Geopolitical Risk Premiums

The S&P 500 fell almost 0.9% to below 5K while the Nasdaq slid 2% on Friday, as Nvidia and Netflix dragged along with woes linked to geopolitical tensions and persistent inflation.

Netflix sank 9% after its Q2 revenue guidance disappointed.

Other megacaps including Microsoft, Apple, Amazon and Meta also underperformed.

Tesla lost 1.9%, a sixth consecutive session of declines, amid new security concerns regarding its vehicles.

On the other hand, Dow Jones added 211 points boosted by a 6.1% gain in American Express after earnings and revenue beat expectations.

GRYNING - turning complex trading patterns into stock insights that earn you more wins.

On 13 April, Iran launched ‘Operation True Promise’ in retaliation for Israel’s attack on the Iranian consulate in Syria. Benny Granz, a member of Israel’s war cabinet, said his country will retaliate “in a way and at a time that suits”.

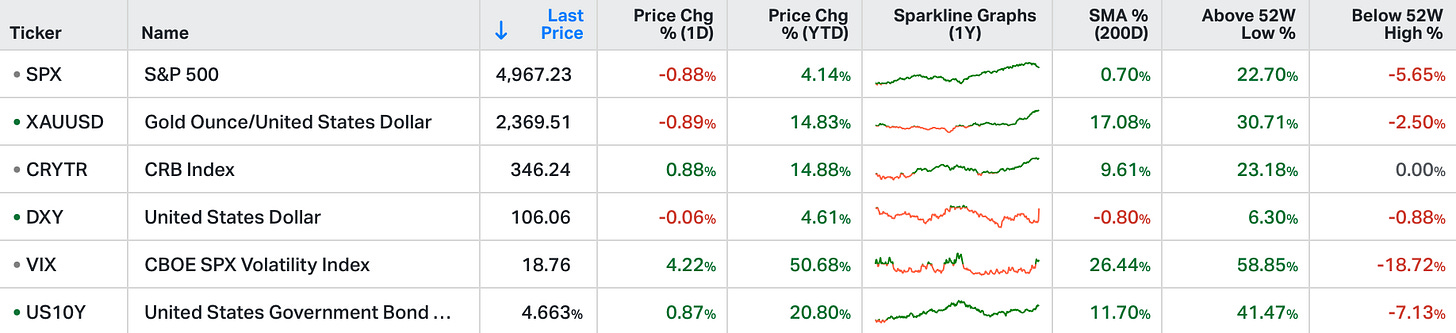

Sentiment has grown more bearish since then, against a backdrop of stalling global disinflation and fading confidence by US Federal Reserve board members about their ability to cut policy rates sooner rather than later - volatility (risk dashboard below) has corrected sharply on the prospect of higher-for-longer policy rates and Middle East turmoil.

Consumer Staples (a defensive sector) has started to outperform the broader market, an indication that the direction of travel of the equity market might be changing.

Bitcoin, a bellwether of market liquidity, has plunged below its 30-day moving average for the first time since February.

Rising geopolitical risk premiums in key commodities such as oil also reinforce the higher-for-longer rates view via unexpected commodity-led inflation.

US inflation surprises have become positive on the back of rising gasoline prices. The elevated risk of positive inflation surprises (partly due to geopolitical event risk in 2024) has been one of the lines of reasoning to adopt an overweight position in commodities, next to an expected cyclical recovery in global manufacturing.

Markets can only price in the level of uncertainty around macroeconomic outcomes, not the specific sequence of future geopolitical events that might trigger these macro shocks. Therefore, risky assets like equities typically tend to rally only once geopolitical uncertainty has peaked - something which can only be assessed in hindsight.

As we inch closer to May, equity seasonality is about to turn negative, while the onus is now really on superior Q1 corporate earnings delivery to keep this market rally afloat. With around 8% of US companies having reported, the first cracks on the earnings front are showing with some of the ‘Magnificent 7’ tech leaders like Apple and Tesla.