We talked about the government bond markets yesterday—we're just four trading days from the Fed meeting next week, and the U.S. 10-year is trading near the June high of 3.50%.

In Europe, the Italian 10-year bond yield (maybe the most vulnerable bond market in Europe) is trading back above 4%-that's near the levels, back in June, that prompted an emergency ECB meeting and a policy response.

And in Japan, the Japanese government bond yield is trading back at the June highs, at the top of their accepted yield curve control band (of-0.25% to 0.25%)—this requires the Bank of Japan to buy JGBs in unlimited amounts to maintain the ceiling on yields.

This comes as the market, just in the past week, has begun pricing in the probability of a (very aggressive) 100 basis point hike by the Fed next week. That would be a move that could quickly manifest in European government bond markets and threaten the solvency of eurozone countries.

Such a bold move on rates by the Fed could become problematic for the U.S. fiscal situation. Remember, every 100 basis points by the Fed adds another $285 billion annually to an already bloated U.S. deficit.

Of course, the anticipation of what looks like a dangerous consideration by the Fed is because the Fed has made a lot of effort over the past month to create that anticipation. This is the "tough talk" strategy we've discussed all along this rocky hiking path.

The goal of this strategy is to manipulate consumer and business behaviors (to curtail exuberance in spending, investing, and hiring) without having to ramp rates to the levels of inflation. It's the opposite of the strategy the Fed explicitly used throughout the post-global financial crisis period (in that case, they were trying to promote confidence to spend, invest, and hire).

So far, the bark has been worse than the bite on rate hikes. But as we discussed above, we're getting to a place for rates where an aggressive move from here could become dangerous for the economy. With that in mind, we had some interesting news after the close of markets yesterday.

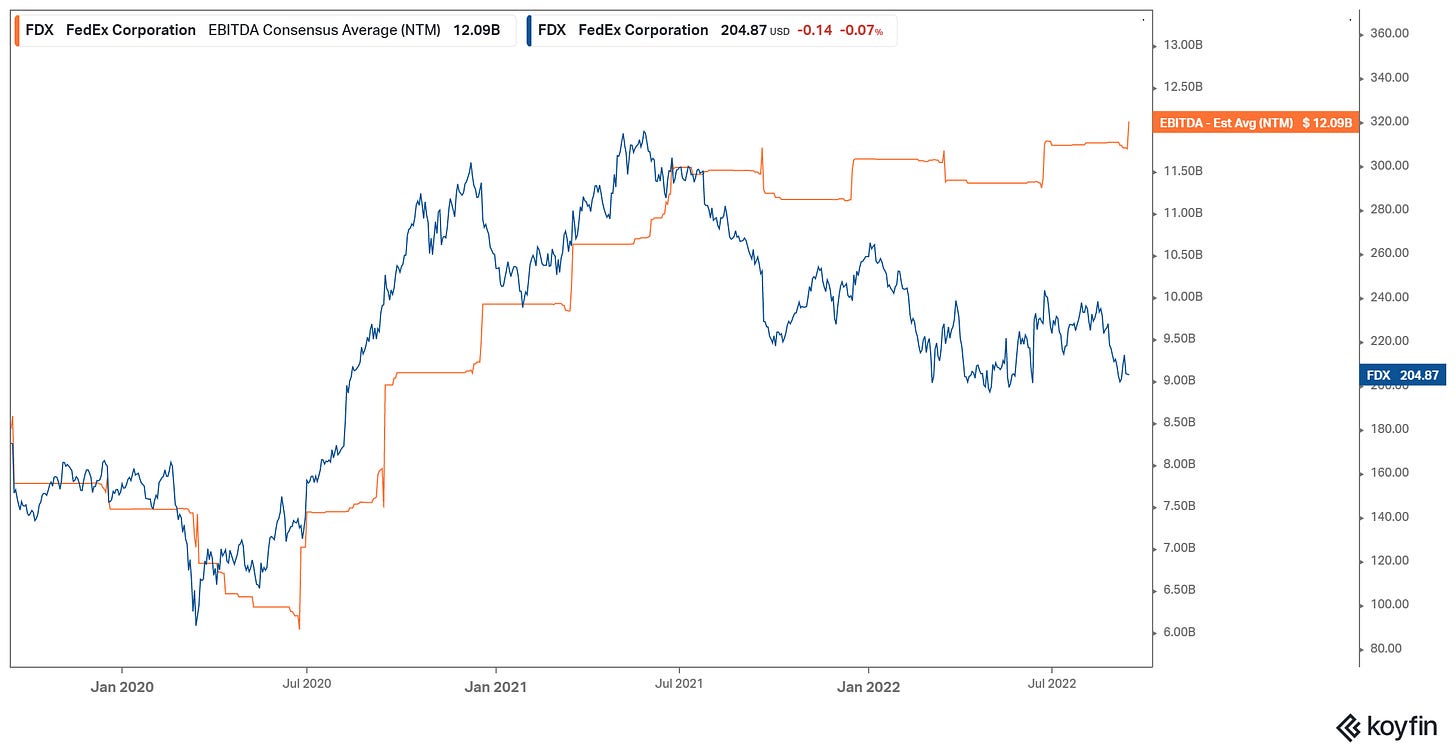

Fedex, the biggest transportation and logistics company in the world, decided to pre-announce earnings. They weren't good. In fact, the CEO went on air, on CNBC, to tell us that China's factories haven't seen demand bounce back since reopening, and it's because of a weak U.S. consumer. He went on to say he thinks we will see a worldwide recession.

Now, this comes four days before the Fed's decision on rates.

When is FedEx scheduled to formally announce earnings? the day after the Fed decision. That's interesting. Has Fedex just given the Fed the cover it needs to under-deliver on rate hike expectations?

This reminds me of another (suspicious) pre-announcement just a couple of months ago. On July 25th, three weeks before their scheduled Q2 earnings release, Walmart decided to "provide a business update" and "revise their outlook." They warned about inflation, lower margins, and a steep EPS decline.

That was two days before the Fed meeting (which is the most recent Fed meeting).

And as you recall, while the Fed followed through with the expected 75 basis point hike, they surprised markets with a couple of intentional statements that telegraphed the near end (if not the end) of the tightening cycle (Jay Powell said they had reached the neutral level on rates, and said that they would no longer provide guidance, and that decisions would be data-dependent from that point).

Stocks rallied 10% in fourteen days.

By the way, Walmart positively surprised on earnings three weeks after making that gloomy profit warning.