Gold's Higher Highs

Wall Street’s major indices were heading for the third straight session of gains in the afternoon trading, fueled by tech shares and economic data.

Both the S&P 500 and the Nasdaq 100 hit fresh records high adding 1.1% and 1.7%, respectively, while the Dow Jones was up nearly 150 points.

On the data front, initial jobless claims came slightly higher than expected and labor costs for Q4 were revised slightly lower.

On the corporate front, shares of Apple rose 0.6%, after falling for six consecutive sessions, and Nvidia jumped 4.6%, breaking another record level of $924, surpassing Saudi Aramco to become the world's third most valuable company.

American Express gained 2.3% to also hit an all-time high of $223.4 and Caterpillar went up 1.6% to a record high of $341.2.

After hearing testimony from Jerome Powell the past two days on Capitol Hill, and after hearing from a slew of Fed speakers over the past week, the takeaway is that the Fed is comfortable not messing with an economy that seems to be doing well (for the moment) with a Fed Funds rate above 5%.

Still, despite highly restrictive monetary policy, we head into the February jobs report this morning with stocks on record highs.

On jobs, as we discussed yesterday it was a hot January jobs report and a big upward revision of the December payroll number that sent yields screaming higher in early February (to the tune of almost 50 basis points). That said, the 10-year yield is down almost 25 basis points in just the past nine days - perhaps in anticipation of some downward revisions to come (in the jobs data)?

If we're looking for a trigger in the economic data, at this point, that might disrupt the current drum-beat narrative of the Fed, it would be a softer employment situation (i.e. a threat to the "maximum employment" component of the Fed's mandate).

Let's take a look at gold which is making new record highs by the day. Yesterday was the sixth consecutive higher high, and higher closing price, which has coincided with five consecutive lower daily closes on the dollar index.

If we look back at the events that aligned with the prior highs in the chart above, we have;

the oil price shock and broad inflation shock of early 1980…

the collapse of Bear Stearns …

thirty-one years later gold finally surpassed the 1980 highs, and the catalyst was rising global sovereign debt risks, in the aftermath of the global credit bubble burst (gold spiked on the downgrade of U.S. debt and a European sovereign debt crisis)…

global war risk on Russia's invasion of Ukraine …

2023 bank runs and risk of contagion …

an 18% two month rise to a new record level originating from the October Hamas attack (global war risk) …

currently gold is, unusually, sustaining these record high levels.

Notably, with the explosion in the money supply, the new record high prices in gold are clustering - which is bullish.

With that, we've often looked at this longer term chart of gold over the years (here).

This is a classic C-wave (from Elliott Wave theory) - the technical pattern projects a move up to $2,700ish. The price of gold has continued to make progress along that path.

How do you play it? Get leveraged exposure to gold through gold miners, or track the price of gold through an ETF, like GLD.

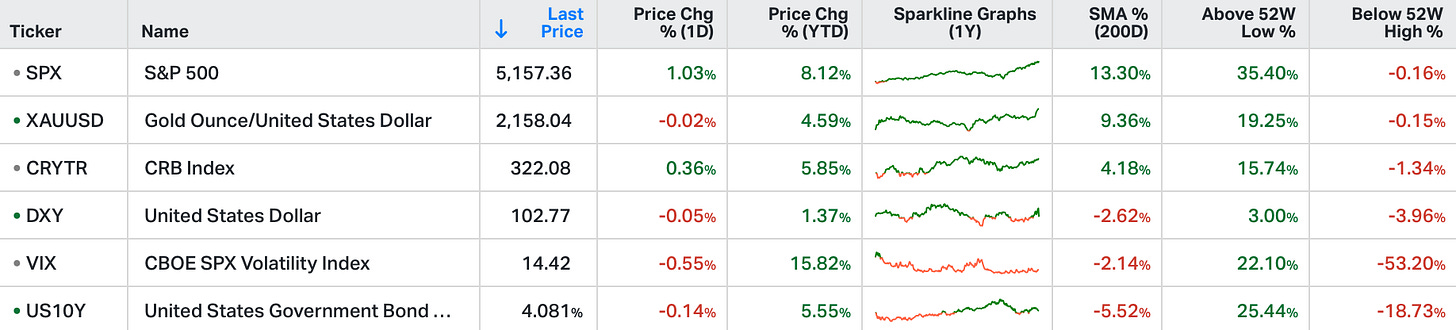

ps: On 23 Oct’23 I released a Technical Analysis (here) follow up to the “Got Gold?” post linked in the text above. The Chart below shows how the tickers within the report have performed.

To incorporate the Technical Analysis reports into your trading/investing toolbox, click on the link below or send me an email - annual memberships are upgraded to ‘Founder’ status.

a.karlsson@gryningcapital.com