We heard from the Fed yesterday, whose message is being reiterated - we should expect the Fed to continue doing whatever it takes to preserve stability and to manufacture recovery. Within that effort, we should expect them to continue to set our expectations that they will keep rates at zero for a long, long time.

The intent is to get us spending, not saving, to drive demand, drive economic output, and drive inflation.

That should all be taken as very optimistic for the economic outlook. The Fed acted early and aggressively to avert an economic apocalypse and they make clear that they will continue to be there to manufacture the desired outcome. Maybe the statement of the day, from Jay Powell: We remain "strongly committed to achieving our goals and the overshoot on inflation."

The theme we've been discussing here, since March, has been a global reset of asset prices. By overshooting inflation, the Fed is telling us that, by policy, they are resetting asset prices.

According to their economic projections on economic output and employment, it (inflation) will be sooner than they want us to believe. The Fed has revised up their GDP forecast for this year to just a 3.7% contraction, they are projecting 4% growth for 2021. That would mean a recovery in GDP, to new record highs, by next year and they're looking for unemployment to recover to 5.5% by next year.

That would be a reflection of a hot economy whilst the Fed would still be at zero rates, with QE...and signalling for it to indefinitely continue.

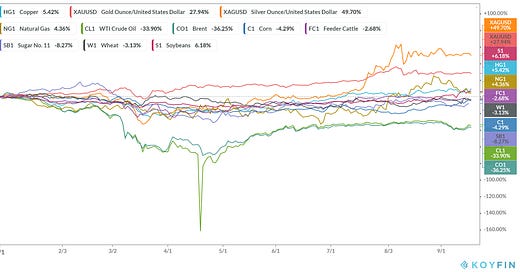

With this outlook, if we look across commodities, currencies, bond and stock markets, the worst performing market in the world this year has been oil. If you're looking for a beaten down market to buy, crude oil is down 34% ytd. It's the best performer on the day, up 5%, and back over $40.