Got Commodities?

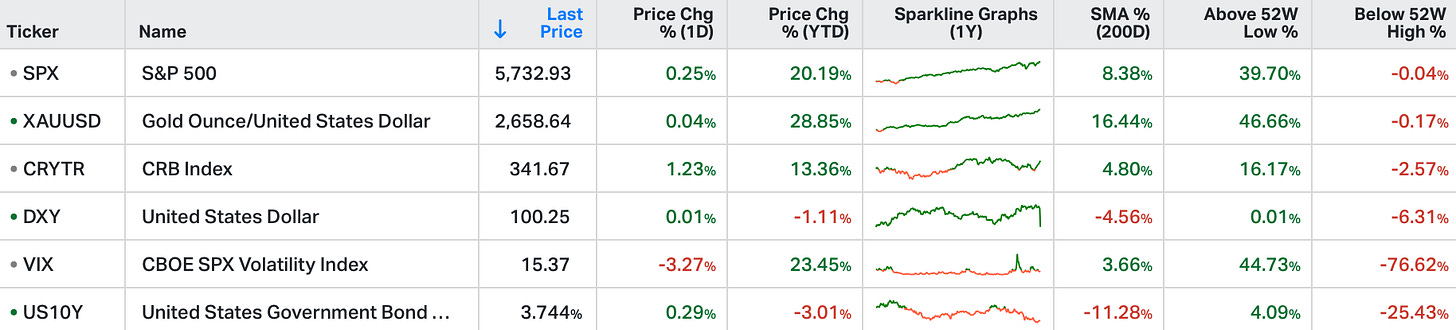

The S&P 500 added 0.2% to close at a new record on Tuesday, and the Nasdaq 100 rose 0.5%, largely due to a surge in Nvidia shares, which climbed 4%.

The Dow Jones also finished 83 points higher.

Fed officials, including Austan Goolsbee, signalled the need for more rate cuts, potentially focussing on the labour market.

Among stocks, Nvidia's shares jumped following reports that its CEO had stopped selling shares.

Estee Lauder (6.11%) and China stocks like Alibaba (7.9%) and JD.com (13.9%) rallied after China unveiled aggressive stimulus to boost growth.

Let's take a look at the dollar.

As we said last week, following the Fed action, the bigger 50 basis point cut was clearly dollar negative. While the first move was up, the direction has since been down. And as you can see in the chart, it looks like it's breaking down technically…

The Fed has kept real interest rates (Fed Funds Rates minus the inflation rate) at historically high levels, and now that real rate is coming down, and has a lot of room to continue coming down before the Fed gets rates to what they consider "neutral" (neither restrictive nor stimulative to economic activity).

The dollar tends to follow the direction of real rates.

For more perspective, let's revisit the long-term dollar cycles, which we've kept an eye on throughout the history of my daily note.

Since the failure of the Bretton-Woods system through the onset of the Global Financial Crisis, the dollar traded in five distinct cycles – spanning 7.4 years on average. The average change in the value of the dollar (in those five cycles), from extreme to extreme was greater than 50%.

As you can see, the era of quantitative easing (QE) has seemingly distorted this last bull cycle.

The top was in late 2022, just after the Fed started QT (quantitative tightening/reversing QE).

And now we're in a dollar bear cycle, which aligns with the outlook for the bull market in commodity prices (lower dollar, higher commodity prices).

We've seen it reflected in gold.

We've often looked at this longer term chart of gold over the years ( here 2020 , here 2021 , and here 2023), since it was trading in the $1,600s in March of 2020 & November 2022 (here 2022).

Spot gold is now closing in on the $2,700 level that we've been projecting from the technical analysis (Elliott Wave Theory).

With this chart above in mind, gold tends to trade inversely to real interest rates. And as we discussed above, real rates are just beginning to decline and have a ways to continue lower. It just happens to be as gold is already on record highs, driven by the U.S. fiscal profligacy of the past few years, global money printing, seizure of Russian assets and geopolitical risks.

So gold still has room to run. And the commodities bull cycle in general is young. Broad commodities prices remain at historically extreme cheap levels relative to stocks.