Over the past two days, we've seen the June inflation rate on consumer and producer prices - both were hot, running at double-digit annualised rates.

Consequently, interest rate markets have quickly adjusted, pricing in a coin-flips chance of a 100 basis point hike at the July 27th Fed meeting.

Stocks reacted yesterday morning, going deeply in the red…But most of the losses were recovered by the end of the day. The Nasdaq (the most interest rate sensitive stock index) finished UP on the day.

What's the story?

The markets have just set up for a positive surprise (i.e. they are not going 100 bps).

As we've discussed here in my daily Macro Perspectives, the Fed doesn't have the appetite for big rate hikes - if they did, they would have acted bigger, and more aggressively already.

High inflation environments, historically, have only been resolved when short term rates (the rates the Fed sets) are raised above the rate of inflation. The Fed is currently almost eight percentage points behind. We can only assume, at this point, that it's intentional.

Also, when asked about the inflationary risks of QE, back in 2010, the former Fed Chair (Ben Bernanke) said dealing with inflation is no problem; "We could raise rates in 15 minutes." They haven't done that.

Add to this: The current Fed Chair has told us that they were going to aggressively attack inflation, by "expeditiously" raising interest rates, and "significantly" reducing the Fed's balance sheet. They have done neither.

So they have the tools, they understand the formula for resolving inflation, but they aren't acting.

Why? Even if the U.S. economy (including the government's ability to service its debt) could withstand the pain of nearly double-digit interest rates, the rest of the world can't. That's it…

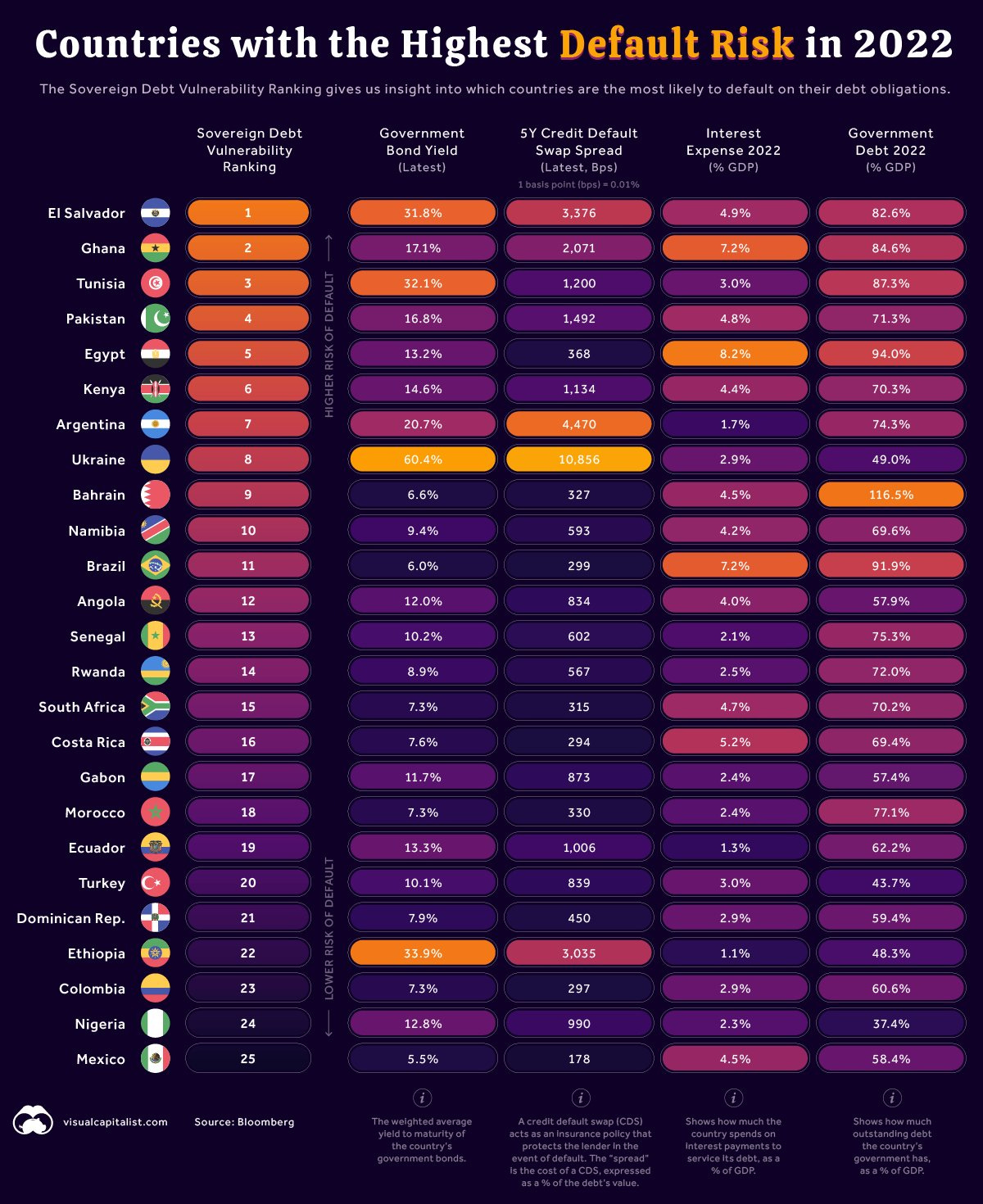

Capital is already flying out of all parts of the world, and into the dollar. Is it because U.S. bonds are finally paying interest? Partly. Mostly, it's because the U.S. is pulling global interest rates higher, which makes sovereign debt more expensive (more likely, unsustainable), particularly in the more economically fragile emerging market countries. Rising U.S. rates accelerate global sovereign bond markets toward default/ sovereign bankruptcy.

And historically, sovereign debt crises tend to be contagious (i.e. you get a cascading effect around the world). So far, we've seen defaults by Sri Lanka and Russia.

This is why the Fed is talking a big game, but doing very little with rates.

PS: If you know someone that might like to receive my daily notes, you can share and subscribe below.