We've talked a lot about the Fed's "tough talk" strategy. They've gone from denying inflation less than a year ago (which people believed), to banging the drum about "expeditious rate hikes" (which people believe).

None of which have been accurate.

We have 8%+ inflation and just a 1.6% effective Fed Funds rate.

Still, the Fed has successfully talked the economy down, without having to make meaningful adjustments to interest rates. By verbally attacking demand, the Fed has flipped the conversation from an inflationary boom, to a recession. They've induced a bear market in stocks, and a related "negative net worth effect." And they've promoted layoffs, by explicitly threatening to loosen the tight job market.

With that the Atlanta Fed is now projecting the second consecutive quarter of negative GDP growth - that'sa recession.

The market has done the Fed's job for them - they've gotten the desired result of "bringing down demand.”

That said, as we've discussed, this reduces the probability of an 80s style inflation fight, and therefore, reduces the probability of a "hard landing" (i.e. crash in the economy) - that's good news.

The recession has been predicted by the bond market (inverted yield curve in March) and has been discounted in stocks over the past six months. The next piece we will need is evidence of cooling inflation.

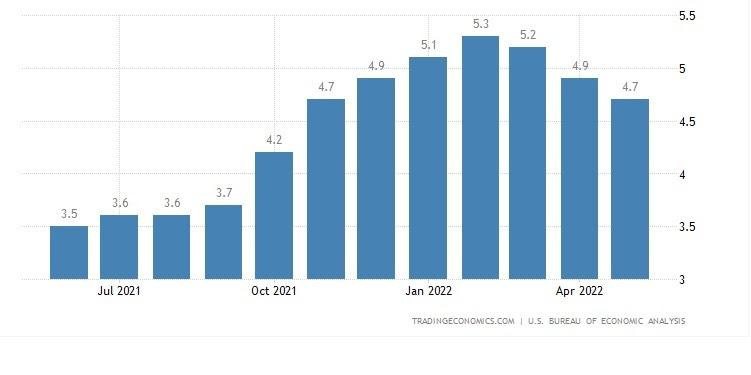

On that note, yesterday morning we saw the report on the Fed's favored inflation gauge (core PCE) - it came in softer, and as you can see in the chart below, a declining trend is underway.

With all of the above in mind, the second half of the year should be about recovery.