for policy to adjust...

US stocks faced a volatile session on Monday, with mixed performance across major indices.

The Dow Jones closed at record high while the S&P 500 and Nasdaq 100 fell by 0.3% and 1%, respectively.

This shift comes as investors digest Federal Reserve Chair Jerome Powell's strong signal that rate cuts are imminent.

Investors are also eyeing earnings reports from Dell, Salesforce, Dollar General, and Gap, as well as Friday's July Personal Consumption Expenditure data.

Data showed durable goods orders jumped 9.9% in July, easily reversing June's 6.9% decline.

The annual economic symposium in Jackson Hole has historically served as a platform for central bankers to communicate important signals regarding policy adjustments.

With that in mind, last Friday Jerome Powell finally made it clear that the "time has come for policy to adjust."

So, the Fed will be cutting in September. It's a matter of how aggressive, which will be determined, in part, by the job market.

As we've discussed, by holding rates too high for too long, the Fed has traded one problem (inflation) for another (unemployment). Now they acknowledge it, particularly the rate-of-change in the unemployment rate. That makes the September 6th jobs report a bigger input into the Fed's calculus (on size of cuts), than the inflation data.

The Fed Chair also reiterated that the current (high) level of the policy rate gives them "ample room to respond to any risks." Perhaps like the risk that bubbled up earlier this month when the yen carry trade started reversing?

But what does Powell's clear signal on rate cuts do to the yen carry trade? It telegraphs a narrowing interest rate differential between U.S. and Japanese rates, which fuels a bigger reversal of the carry trade (i.e. more unwinding).

And remember, the first whiff of this rate and policy differential (between the U.S. and Japan) gave us this chart below — the sharp spiral down in global stocks in early August (the dotted yellow line).

The sharp reversal only came from the verbal (and likely actual) intervention by the Bank of Japan. It came with a policy about-face in Japan.

So, while Fed rate cuts will remove a burden on some areas of the U.S. economy (growth positive), the reversal of the carry trade leads to tighter global liquidity (growth negative).

With that, we may find that global easing of interest rates in the Western world will also come with a required return of QE. If we needed a clue that the central banks can't successfully exit QE, we can find it in the price of gold (on record highs and persistently climbing).

On that note, let's revisit another important Jackson Hole speech — this one from 2023 (a year ago). It wasn't by the Fed Chair, but by the head of the European Central Bank (ECB) - President Lagarde's speech was titled, "Structural Shifts in the Global Economy."

In it, she said "there is no pre-existing playbook for the situation we are facing today – and so our task is to draw up a new one."

Just as everyone had hoped the central bankers would step away from manipulating the economy and markets, Lagarde said we need even more "robust policymaking in an age of shifts and breaks."

As I've said many times here in my daily notes, we are in the era of no-rules central banking. The world's central banks crossed the line in the sand (i.e. ripped up the rule books) at the depths of the Global Financial Crisis, and unsurprisingly, they haven't turned back. It is now standard operating procedure to fix and manipulate.

GRYNING | Signals - Market recap, open positions, new signals, and performance of six trading strategies. Tactical asset allocation, mean reversion, cross-sectional momentum, and equity long-short with weekly and monthly updating.

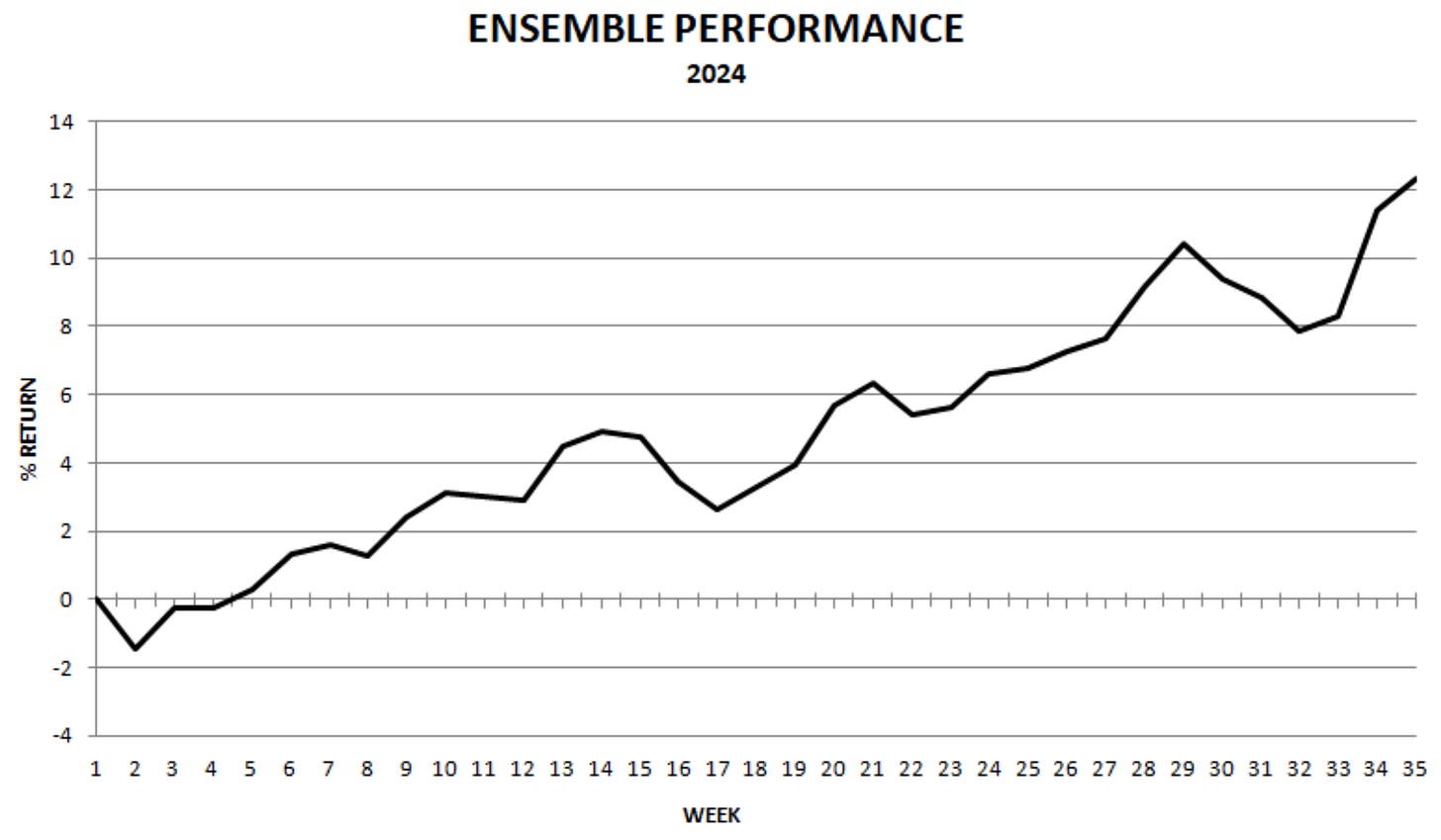

Performance of the ensemble and benchmarks | Weekly return of the ensemble: +0.8%

Year-to-date performance (Backtests, no leverage)