On Thursday, we looked at this chart ...

Stocks were bouncing from technical support - the big trendline (the yellow line) and the 200-moving average (the purple line). We finished Thursday with a strong technical reversal signal (an "outside day" - a good historic predictor of tops and bottoms).

Stocks have since rallied 4% from that Thursday low. Here's what the chart looks like now ...

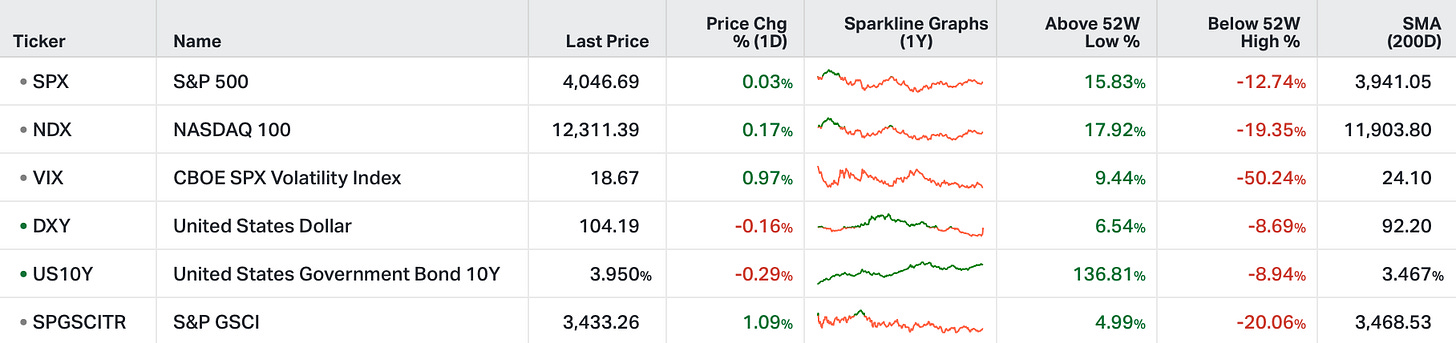

So, stocks are now down a little over 15% from the highs of early last year (which were record highs).

This decline from the highs wasn't just a garden variety correction in stocks, driven by a regime change in monetary policy (from easing to tightening). It was driven by fear that the Fed would have to do a "Volker-like" attack on inflation, to get it under control - and with a 9% inflation rate last year, that would mean double-digit interest rates!

Moreover, the decline was driven by the Fed's verbal threats on jobs and demand, and their explicit efforts to talk down the stock market (to damage wealth and confidence).

Lower stocks, and threats have done the trick - they've gotten control of inflation (most importantly, inflation expectations are tame).

With the above in mind, when the Fed kicked off its tightening campaign a year ago, Jerome Powell said this about their plan: "Across the economy, we'd like to slow demand so that it's better aligned with supply; give supply time to recover, to get a better alignment of supply and demand.

On the supply note, the New York Fed said, yesterday, that the global supply chain is "back to normal."

The GRYNING | Portfolio is how you exploit trading opportunities inherent in macroeconomic and policy-related developments. The research empowers members to take more intelligent risks and understand where to spot opportunities;

My goal is to continuously refine my views so the you can prosper.

The work is time-sensitive and impartial research focused on successfully navigating markets.

I only publish when opportunities are identified, not on a set schedule. I don't speak out unless we have value to add.