We finished last week with another big day for stocks.

The bad earnings news from the tech giants has gotten a lot of media attention, but the earnings season for corporate America, overall, continues to be solid.

We've now heard from over half of the companies in the benchmark blue-chip index (S&P), and over 70% have beat earnings estimates, growing earnings at 2.2% compared to Q3 of last year.

As a reminder, heading into this earnings season, there was a lot of chatter about a big contraction in earnings (i.e. negative growth) - it hasn't happened.

With that, and some intervention-induced stability in the financial system (BOE and BOJ), stocks are having a big bounce for the month - following a down 8% September, with an up 8% October.

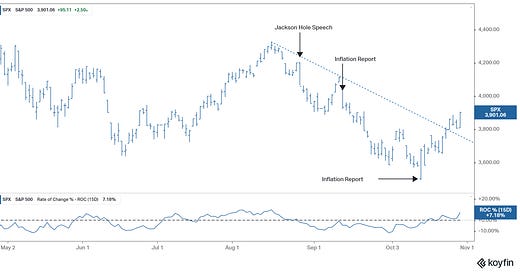

As you can see in the chart, we end the week with a bullish trendline break.

You can also see that the big force within this downtrend (denoted by the blue dotted trendline) has been the Fed and the related inflation outlook.

On that note, it's important to remember what data drove the big 5% swing in stocks on October 13th (the bottom), which ultimately ended up 2% that day - the September inflation report.

Why did stocks bounce? Because the hot spots in that inflation report (like new cars and rents) have been cooling (actually falling), but have yet to show up in the government's numbers.

Add that to the very tame inflation numbers over the prior three months, and we could be looking at a collapse in inflation by next year, as most of the effect of the 300 basis points of tightening has yet to be felt in the economy (still lagging). This, as the current level of market interest rates is proving to be a destabilizing force in the financial system.

With all of this in mind, the Fed meets on Wednesday.

If they are paying attention, they should dial down the temperature in the interest rate market. Especially given the recent polling, that shows a likelihood of Congress flipping on November 8th.

In that scenario, the spigot on any additional fiscal spending would be closed. Moreover, the inflationary policies that have already been approved (including Build Back Better/IRA) would be challenged. If that plays out, the Fed would find themselves in a position where they have overtightened, already.

PS: I would like to invite you to join The Gryning Times as a paid member, where we are agnostic to what the markets seem to be and instead focus solely on your advances in the market.