The Fed raised rates by another 75 basis points yesterday. No surprise there.

Jay Powell opened his post-meeting press conference by saying his main message from his Jackson Hole speech (last month) hasn't changed. So, no surprises in the press conference.

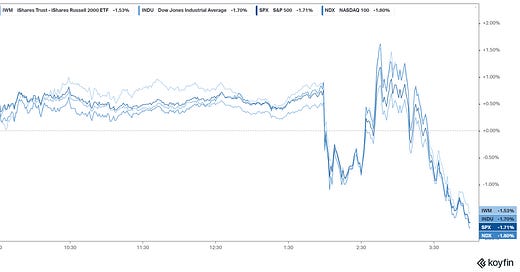

Markets rallied... but then reversed at the end of the day.

Because of this, the Fed's quarterly economic projections

They revised their growth projections for the economy down to 0.2% for the year. Just three months ago, they were looking for the economy to grow by 1.7% this year. That's a big downgrade.

They also revised their unemployment projections and inflation.

They revised UP (it wasn’t a small upward revision) the projection for interest rates. The Fed is now at a 3.00%-3.25% range on the Fed Funds rate, with projections having them getting to 4.4% by year end.

That's another ~125 basis points of tightening—if they were to follow through on this outlook, they would bury the economy into a deep recession.

We've already had two consecutive quarters of negative growth in the first half of the year, and the Atlanta Fed's GDP model is barely showing growth for the third quarter (at just 0.3%). With the deterioration in the economic data, it's a safe bet that Q3 will turn negative too. If the Fed goes another 125 basis points before year end, we will probably have four consecutive quarters of economic contraction.

Stocks reacted to this scenario late in the afternoon.

If the slide in stocks continues today and into Friday, we may get a response from Powell himself. He's conveniently scheduled to speak on Friday afternoon in a virtual conference called "Fed Listens," where the Fed engages a wide range of business leaders from a variety of industries.

Remember, while the Fed cares about inflation, they care more about inflation expectations. Powell said that inflation expectations remain anchored (under control). What the Fed cares most about is maintaining stability. If stocks test the June lows (not too far away), stability becomes questionable.

They don't want to see market meltdowns. Market meltdowns can quickly become financial system meltdowns and economic meltdowns.

I suspect the Fed will be "listening" to markets closely over the next day and a half. If the message isn't resonating well, Powell will likely soften the tone (walk things back) on Friday.