Flat to Up

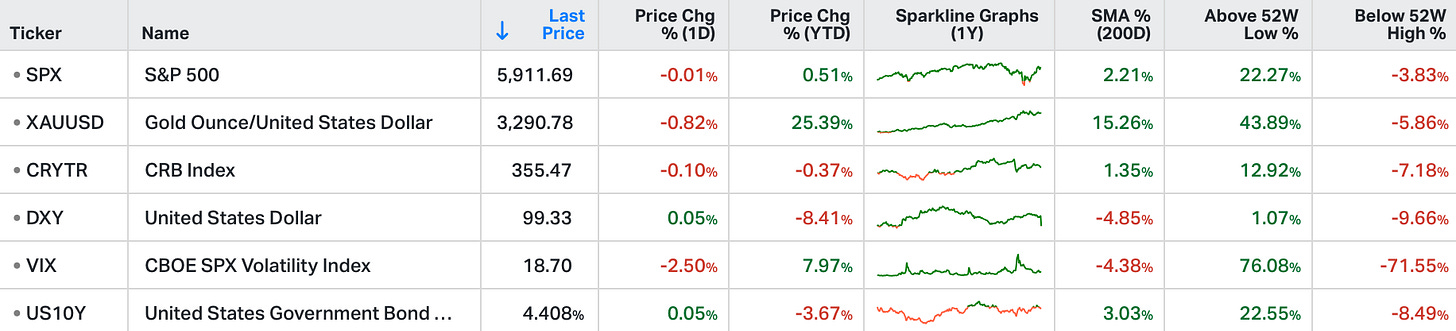

US stocks wavered on Friday, capping a volatile but strong May as investors weighed renewed trade tensions with China and cooling inflation data.

The S&P 500 ended near flat after falling over 1% intraday, while the Nasdaq slid 0.4% and the Dow added 53 points.

Trade talks appeared stalled, and legal uncertainty surrounding Trump’s tariff strategy added to investor unease.

Meanwhile, the Fed’s preferred inflation gauge showed cooling price pressures, offering some relief.

On the earnings front, Costco (+3.1%) and Ulta Beauty (+11.8%) gained on strong results, but Gap tumbled 20.2% after weak sales guidance.

The S&P 500 is roughly flat on the year. On the way to a zero-return year-to-date result, the S&P 500 has been up by about 5% and down by about 15%. The stabilising force year-to-date has been the consumer cash pile.

Cash held by consumers in checking, savings, and consumer money-market funds reached a new record of $21.6 trillion in the fourth quarter of 2024, up from $14.8 trillion in the fourth quarter of 2019. Consumer credit levels are rising but household debt payments as a percentage of disposable income are returning to pre-COVID levels, off of historical lows. This may be viewed as a ‘normalisation’ and not a ‘deterioration’.

The May Consumer Confidence index rose to 98.0, well above the consensus expectation of 87.0 and the prior month’s reading of 85.7 – the lowest level since October 2011. Generally, first-quarter earnings reflected a resilient consumer with, so far, minimal tariff impacts felt by the real economy.

The slide below shows how the US consumer came into last week.

Counterbalancing a relatively stable consumer has been yo-yo tariff announcements. Since April 2 Liberation Day, when Trump first announced his tariff program, the market has reacted sharply downward to more tariffs and sharply upward to fewer tariffs.

On Monday last week, the administration announced a delay until July 9th of 50% European Union tariffs. On Thursday, the U.S. Court of International Trade ruled that President Trump does not have legal authority to impose reciprocal tariffs. The ruling has already been appealed. Both announcements helped the S&P 500 recover from the sell-off the previous Friday from the initial 50% EU tariff announcement.

Assuming American consumers remain resilient, and tariff news oscillates less, the Artificial Intelligence (AI) growth story may eventually pull the overall market higher.

At the center of AI development is the leading AI chip maker, Nvidia (NVDA) - which reported better-than-expected earnings and revenues. For the first quarter revenue was $44.1 billion, a 69% year-over-year increase. Guidance was strong with $45 billion in revenue inclusive of an $8 billion revenue deduction from the China sales ban. This implies almost 14% July quarter sequential revenue growth with a full de-risking of China sales. Gross margins were up to 72%. Forward 12-month EPS growth is expected to be about 30%.

The rapid adoption of AI may measurably increase S&P 500 operating margins (profitability) across the board and is driving demand in recently stagnated industries such as electricity production.