We talked about the G7 leaders meeting - it concluded yesterday with the release of an official communique.

With confidence at record lows, stocks in a bear market, tightening financial conditions and layoffs on the rise, the world's most powerful consortium ignored it all, and doubled down on their climate agenda. Not only did they reiterate their commitment to the agenda (a "sustainable planet"), but they reiterated their commitment to each other (to coordinate).

So, just in case anyone thought the lack of approval from their constituents, due to economic and social calamities, might alter their course, now we know better.

These powers, consolidated, equal 40% of the global economy. They will continue to do what they want to do - end fossil fuels. They will do so by continuing to impose their regulatory power and by continuing to spend to advance renewable alternatives.

Their latest: They have committed to spend $600 billion on infrastructure in developing countries.

With that, let's talk about "climate" stocks.

Given the performance of these stocks in recent months, it has been fair to ask, is this agenda defunct, and, therefore, is this clean energy investment opportunity over?

After all, the high valuation, no eps tech stocks were easy targets to dump with the new rising interest rate environment earlier this year. But the investment community went from selling garbage stocks, to selling big tech, to selling blue-chip stocks, to selling (policy) agenda-driven stocks, to selling commodities stocks with fundamental tailwinds, strong balance sheets and sustainable cash flows.

All have been thrown out of the pram.

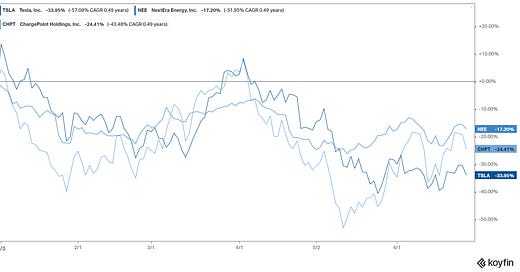

Telsa has been the world's proxy stock on the transition to "clean" energy - it's down 34% on the year.

NextEra has led the way for utility companies in transitioning to renewables - it's down 17% ytd.

Chargepoint operates the largest EV charging network - it's down 24%.

Maybe more interesting, given the G7 restated allegiance to the clean energy agenda, is the oil trade. The surviving oil and gas producers have continued to produce oil with wider and wider margins (higher prices/ less competition). Those stocks too have been thrown out of the pram in recent months - it's a dip to buy.

Uncorrelated Convexity

“What happens when one group of investors, call them the virtuous, simply won’t own a segment of the market (the sin stocks)? Well, in economic terms the market still has to “clear.” In English, everything still gets owned by someone…if the virtuous decide they won’t own something, the sinners then have to, and they have to be induced to through getting a higher expected return than otherwise. This in turn is achieved through a lower than otherwise price.” - Cliff Asness, AQR.

Put simply, if the discount rate on sin is now higher, the sinful investors make more going forward than otherwise.

The Gryning Portfolio gives you access to such a portfolio: rebalanced monthly, you’ll gain exposure to outsized returns in a minimally correlated manner.

Subscribe above and please share this with those that want to take control of their Investment’s. This is a limited time offer and the subscription will be closed off on 100 subscribers.