"High-Water Mark"

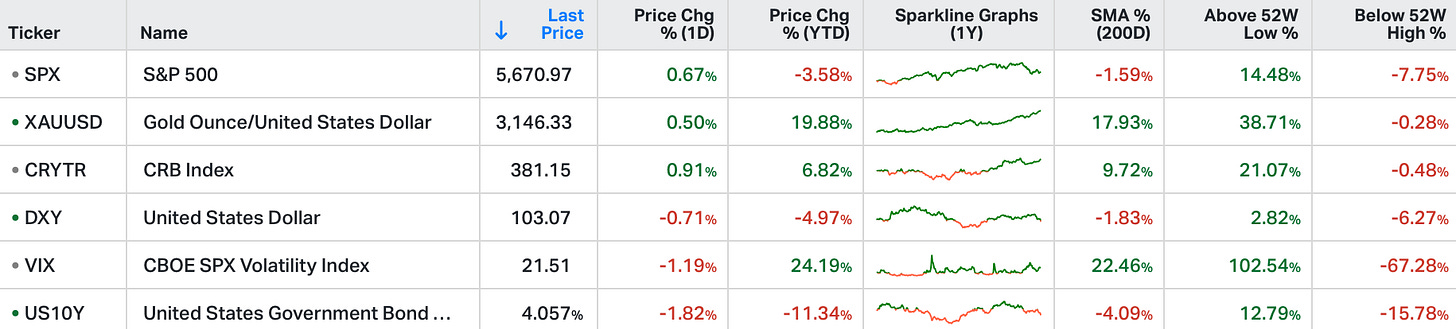

Stocks in the US were lower on Wednesday, with the S&P 500 falling 0.9%, the Nasdaq tumbling 1.4% and the Dow Jones falling more than 240 points.

Investors remained on edge ahead of President Trump’s upcoming tariff announcement.

Meanwhile, the ADP report showed a surprise 155K gain in private sector employment in March, well above forecasts of 105K.

Consumer discretionary and tech were the worst performing sectors.

Generate informed investing decisions → Valuation Model.

After the market close, the President revealed details on broad-based tariffs.

It starts on April 5th, with a blanket 10% on all countries.

And if there's no movement, the escalation would be on April 9th where largely the "reciprocal" tariff plan calls for an amount that's about half of what's currently being charged on U.S. imports.

Excluded from tariffs are copper, pharmaceuticals, semiconductors, lumber, bullion, energy and other critical minerals.

So, as Trump said in the Oval office a couple of days ago, the tariffs wouldn’t be of equal scale, but rather they would be “very nice by comparison” and “lower than what they’ve been charging us".

Even so, not surprisingly, the tariffs are toughest on China. China gets 34% and it seems to be on top of the existing 20% (the blanket China tariff was doubled from 10% to 20% early last month) – so, 54% for China.

Given that these details were delivered AFTER the market close, you get a thin reaction in after-hours markets. That means big moves. And in this case, it was stocks down, yields down, and the dollar down.

*Snapshot above shows futures changes at time of publishing, 12:20 GMT+2.

Following the announcement event, Scott Bessent said this would be the high-water mark, assuming no retaliation.

Which means we should expect plenty of countries to come to the deal table between now and April 5th, and more into the April 9th escalation date. With the "high-water mark" in mind, the incremental news should be in the direction of lowering tariffs.

Thank you to all that subscribed and expressed an interest in our Valuation Model reports. Every Thursday, starting today, we will release 5-7 timely and actionable reports to highlight key themes, trends, and opportunities from the framework.

For more information and to become a member, please see the link below.

Valuation Model

Our PRV Model is an established standard in measuring, analysing, projecting, and valuing a firm’s underlying economic profit rather than its accounting profit. With coverage of 21,000 public companies, this solution enables investors to measure, analyse, and value corporate performance and generate informed investing decisions.