The top finance officials from G7 countries are meeting in Germany. The three day meeting - a prep for June meetings of G7 leaders - will conclude today.

Importantly, both the finmin meetings and the leaders meetings have a history of resulting in meaningful market influence - especially in times of crisis. We have plenty of crises to review over the past 14 years.

The biggest takeaway from these meetings over the past 14 years, is the commitment to "global coordination." In times of economic weakness, and financial market instability, they have consistently vowed to coordinate. And when they do, and they lead the communique with focus on the economy, stocks have done well.

But much of this 14-year era was dealing with demand problems. Now, we are dealing with supply problems, an inflation problem, and financial market instability. With that, what should we expect to come from these meetings of the world's most powerful finance officials? The report from Reuters yesterday, is that the communique will focus on;

climate change

Ukraine support

food and energy support for emerging markets (keep exporting, even in the face of domestic shortages)

inflation

crypto

This is not a focus on the economy. It's a focus on the globally coordinated transformation agenda (climate and social), which has created most of the problems they are vowing to address.

So we shouldn't expect a G7 finance ministers lifeline for global stock markets (probably no mention at all).

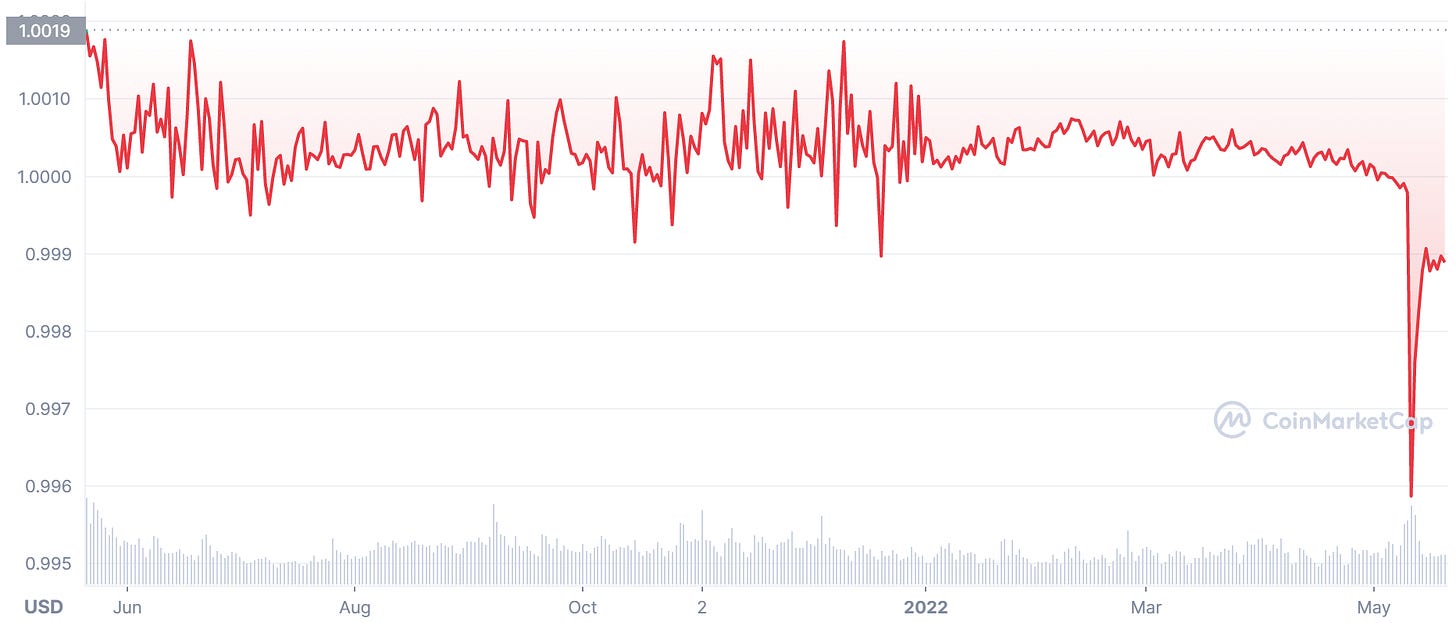

Importantly, in that regard, they vow to crack down on crypto (with swift regulation). Remember, on Monday we discussed the likelihood that we may see a response (from these meetings) to the deflating crypto bubble. After all, last week we saw the first fracture in the stablecoin business - with the failure of the stablecoin called Terra.

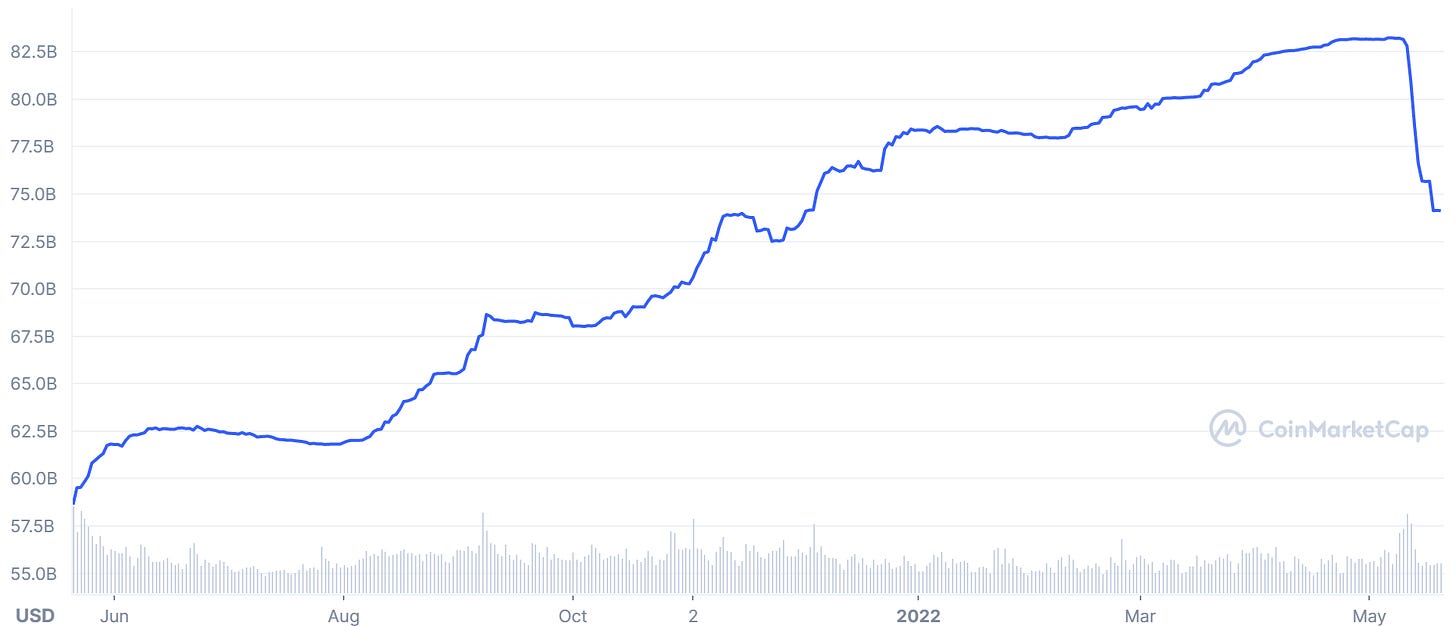

The big brother in the stablecoin world is Tether. A similar run on Tether (as we've seen on Terra) could expose the lack of integrity behind the reserve management of this $74 billion (market cap chart below) stablecoin (i.e. based on the company's own disclosures, they don't appear to have liquid access to the dollars, necessary to back the coins).

Swift regulatory requirements here, could result in a swift end of Tether (price chart below) - and perhaps the fall of crypto dominoes. Governments have made no secret that they want to regulate away private crypto, to make way for sovereign crypto (central bank digital currencies).