We kick off fourth quarter earnings this week, hearing from the big banks on Friday: JP Morgan, Citi and Wells Fargo. Bank of America and Goldman Sachs earnings will come early next week.

Last year, across the broad market, the table was set for positive earnings surprises, against a backdrop of deliberately dialed down expectations. And those low expectations were against a low base of 2020, pandemic/lockdown numbers.

With that, we had positive earnings surprises throughout the first three quarters of 2021. The expectation is for 21% earnings growth for Q4, which would give us four consecutive quarters of 20%+ earnings growth and 40% earnings growth on the year.

That said, of the nearly 100 S&P 500 companies that have issued guidance for Q4, 60% are negative. That's straight from the corporate America playbook: Using the cover of the Omicron news from late November to lower expectations, to position themselves to manufacture positive earnings surprises OR withhold some earnings power for next quarter.

So, in addition to the changing interest rate cycle, could the slide in stocks to open the year have something to do with weaker Q4 earnings? Maybe.

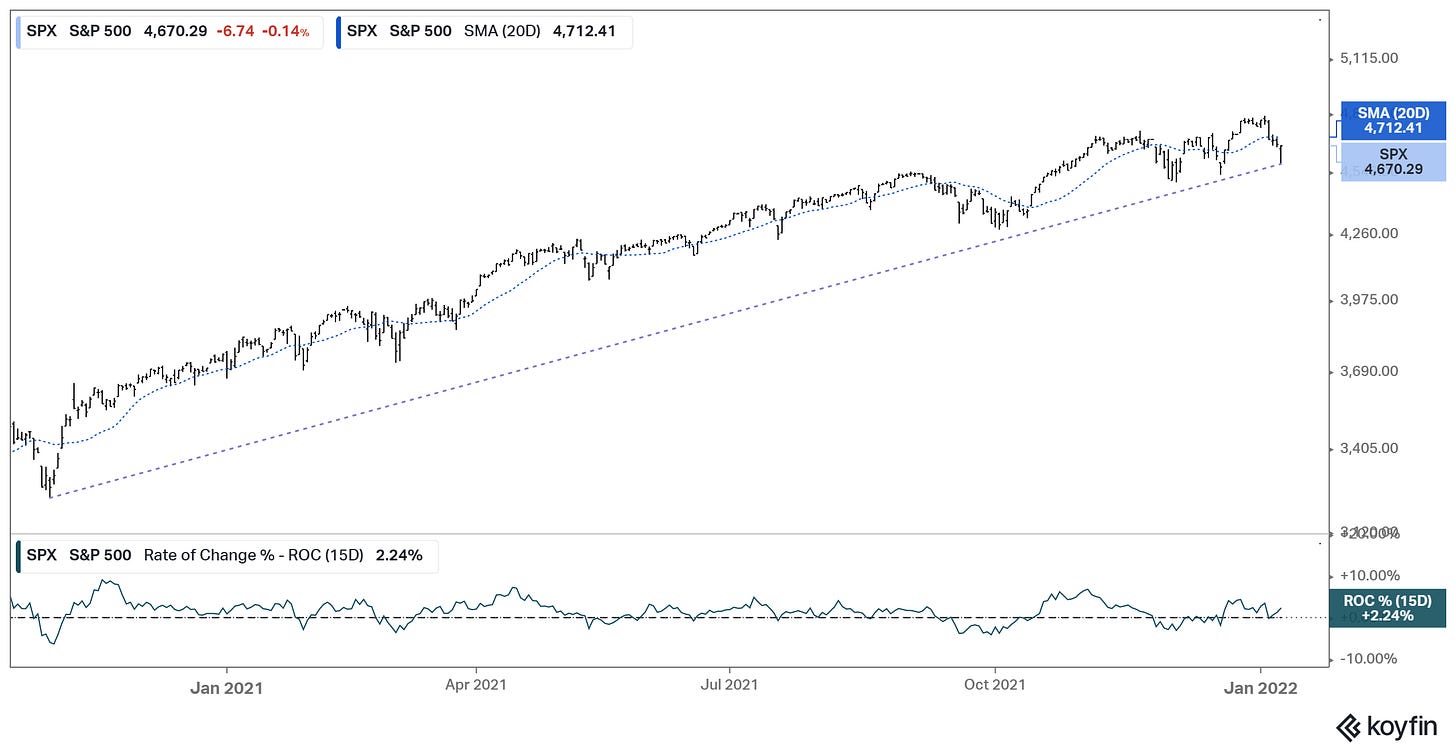

Let's take a look at the big technical support...

In the chart above, the S&P 500 hit this trendline that comes in from election day. This rise in stocks, of course, has everything to do with an agenda that entailed even more massive fiscal spending programs - AND a central bank that remained in an ultra-easy stance.

Indeed, we've since had another $1.9 trillion spend passed in late January of last year, plus a $1.2 trillion infrastructure package later in 2021.

Now we have a Fed that has flipped the script, and the additional bazooka agenda-driven fiscal package has been blocked -- and we get a test of this big trendline.

The good news: The line held, and stocks bounced aggressively (about 100 S&P points) into the close.

As you can see in the chart below, we have a similar line in the Nasdaq, dating back to the election. This breached but closed back above the line.

With the above in mind, we should expect the banks to continue putting up big numbers to kick off the earnings season later this week. That will be fuel for stocks.

Remember, the banks set aside a war chest of loan loss reserves early in the pandemic, and they have been moving those reserves to the bottom line since, at their discretion. As an example, both Citi and JP Morgan have another $5 billion to release, to bring their loan loss reserves back in line with pre-pandemic levels. That's $5 billion (each) that will be turned into earnings.