Gain Favour

US stocks faced a mixed session on Tuesday as investors weighed Fed Chair Jerome Powell’s cautious stance on interest rates and President Trump’s new 25% tariffs, which fueled concerns over a potential trade war.

The S&P 500 was mostly muted, the Nasdaq 100 dropped 0.3%, and the Dow gained 0.3%.

Trump’s tariffs boosted US steel and aluminum stocks, including Cleveland-Cliffs (+4.9%), Nucor (+0.6%), and Alcoa (+0.7%).

Apple rose 2.2% on news of an AI partnership with Alibaba, while Tesla dropped 6.3%.

In earnings news, Coca-Cola shares surged 4.8% after its sales topped estimates.

Jerome Powell was on Capitol Hill giving testimony on monetary policy to the Senate Banking Committee. There wasn't much new. He reiterated his talking points from his post-FOMC press conference two weeks ago: The economy is strong, inflation is still somewhat elevated, and they "don't need to be in a hurry" to remove restriction.

He made no mention of tariffs in his prepared remarks, though the word came up 29 times in the Q&A. If there were a takeaway from the event, it's that the Fed Chair may have said a few things to gain favour with the President.

When asked about the impact of tariffs on inflation, he pointed out that the exporter can pay for it, the importer can pay for it, a middleman can pay for it, the consumer can pay for it. He said, "In some cases it doesn't reach the consumer much, in some cases it does."

When he was asked if tariffs are "a wise policy" he responded with this (pretty deliberate response): "I think the standard case for free trade logically still makes sense, [but] it doesn't work that well when we have one very large country that doesn't really play by the rules."

Of course, he's talking about China. And of course, that's what this tariff policy is all about — it's about (finally) dealing with China's multi-decade economic war, which has resulted in its ascent from a $300 billion economy in the early 90s, to an $18 trillion economy today and global economic superpower — all from strategically cornering the world's export market via the manipulation of its currency (keeping the yuan cheap).

Let's talk about what happened in Paris.

Over the past two days, France has been hosting the AI Action Summit, with participants that included global heads of state, heads of international organisations, and leadership from the tech giants.

The template of the summit looked and sounded much like one of the gatherings on the climate agenda. It was attended by many of the same characters. It was led by many of the same characters. And the objective was a global agreement on AI strategy.

Much like the climate gatherings, the words "coordination" … "collaboration" … "synchronisation" were used throughout the summit.

This all looked like the design of another "Paris Agreement" (an AI version of the global climate accord of 2015).

JD Vance was there representing the United States. And not only did the United States refuse to sign the AI strategy agreement, Vance gave a speech that, in no uncertain terms, let the attendees know that;

The US won't let excessive regulation get in the way of innovation.

The US will continue to be the gold standard in AI (it's not a collaboration).

American AI will not be co-opted into a tool for authoritarian censorship.

The latter was a shot across the bow at China and at the global governance framework (which has been influenced by China).

VP Vance appealed to the audience to follow the lead of the US, and partner with the US on AI, rather than, as he put it, "chaining your nation to an authoritarian master" (i.e. China).

So, he went to Paris and let the world know that this is a two horse race for AI supremacy, and diddling around in meetings and getting to global consensus on rules wasn't going to win it.

The stakes are high. As the CTO for Palantir said in his recent earnings call, "the AI race is a winner takes all."

And as we discussed in my note last week, the winner will probably be the difference between AI that serves humanity, or AI that controls humanity (serving the interest of the Chinese Communist Party).

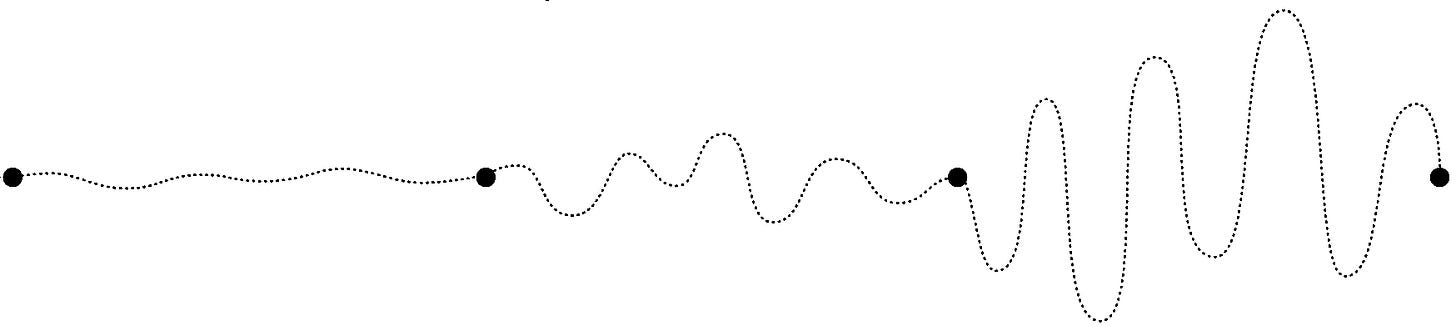

Systems Trading is a Business

One where you control risk, identify when a trade is happening, and know it will happen over and over again. It’s about executing a business plan where the market pays you for following rules.

When you treat trading like a business, you eliminate the emotional rollercoaster. You know your objectives, your edge, and your risk. Every decision is based on data—not gut feelings.