Experience a unique way of financial risk assessment. Our dynamic approach is already helping professionals anticipate trends and stay ahead of crashes.

A GRYNING Times membership contains three main features;

Weekly Commodity Chartbook: Commodity Chartbook | May 19, 2025

Daily equity option spread trade idea’s & weekly seasonal commodity spread trade ideas: Equity Option Spreads & Commodity Spreads

Global Trend Report: Discussed in more detail below, Trade Idea Example

The Global Trend Report: features, descriptions and examples.

Comprehensive Reports: Receive monthly, in-depth technical analysis reports featuring professional-grade insights and recommendations from the various models tracking about 450 systemic assets and about 850 single stocks.

Daily Trend Score Calculation: Track the top 12 daily trend scores across each asset class.

Daily Trend Summary: Access a high-level summary of daily trends across all asset types.

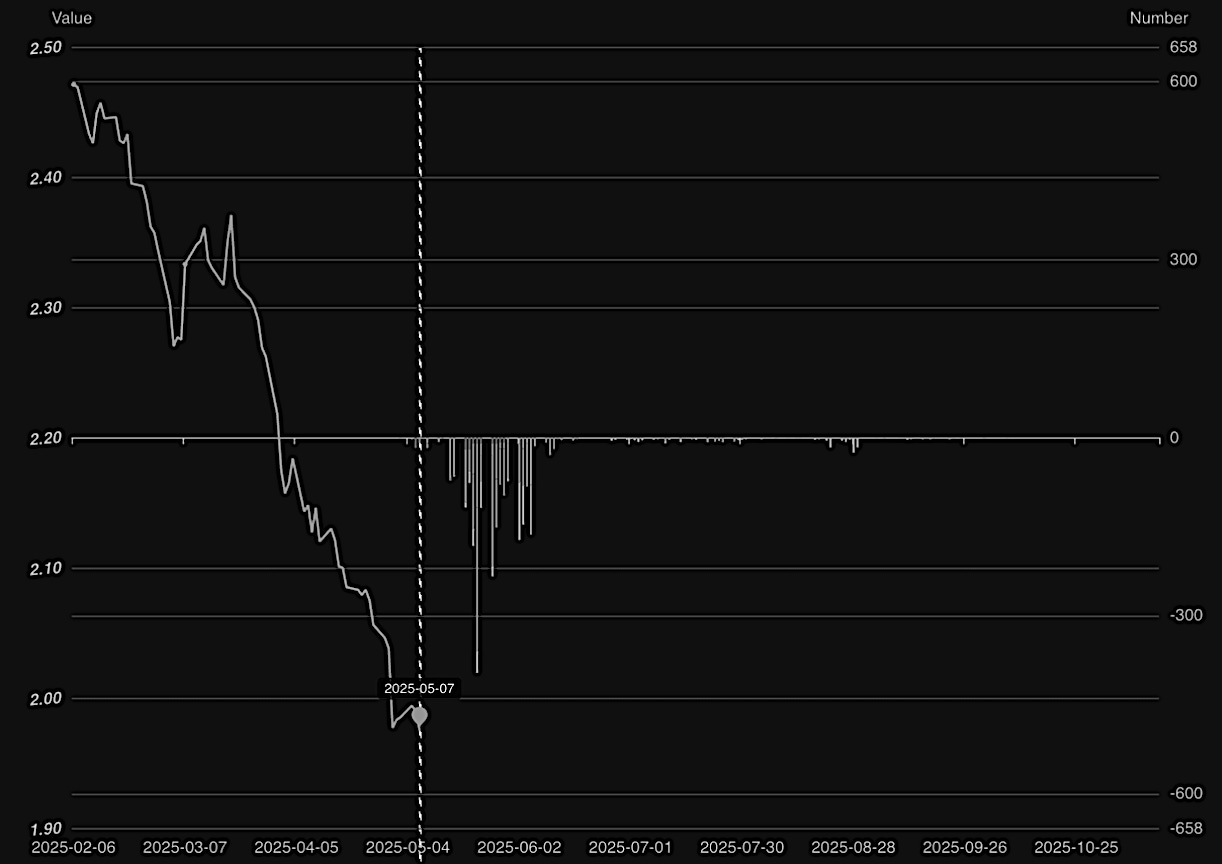

Trend Indicators: We show visual market trend strength indicators (shown as vertical spikes) across the various asset classes using our model indicators on various time scales. Foundational/institutional members receive daily updates on a bespoke portfolio of 100 tickers.

Trend Scenarios: Visualise forecasting fits for any asset across different time scales. Bespoke members receive daily updates on a bespoke portfolio of 100 tickers.

Critical Time: We dynamically analyse and present critical time scenarios - these are future dates/time clusters (shown as vertical bars) when the anticipated trend is likely to begin. Foundational/institutional members receive daily updates on a bespoke portfolio of 50 tickers.

All of the daily features are also included, at a larger scale, in the monthly reports.

Our reports provide indicators and diagnostics to help assess the current state of financial markets across various asset classes and regions. Its primary objective is to identify which asset classes and sectors are exhibiting potentially unsustainable behaviour and assess the extent of their crash risks, regime shift potential, and broader systemic vulnerabilities.