We talked yesterday about the Fed meeting, raising concerns that the Fed would stick to its mantra, ignoring the obvious inflationary signals and risks - which would give way to even crazier (and dangerous) speculation and even more inflated asset prices.

The good news: The Fed did indeed acknowledge the higher growth and inflation environment.

What I’ve also highlighted in my notes, that unless they are acting now (which they aren't), by ending the emergency policies and beginning the process of taming the madness (of screaming asset prices and speculation), they are too late. They have already done the damage to their "price-stability" mandate.

Common sense should tell us that growing the money supply by better than 30% over the past year is going to create hotter inflation than we've seen in a very long time, as more money chases a relatively finite supply of goods. At this stage, our observations are confirming common sense.

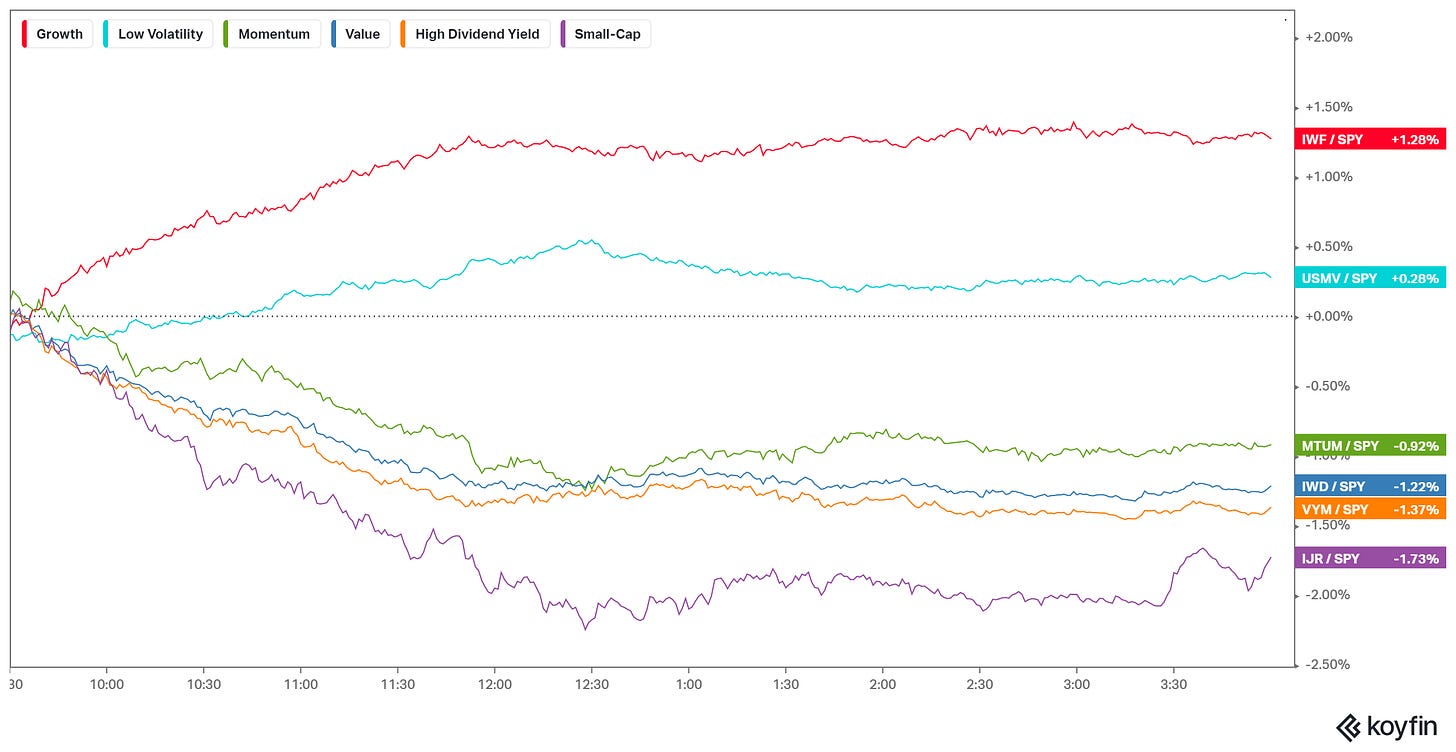

That said, markets behaved (during the day) in a way that signaled some approval of the Fed's message: The dollar was up, commodities were down big, and value stocks were down big, while big tech growth had a good day.

Does this response in the dollar mean that global investors are betting on some monetary policy divergence, coming sooner than expected (i.e. the Fed tightening money, while the rest of the world continues to ease)? Probably.

Does the response in commodities mean that investors think the Fed is signaling that they will be less rigid, and therefore might actually be able to quell a hyper-inflation scenario? Maybe.

Does the response in stocks mean that the rotation of money into value is over and the next big run in tech stocks is coming? Probably not.

What does seem to be happening, is some profit taking on the trends of the past three months. With that said, we have only a couple of weeks until the market will be presented with major catalysts for the inflation trade - we will get Q2 economic data and Q2 earnings data, which will be mind-blowingly big.

Add to this, expect the - substantial - Biden "infrastructure"/clean energy bill to start working its way through a party-aligned Congress. The inflation trade is, and will be, alive and well.