The technical relief rally in stocks was short-lived.

This continues to look like the Fed is using stocks as a tool to bring down demand (to bring down inflation). Just as they explicitly influenced stocks higher in the low inflation, low demand post-Global Financial Crisis era ... they are now using that strategy in reverse, by talking tough and telegraphing tighter financial conditions, which is a headwind for stocks.

Arguably, they have achieved their goal already. The animal spirits of just months ago have been knocked down. The conversation has flipped from boom to recession - that will slow the rate of price change (i.e. inflation).

What won't change is the level of prices - higher prices are here to stay.

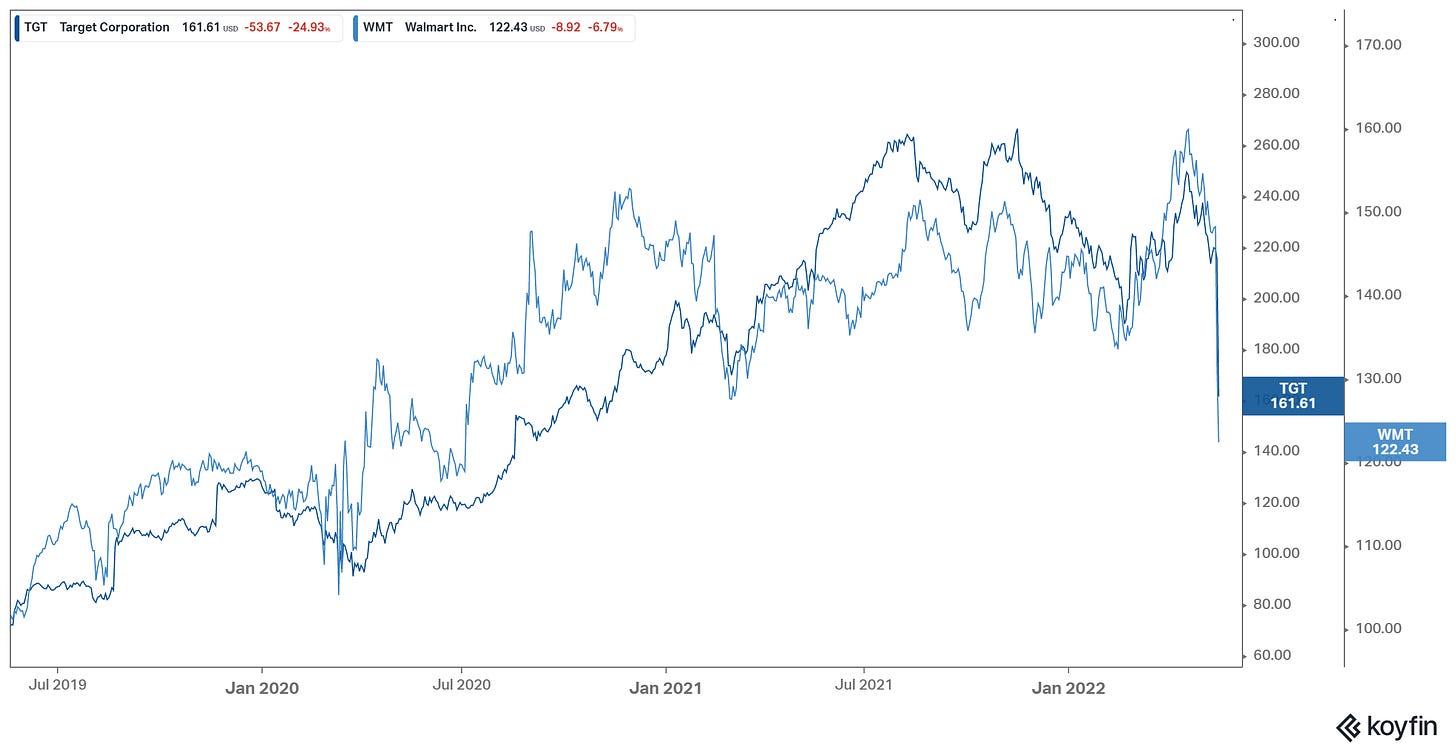

The offset to that, is higher wages. That's a new paradigm for corporate America, and though they talk a good game, they don't want to reset the wage scale. We are seeing that translate into lower margins at Target and Walmart (where the low end of the pay scale was adjusted sharply higher, to get people back to work, and to comply with the social agenda pressures).

On a related note, the Fed is now attacking (verbally) wage growth, having begged for wage growth for fourteen years (when inflation was low).

That means, we should be prepared for a slow adjustment in wages across the rest of the pay scale. It will, over time, close the gap with what was a swift jump in prices (the consequence of the massive pandemic response, and the additional $3.1 trillion opportunistically poured on top, to fund the Biden agenda).

This slow closing of the wage/price gap will mean a lower standard of living/lower quality of life. This was telegraphed all along the way - higher prices, but not higher value.