Fed's Focus

The S&P 500 and Nasdaq 100 each fell about 0.3% on Tuesday, while the Dow Jones slipped 154 points.

Despite the market dip, indices remain close to record highs, driven by optimism that the inflation data may reinforce expectations of a "soft landing" and pave the way for a Fed rate cut in December.

Nvidia saw a 2.7% decline, deepening losses amid a Chinese antitrust probe, keeping the chipmaker at the center of U.S.-China tech tensions.

Alphabet bucked the trend, jumping 5.6% after announcing significant breakthroughs in quantum computing.

Tesla advanced 2.9% as analysts raised price targets, and Meta Platforms booked a 0.9% gain.

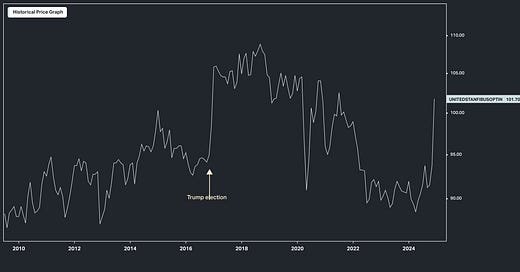

Remember, back in 2016, small business optimism spiked in the weeks that followed the Trump election.

As we discussed last week, we should expect a repeat, especially given that the index that measures small business optimism (by NFIB) was below 2016 levels, having spent 34 consecutive months under the UNDER the 50-year average.

The November report was published yesterday morning, and as you can see, indeed the Trump effect is back for small business.

This surge in optimism was even bigger than the November 2016 surge, and was described as "clearly" driven by "a major shift in economic policy, particularly tax and regulation, that favours economic growth."

Remember, the Fed was influenced by the Trump agenda in 2016, and the related reset in consumer and business attitudes that came with it, so much so that they proactively hiked rates a month after the election, in an economy that had averaged only slightly above 1% PCE inflation that year.

That won't be the case this December. The easing cycle will continue, but it's a matter of how many more cuts before the Fed goes into a holding pattern, swayed by their perception of potential inflation from what they think is hot growth.

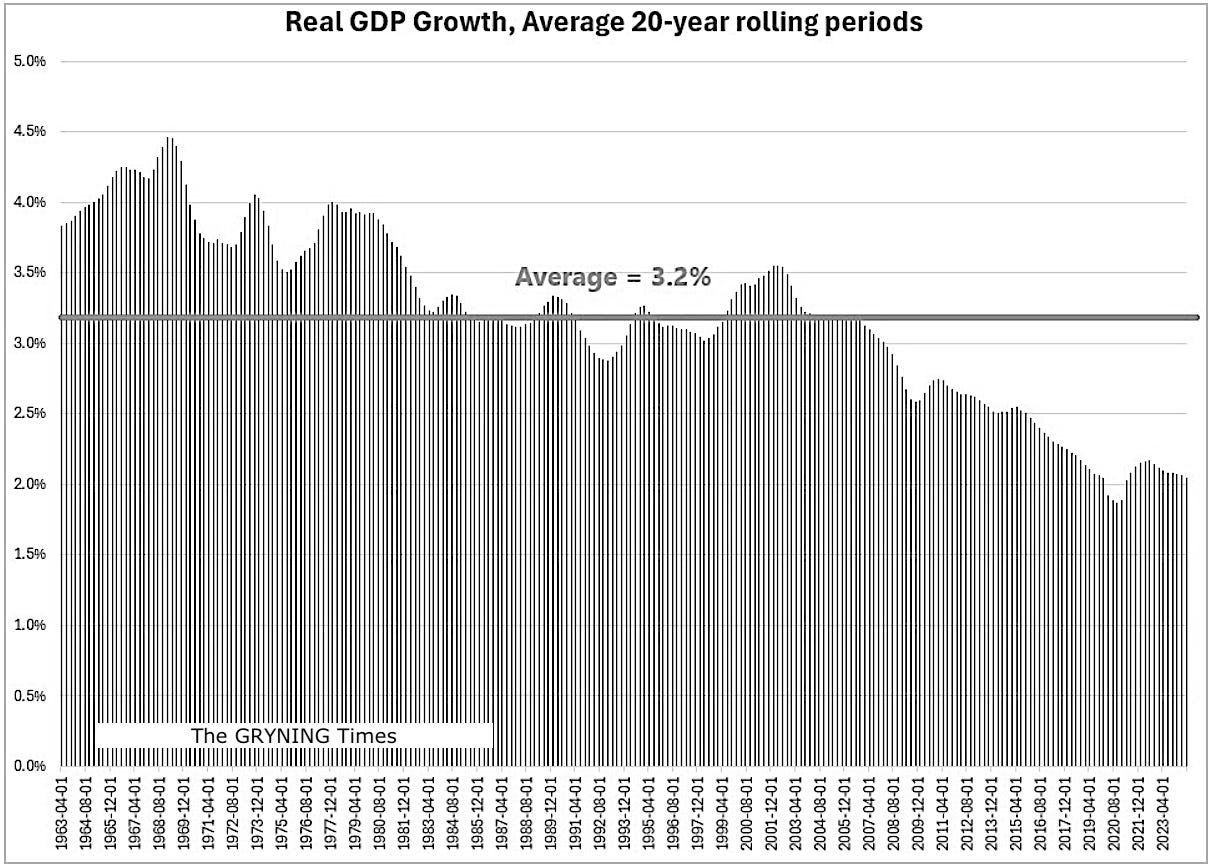

As we discussed yesterday, the Fed has misjudged the strength of economic output for two consecutive years (an economy which has run at a rate of about 3%). And they see the long-run growth rate for the economy now at less than 2%.

Clearly, they think the below average growth of the past fifteen years is the "new normal."

As we observed in my note yesterday, in this chart below, the Fed's expectations are more than a full percentage point below the long-term average growth of the economy.

With all of this in mind, the Fed is slowly acknowledging that we're in a productivity boom (likely driven by the technology revolution, generative AI). We had more data in the morning to support that. Hot productivity gains promote wage growth, which is needed to reset wages to the increased level of prices (which restores quality of life). And it can fuel wage growth without stoking inflation.

Jerome Powell himself presented back in 2016 at the Peterson Institute (click here), that higher productivity growth is a driver of a higher long-term potential growth rate of the economy.

So, they should not be surprised by the current 3%+ GDP growth, and low inflation.

In fact, with real rates (Fed Funds rate minus PCE) still over 200 basis points, which is historically very restrictive territory (putting downward pressure on the economy), the Fed should be looking to maximise growth. They should continue to aggressively reduce the restriction on the economy.

If we look back at the late 90s boom, which was fuelled by a technology revolution (the internet), we were in a productivity boom. Economic growth averaged 4.5% a year, stocks averaged 26% a year over a five-year period, and inflation averaged just 1.6%. Still, the Fed was tinkering around with historically high real rates.

But we didn't have the extent of indebtedness we have today.

Again, in this high productivity environment, the Fed should be focused on maximising growth. Growing the denominator in this chart goes a long way toward solving the debt problem.

Exploit trading opportunities inherent in the market place.

Account growth is why you’re here: You’re looking for actionable insights that allow you to express trades in the most appropriate form for your portfolio.

Repeatable processes and frameworks are your thing: Models, frameworks, and exhaustive research are the foundations on which you are looking to build your success.

Modern market insights make you tick: We focus on the analysis so that you focus on what matters most, be it diversifying your portfolio or outright alpha generation.

The research is designed by buy-side professionals and built to appeal to serious investors, financial advisors, and investment professionals. Become a member below and any single membership can be shared with teams of three…