In the face of broadly rising asset prices yesterday, gold was down 2%.

As we discussed in my previous note, this looks like the market is anticipating a lower probability of a big, multi-trillion-dollar stimulus package - the Treasury Secretary went to the Fed and requested the return of nearly half a trillion-dollars of unused funds from the original Cares Act. The game plan is to repurpose that money as targeted COVID relief for small businesses and federal unemployment checks.

This can get money into the hands of people sooner.

The Democrat-led House would surely reject the smaller package, but it may not require approval from Congress. Congress has exclusive control of the purse, however once they've appropriated funds (which they have through the Cares Act), "the President and executive branch enjoy considerable discretion as to how those funds are spent" (I’ve posted a paper on Presidential Spending Discretion and Congressional Controls previously).

So, a more modest fiscal response is less inflationary, which leads to the dialing back on some inflation hedges. Gold is the favored inflation hedge - and it has been sliding.

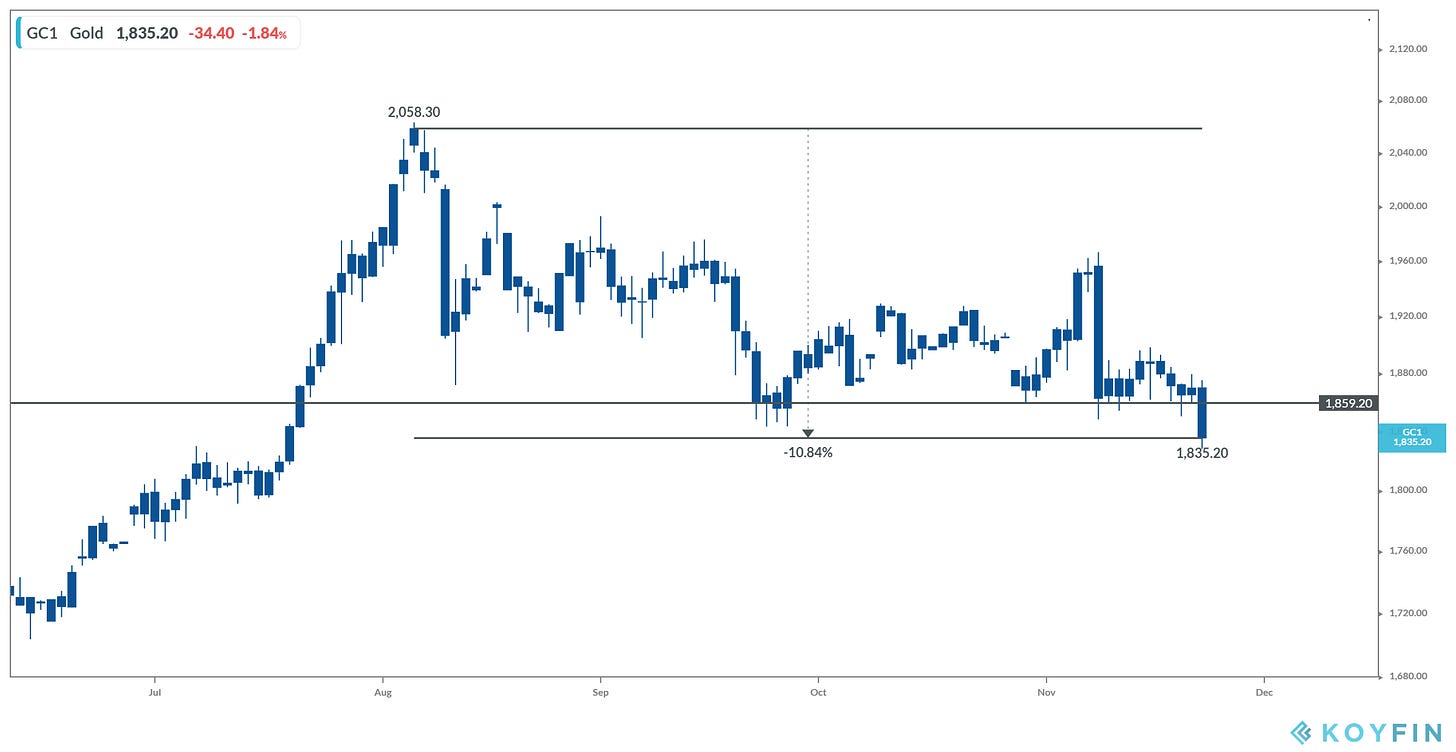

Gold prices peaked on August 7th, and are down 11% since, with Monday giving us a little technical break (down) in the chart. This is likely a shallow correction in a very strong bull market. The longer-term inflationary damage is done, from the massive global monetary and fiscal response earlier this year.

That makes this dip in gold a buy.

Remember, we looked at this chart back in early March.

For those that appreciate the value of technical analysis, the ABC pattern (from Elliott Wave theory) projects a move to $2,700.