Hawkish?

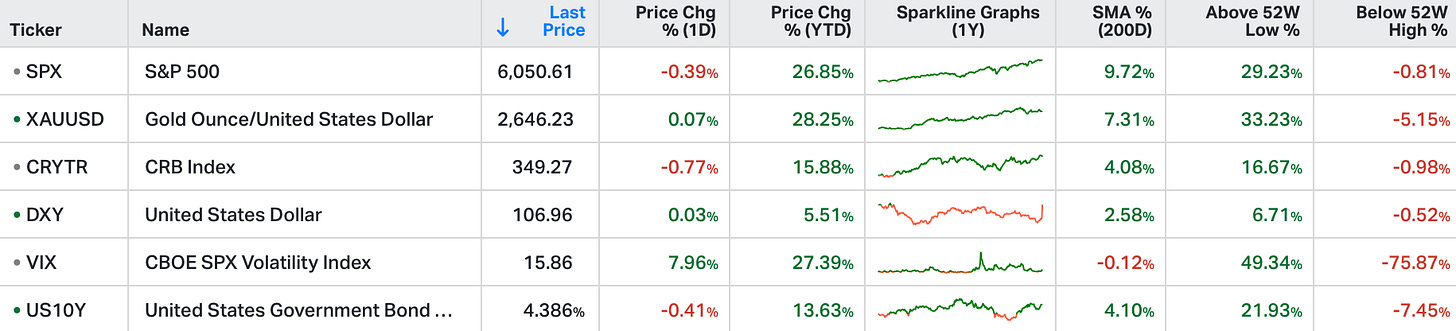

US stocks fell on Tuesday, with the S&P 500 slipping 0.4% but remaining close to its record high, while the Nasdaq 100 declined 0.3% after hitting a fresh milestone in the previous session.

The Dow Jones dropped 267 points, marking its ninth straight loss, the longest losing streak since 1978.

Additionally, market sentiment took a hit after stronger-than-expected US retail sales data showed a 0.7% increase in November, raising concerns that the Fed might hesitate to ease monetary policy further.

Traders are focused on the Federal Reserve's 2025 interest rate outlook, ahead of the Fed’s last rate decision of the year.

While a 0.25% rate cut is expected Wednesday, inflation concerns have raised fears of a stock market bubble or economic overheating.

We get the Fed rate decision today.

As we've discussed, they should do nothing to disrupt the market expectations for a quarter point cut.

The 2-year yield (the market determined interest rate) tends to be the guide for Fed policy. It has historically led on the way up, and on the way down. In the current case, the 2-year is at 4.24% and the Fed is at an effective rate of 4.62% (still 38 basis points higher).

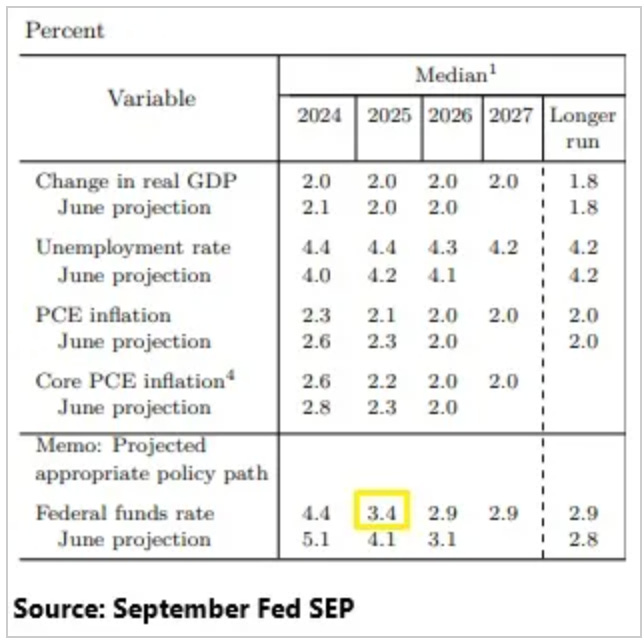

That said, the market is expecting a "hawkish cut," where the Fed telegraphs fewer cuts for next year in its Summary of Economic Projections. In the table below, coming out of their September meeting, they saw the Fed funds rate at 3.4% level by the end of next year. They will likely dial that UP by a quarter point, which would align with the market view.

Let's take a look at the year-to-date performance of the AI Kings (otherwise known as Mag 7).

These stocks now represent 34% of the S&P 500 index. They are contributing about 90% of the overall return of the index for the year.

If we look at growth in world money supply since Covid, it's around $20 trillion. The growth in market value of the AI Kings has been $12.5 trillion over the same period. Add another $3 trillion in the growth in the value of cryptocurrencies, and it's fair to say that we know where most of the excess money supply (i.e. above trend growth money supply) has been absorbed from the covid response.