Fumbled Carry

Wall Street closed out a volatile week on a calmer note as the session was relatively uneventful, with no major economic reports or earnings.

The S&P 500 and Nasdaq gained 0.4% and 0.5% respectively, while the Dow Jones added 51 points.

Eli Lilly also saw a boost, up 5.5%, after multiple Wall Street firms, including Morgan Stanley, raised their price targets on the company's stock.

Take-Two Interactive Software added 4.3% after outperformed analysts’ expectations, while elf Beauty shares dropped 14.4% after its quarterly results fell short of estimates and concerns about slowing growth.

From the market close on July 31 to the low of August 5 (three trading days), the S&P 500 depreciated by 7.3%. Headline news reported it was due to heightened recession fears. The good news is a U.S. recession in 2024 remains a remote possibility. The potentially even better news is the market weakness may be mostly attributed to a Japanese “carry trade” gone bad and not to a fundamental U.S. economic issue.

No recession:

Monday’s ISM services number was better than expected. Services make up 70% of US economic activity - the underlying composition was strong, as the business activity (+4.9pt to 54.5), new orders (+5.1pt to 52.4), and employment (+5.0pt to 51.1) components all increased back to expansionary territory.

The ISM manufacturing report has been less than 50 (contraction) every month since October 2022 except for March 2024 - there was no new information in last Friday’s report.

The rise in unemployment from 4.1% to 4.3% was caused by an immigration-driven increase in labour supply, not a sudden drop in labour demand.

Although credit spreads increased (the difference between treasury and non-investment grade yields), it remained well below worrisome levels. Bond market traders do not see the risk of recession as highly elevated.

Earnings season has been better than expected with realised EPS growth of +11% year/year versus 9% expected. In aggregate, both sales and margins have surprised to the upside.

The Atlanta Federal Reserve GDPNow model raised its estimate for GDP growth in the third quarter from 2.5% to 2.9% this week.

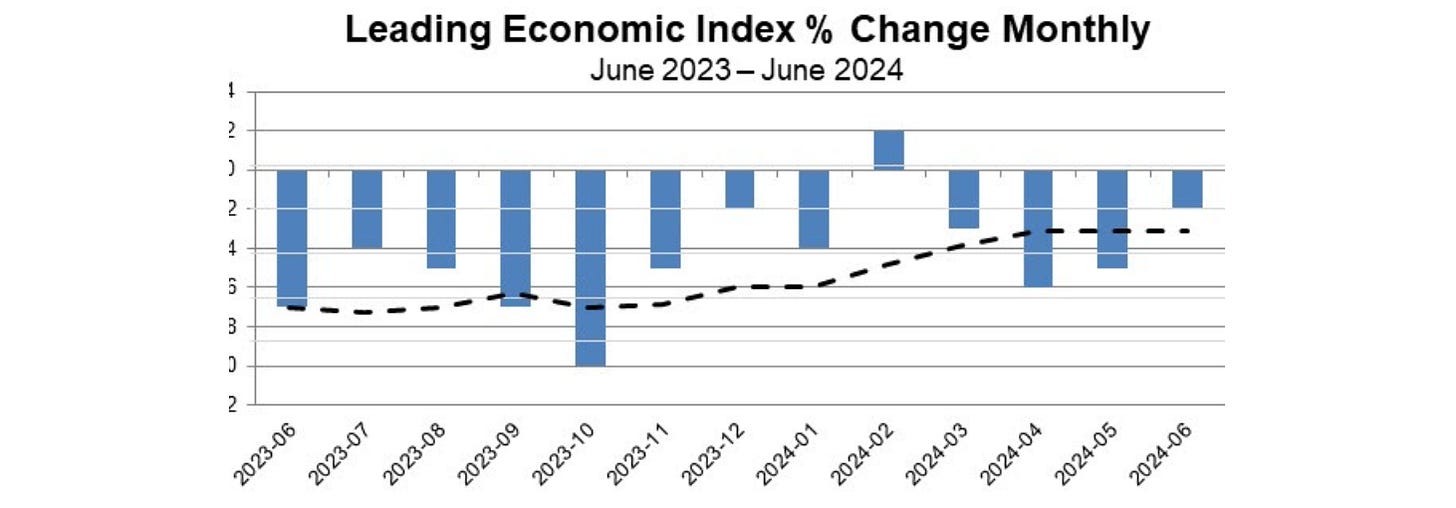

The Leading Economic Index (LEI) and treasury yield curve have been signalling a recession for over two years. Recession worries are not new.

The CBOE Volatility Index (VIX) touched a high of 65.7 placing it among the top 3 percentage jumps of all-time – the highest VIX spike outside of the Great Financial Crisis (2008) and COVID (2020). This suggests a market shock and global margin call, not an evolving view of economic growth.

So, what did happen?

The simple answer is the Bank of Japan raised its key interest rate from about zero to 0.25% on July 31. The U.S. stock market sell-off began the next morning on August 1.

U.S. hedge funds, Japanese pension plans, state-owned banks and the Bank of Japan borrowed Japanese Yen (JPY) with zero (or negative interest) and bought U.S. stocks. Deutsche Bank estimates that at least $20 trillion had been borrowed for this purpose - this is called the Japanese carry trade.

When the Fed began to hike rates in 2022, the Japanese carry trade accelerated, pushing the Yen to its weakest level since 1986. With higher rates in the U.S. than Japan, the U.S. dollar (USD) gained strength versus the JPY. Assets bought in the U.S. gained value, especially relative to the amount borrowed in Yen.

Rising inflation in Japan caused the Japanese central bank to raise interest rates - the Yen rallied sharply versus the dollar. The recent Yen rally of 14% is among the largest seen over the last 40 years. Not only was the U.S. stock market weak, the Friday, Monday Japanese stock market decline of -18% was the worst two-day decline in Japan equities history.

With the sudden strength in the Yen, assets purchased in the U.S. depreciated relative to the borrowed amounts in Yen. Rapid selling of assets was required to make sure the debt obligation did not become overwhelming. Much of the carry trade had gone “underwater” (assets worth less than the amount borrowed to buy them).

It is difficult to know how much carry trade will need to be unwound placing further selling pressure on U.S. stocks. On Wednesday, the Bank of Japan's Deputy Governor Uchida said the bank will not raise rates during market instability.

Stable currency values should help stabilise equity values.