Let’s start the week by taking a look at how things stood heading into the weekend - stocks had a nice technical relief rally.

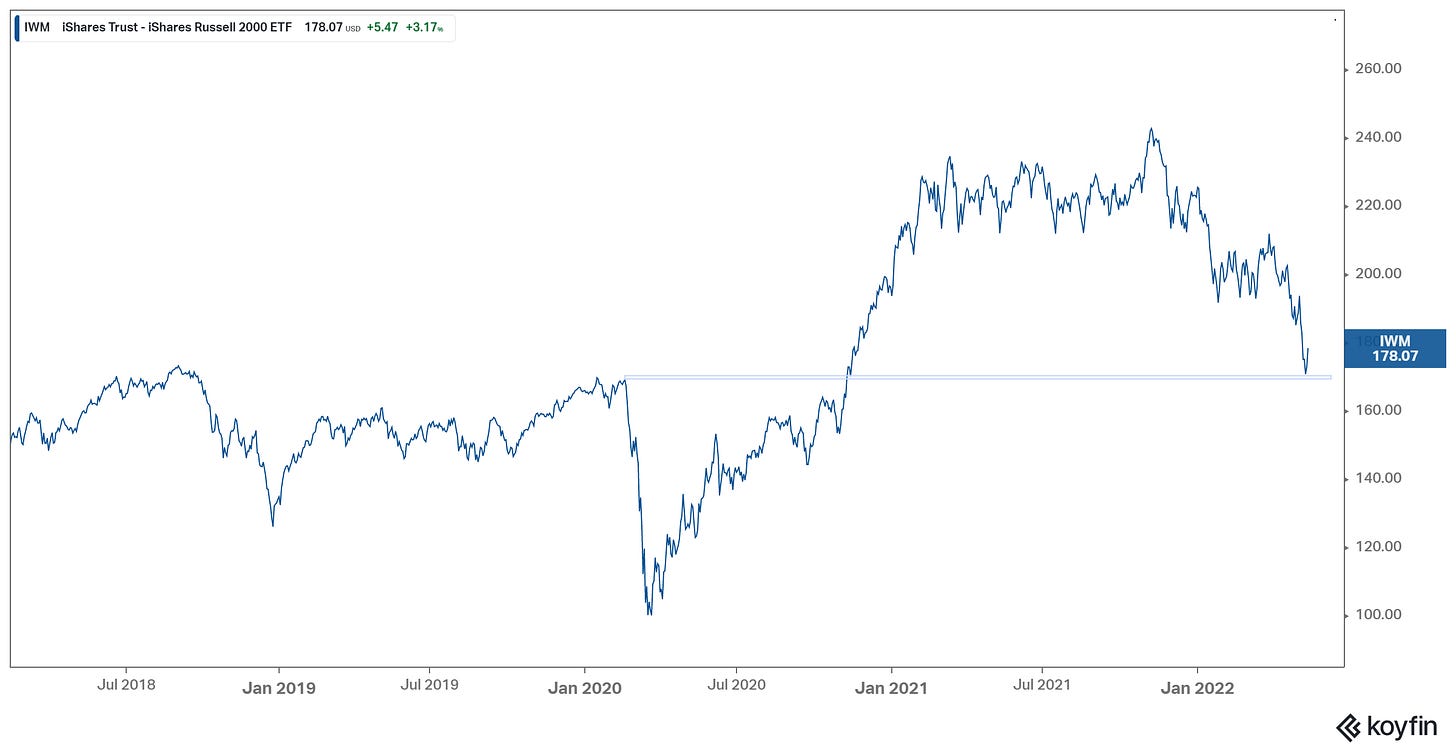

Here's the Russell 2000 (small caps) - the index has fully retraced to pre-pandemic levels (and has bounced).

Of note, Japanese stocks did were at pre-pandemic levels in March, whilst German stocks are also back to pre-pandemic levels.

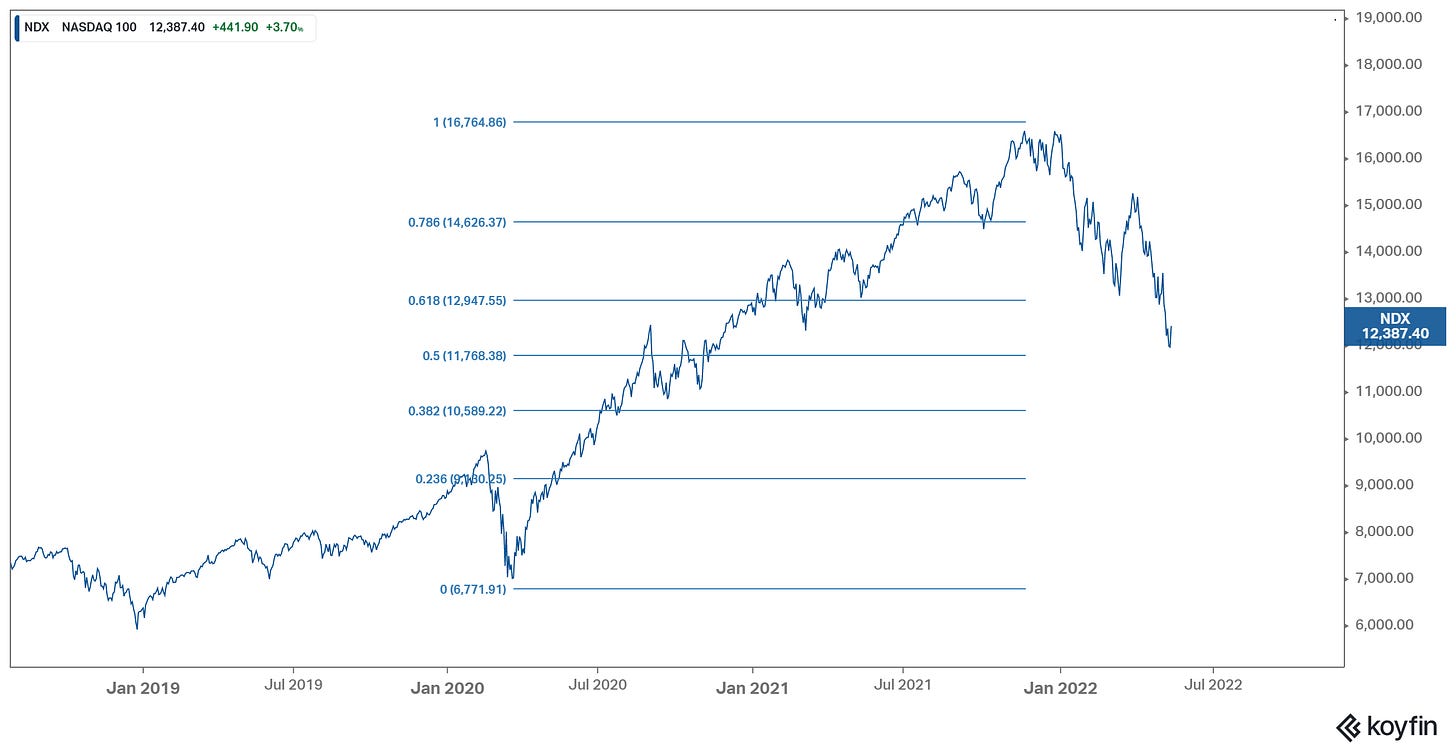

Above is a look at the Nasdaq (the center of the tech bubble universe). This has bounced from the 50% retracement of the move from the pandemic lows - pre-pandemic levels for the Nasdaq would still be 20% lower. So, has the tech bubble deflated - or more to come?

Bubbles tend to end with panic. What does seem to be on path for panic is the bubble in crypto currencies.

Stablecoin cryptocurrencies have been exposed as vulnerable last week (with the failure of the stablecoin Terra). I suspect more is to come…and that brings risks to the financial system. Coincidently, the G7 finance ministers are scheduled to meet this week in Germany. If there are any shock waves from crypto, a coordinated response from global central banks to restore stability would likely be quick.