoly in tech has only gotten to this point of power consolidation because the government has turned a blind eye to antitrust law.

Now we have the Biden FTC threatening to break up Amazon. We've had plenty of empty threats from Capitol Hill and the DC bureaucrats about breaking up the big tech monopolies through the years, only to allow them to multiply in size and strength.

Is it for real this time?

PS: Free Gold focussed Chartbook and Alpha Breakdown to end your week.

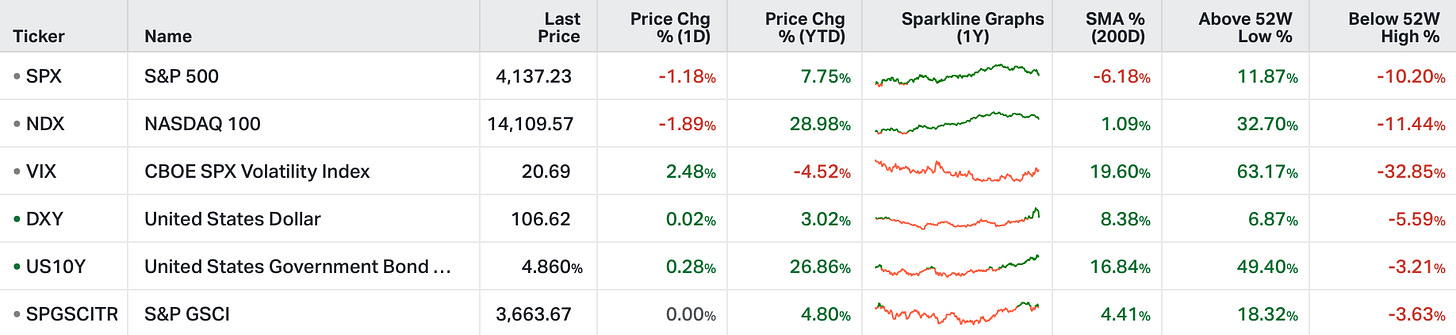

Perhaps it is simply the consequence of higher yields forcing a derating of the multiples on which these companies trade

thank you for including the Gold chart book!