US stocks closed sharply lower on Tuesday, extending losses from the previous session as escalating trade tensions between the US and its key trading partners rattled the markets.

The Dow and S&P 500 fell 1.5% and 1.2%, respectively, while the Nasdaq declined 0.3%, with gains in tech stocks helping to cushion the broader losses.

Mexico is expected to announce its response on Sunday.

Traders are now closely monitoring Trump’s address to Congress for potential signals on the future of trade policy.

Meanwhile, Tesla plunged 4.4% after data revealed its vehicle sales in China dropped nearly 50% year-over-year in February.

Over the past few weeks, Europe has been working up plans for a massive fiscal spending spree.

It started last month with a pledge of 50 billion euros for AI infrastructure, in a plan that included 150 billion euros of private investment (likely to be supported by cheap liquidity from the European Central Bank).

This past weekend, European leaders held emergency meetings to devise a gameplan to backstop Ukraine, if Trump were to end U.S. funding.

What's the gameplan? They want to spend 800 billion euros to "rearm" Europe.

To do so, they want to relax the budget deficit limits imposed on member states through Europe's Growth and Stability Pact — allowing them to ramp up defense spending.

So, more deficit spending. More debt.

They think this will get them 650 billion of the 800 billion euros, and the European Commission will plug the remaining 150 billion euro gap with loans to member states.

Guess who provides the financial guarantees that allow the European Commission to borrow?

The member states.

So, this is just off-balance sheet borrowing, which effectively compounds the debt burden of member states.

That all said, Europe has its fiscally weak spots, namely Italy and Spain. Both were on default watch in 2012, only to be saved by a central bank rescue — which, to this point, appears to have become a permanent feature.

For this 800 billion euro funding plan to work, without triggering another European sovereign debt crisis, the ECB will be back in action — more central bank backstops (at least verbal, if not more QE), to tame the bond yields of the fiscally vulnerable countries.

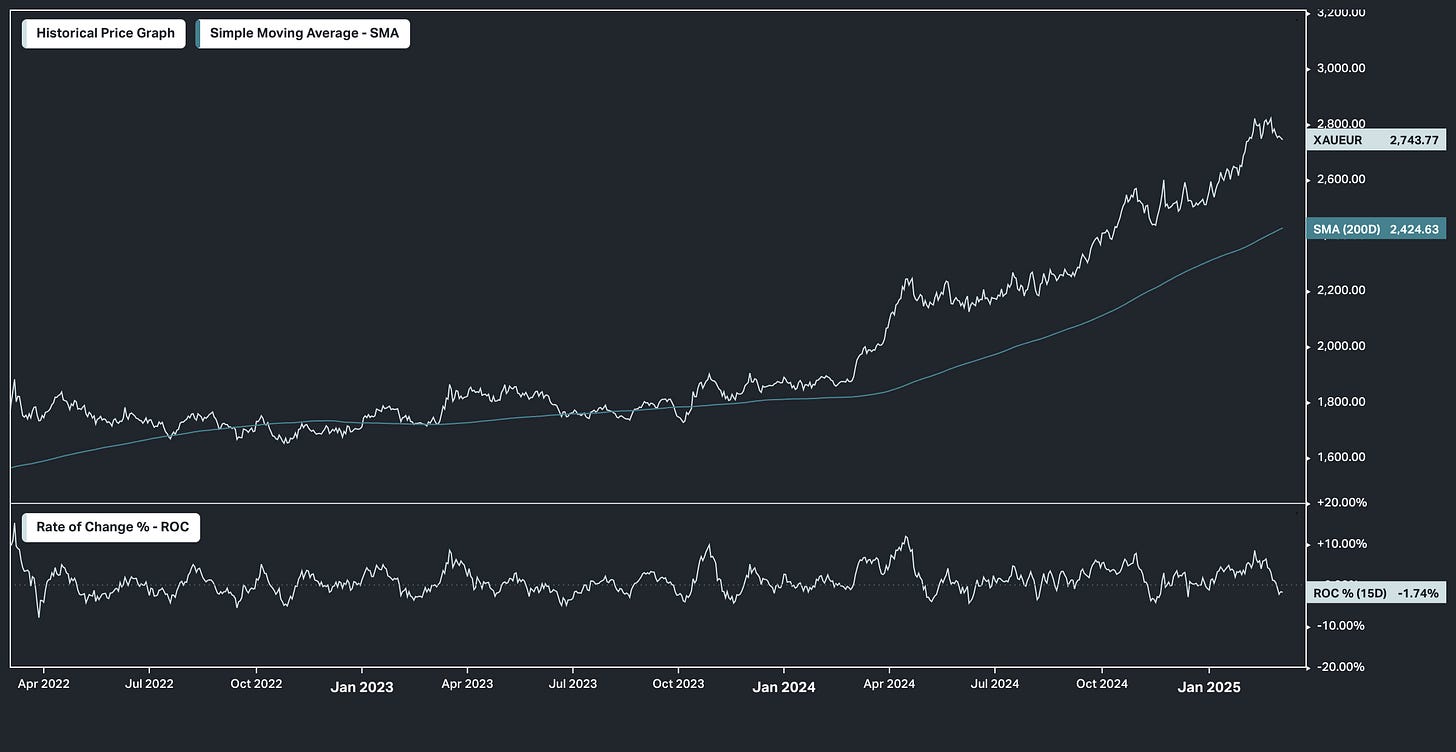

That's bearish for the euro, bullish for gold.

Investing by Design : Monthly Asset Allocation Update (28 Feb’25 after close)

SPY +1.24% ytd return,

Cross-sectional momentum: +3.3% ytd return, -0.5% ytd drawdown

Strategic asset allocation: +0.4% ytd return, -1.7% ytd drawdown

HAA (50-50): +1.8% ytd return, -1.1% ytd drawdown

Dynamic momentum: +1.4% ytd return, -1.3% ytd drawdown

Capital moves like a relentless tide—those who follow it early reap the rewards. Join us at Investing by Design, add 16 quantitative strategies to the above 4 asset allocation models and ramp up your trading pipeline.