Follow the Money

US stocks closed sharply lower on Friday, with the S&P 500 down 1.8%, the Nasdaq sinking 2.4%, and the Dow Jones plunging nearly 610 points.

Nonfarm payrolls increased by just 114,000, well below the forecast of 175,000, while the unemployment rate unexpectedly rose to 4.3%, the highest since October 2021.

Amazon's shares fell by 8.8% after missing revenue forecasts and issuing a disappointing outlook.

Intel plunged 26.1% following poor quarterly results, with Nvidia (-1.8%), Broadcom (-2.2%), and Microchip Technology (-10.6%) also experiencing sharp declines.

In contrast, Apple’s shares rose 0.7% after beating earnings expectations despite a drop in iPhone revenue.

Monday Overview - A simple, weekly, commentary on investing.

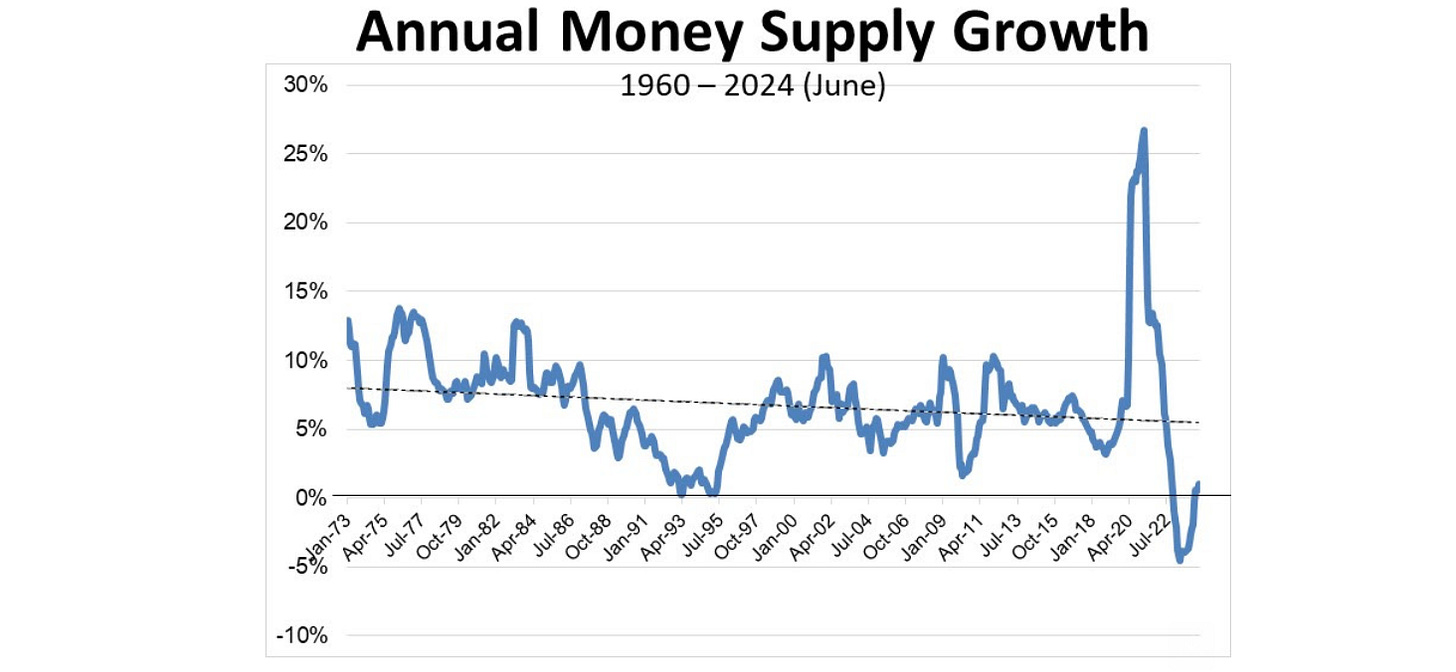

One of the most crucial determinants of market behaviour and economic health is the money supply. Central banks, including the Federal Reserve, manage the money supply by adjusting the monetary base, which is closely linked to the size of the Fed's balance sheet.

To mitigate the economic impacts of COVID-19 and related government measures in 2020, the Federal Reserve significantly increased the money supply. From March 2020 to March 2022, the money supply (M2) expanded by 26% beyond its typical growth trend.

Although M2 remains above its long-term trend, the gap between the actual and the trend has been narrowing since April 2022, now reduced to just +6.5%. Notably, the year-over-year monthly growth rates declined from December 2022 through April 2024, marking the only negative growth rates since 1960. However, in the past four months, the money supply has resumed its upward trajectory. Maintaining supply growth below the long-term average of 6% will eventually realign it with the historical trendline.

During significant economic downturns, such as the 2008 Great Financial Crisis and the COVID-19 pandemic, the Fed's policy of slashing interest rates to near zero and expanding their balance sheet can be seen as further rate cuts. Conversely, when the Fed raises rates and reduces its balance sheet, it effectively tightens the money supply, acting as an additional rate hike.

Current signals from the housing and job markets suggest that the tightening phase may have reached its limit. The 10-year Treasury yield has fallen below 4%, a decrease from 4.7% at the end of April. The Fed's decision to halt tightening the money supply is a positive initial step, but a substantial reduction in the Fed Funds rate—beyond a mere 25 basis points—may be necessary to stabilise market conditions.