With the U.S. markets closed yesterday, following a week of continuation, a brief summary and look from the major markets.

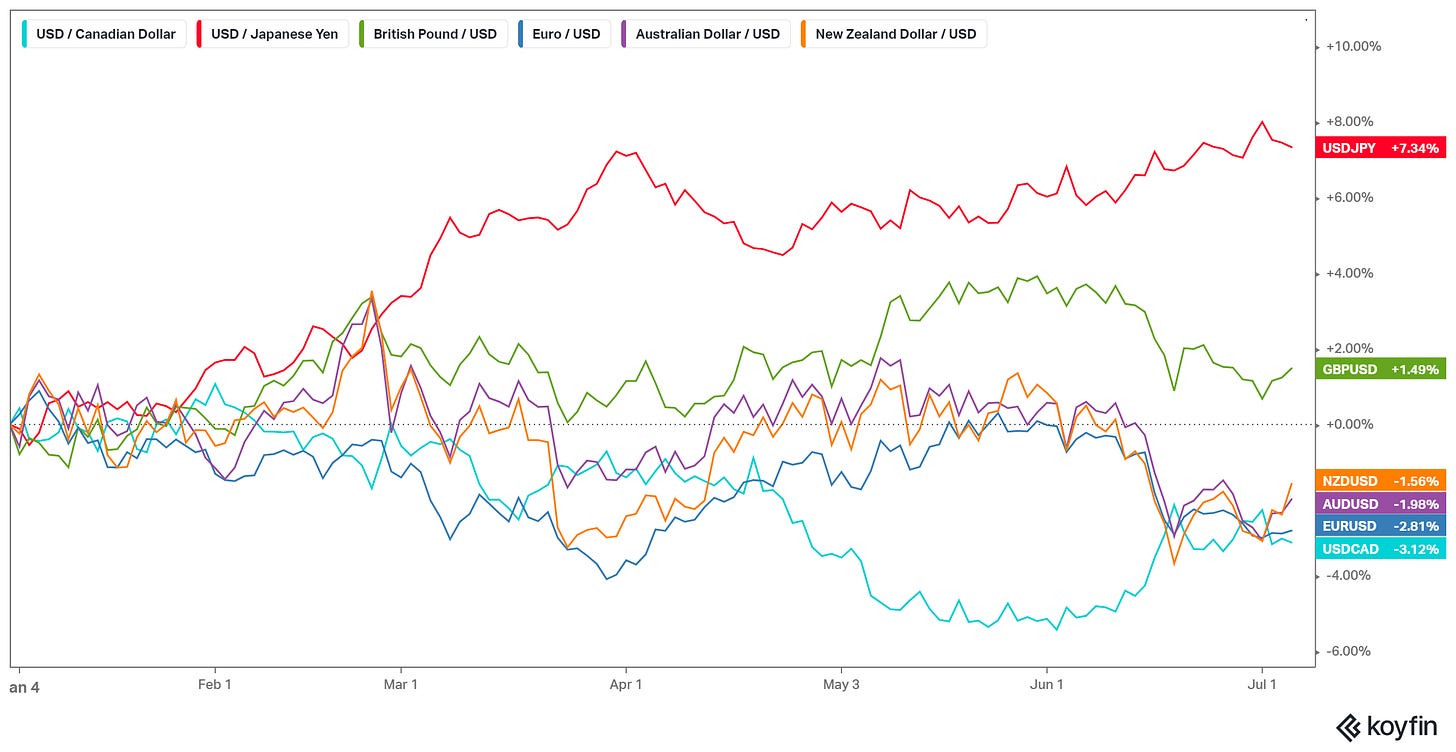

The SPX and NDX made further all-time highs, long-term yields pushed lower and the US dollar put in another strong week to test the gap created on 6th April.

NFP was the event of the week and beat estimates (which were trending higher anyway) with a print of 850k. While a solid number, the unemployment rate actually rose to 5.9% and the Fed can still point to weaknesses in the labor market as reason enough to stay put. Other data was mixed with soft inflation readings in EU inflation and an uncomfortably hot US ISM PMI. The much-anticipated OPEC+ meeting failed to reach agreement but is likely to settle on an output rise of 400,000 bpd, some way short of the expected 500,000 bpd and accompanied by talk of extending the cuts beyond their April 2022 cut-off point. Oil rallied on the news and broke above $75/bbl for the first time since October 2018.

Apart from a stream of industrial data, this week is dominated by central banks. Minutes of the last Fed meeting will allow the market to gauge the strength of the recent hawkish Fed shift and eyes will also be on the RBA which is also tipped for a policy change.